Keep up to date with the news about valuation trends.....

CBRE - Cap Rates held steady during the 2nd half of 2024

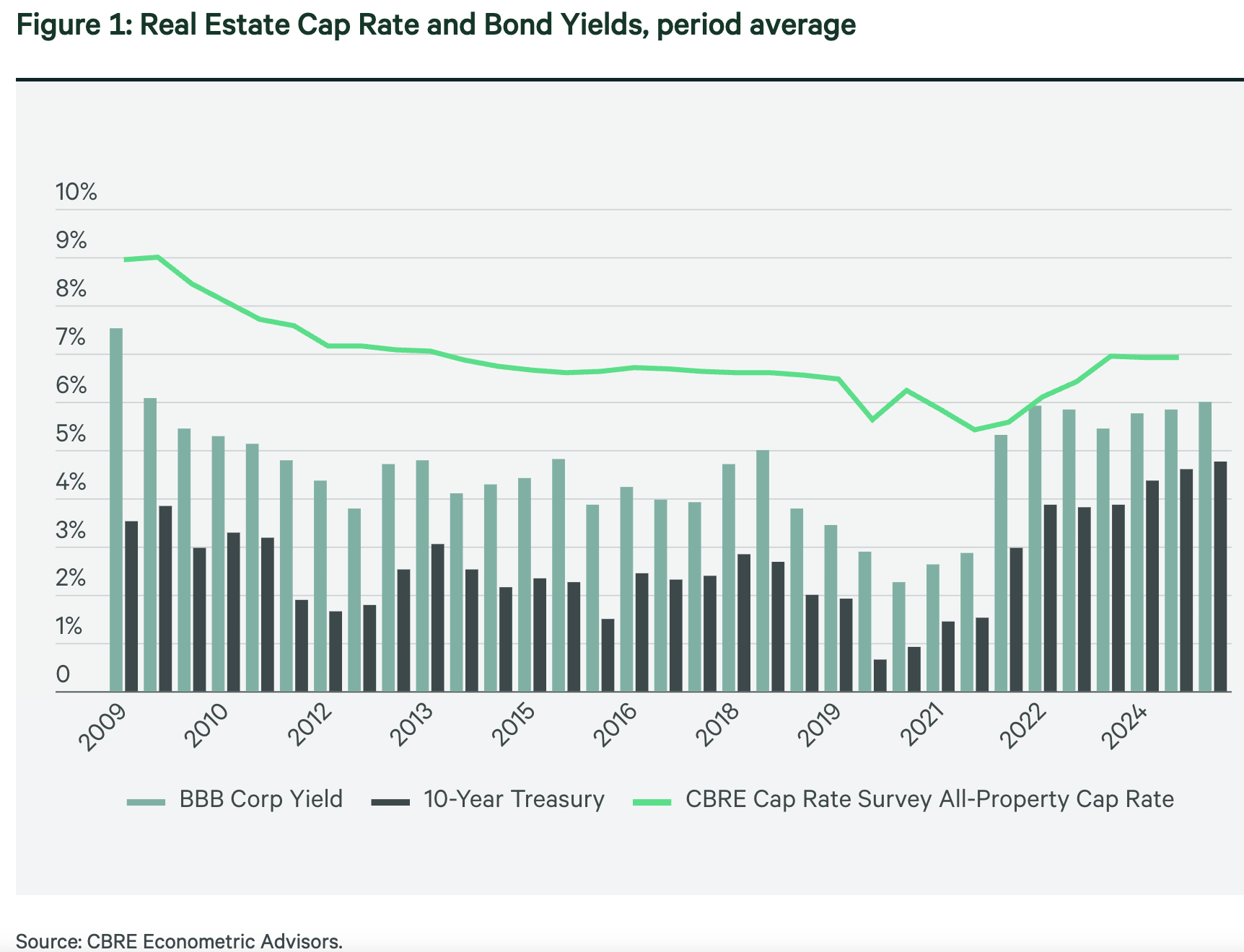

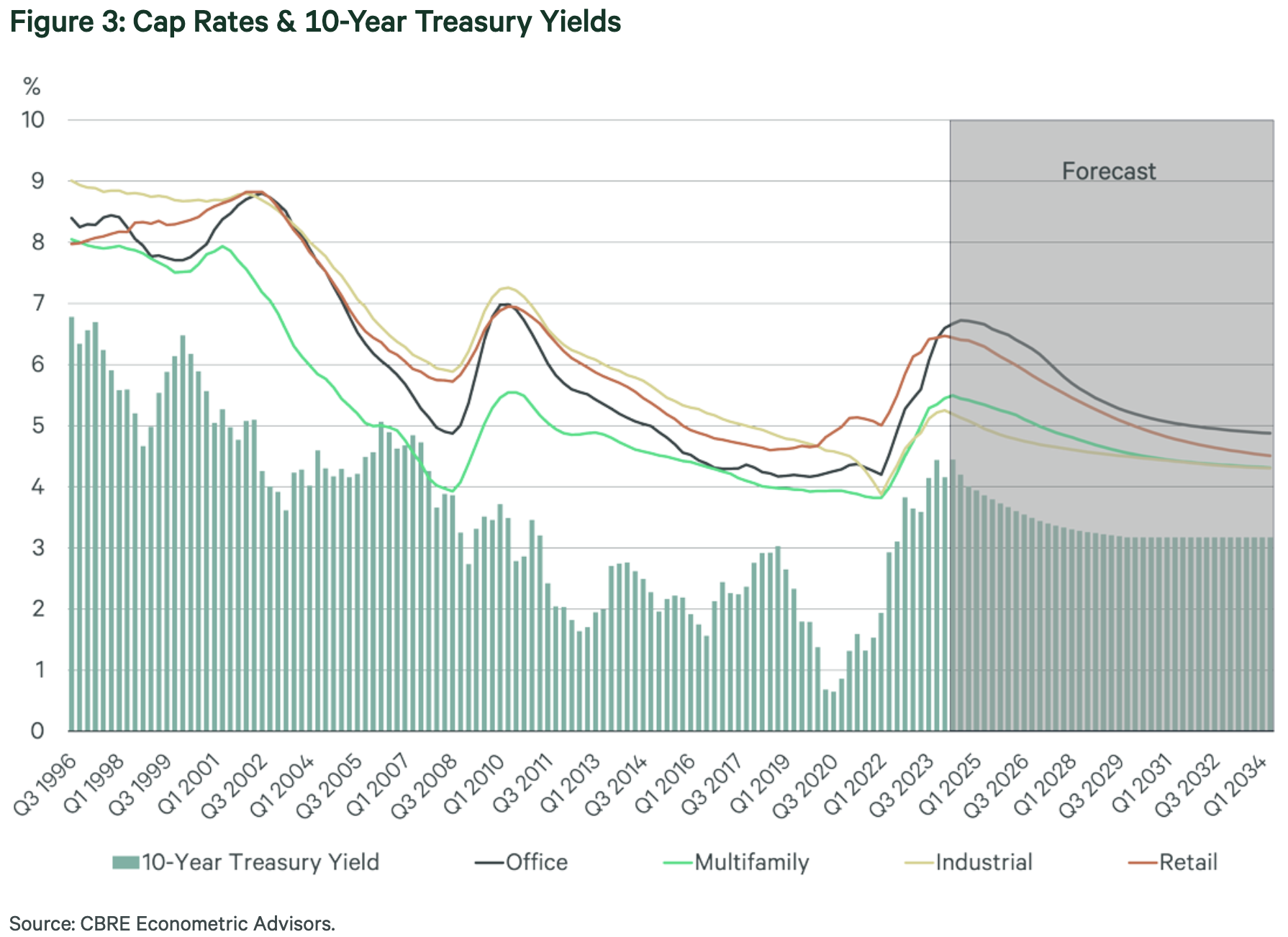

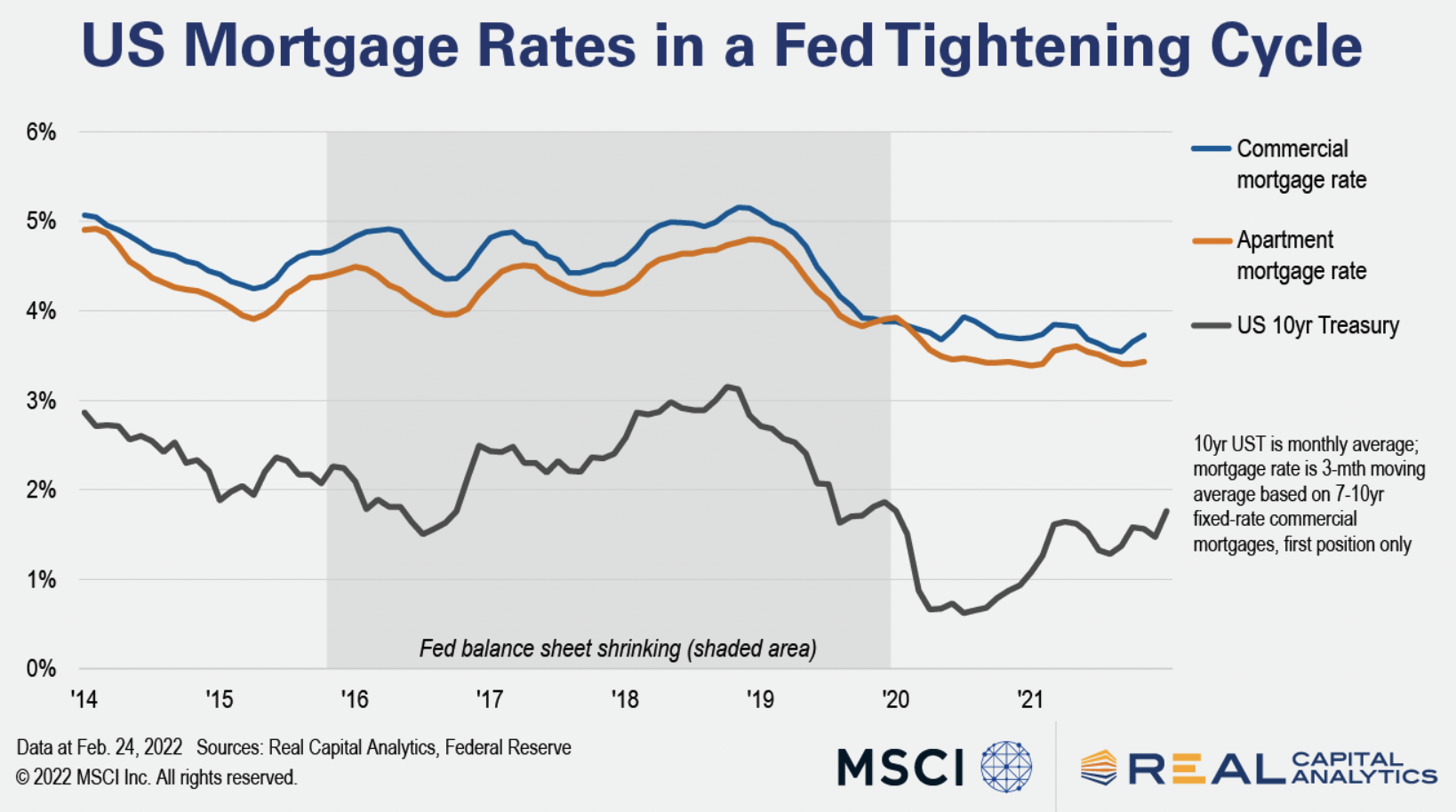

Treasury yields were extremely volatile during 2024, as financial markets grappled with economic data that sent mixed signals about the outlook for inflation, Federal Reserve policy and where long-term interest rates will settle.

The 10-Year Treasury yield started the year below 4% and peaked at 4.7% in late April. Ultimately continued disinflation and expectations for Fed rate cuts pushed the 10-Year Treasury yield down to 4.2% in June and 3.6% in September. But yields reversed course during Q4 as the Fed signaled there would be fewer future cuts than the market was expecting. This pattern has continued into 2025 as the large federal budget deficit, policy uncertainty, and varying inflation signals keep bond markets guessing but with an upward bia

Feb 12, 2025

Source - read more

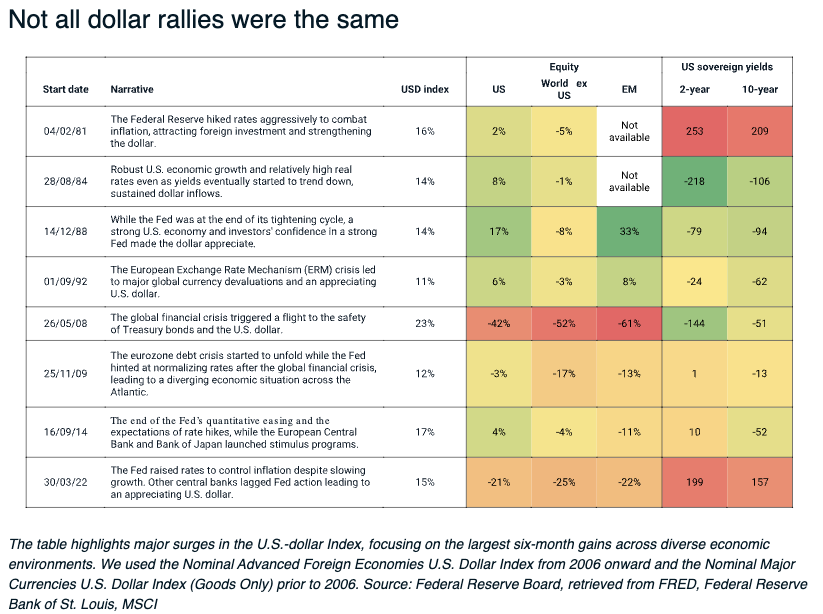

Scenario Analysis: Tariffs and a Strong US dollar

With tariffs taking center stage, multi-asset-class investors may face a variety of stresses on their portfolios. We model a what-if scenario with an inflationary spike, a drag on growth and strength in the U.S. dollar.

History shows that USD strength has had varied implications for asset classes, depending on the underlying economic backdrop.

Under our scenario, both U.S. equities and bonds take a hit, while global stocks face two distinct pressures in USD terms — economic headwinds and home-currency depreciation.

March 3, 2025

Source - read more

Trump’s Housing Chief Embarks on Shake-Up at Mortgage Giants Fannie Mae and Freddie Mac

In his first full week as head of the Federal Housing Finance Agency, home-builder heir and former private-equity executive William Pulte ousted more than a dozen board members at mortgage giants Fannie Mae and Freddie Mac.

Pulte made himself the chairman of the boards and installed a set of new directors (one of them was Christopher Stanley, an Elon Musk ally who resigned from the post a day later). He removed senior executives at the companies and the FHFA, which regulates Fannie and Freddie. Among those let go was Freddie CEO Diana Reid.

March 23, 2025

Source - read more

Pulte made himself the chairman of the boards and installed a set of new directors (one of them was Christopher Stanley, an Elon Musk ally who resigned from the post a day later). He removed senior executives at the companies and the FHFA, which regulates Fannie and Freddie. Among those let go was Freddie CEO Diana Reid.

March 23, 2025

Source - read more

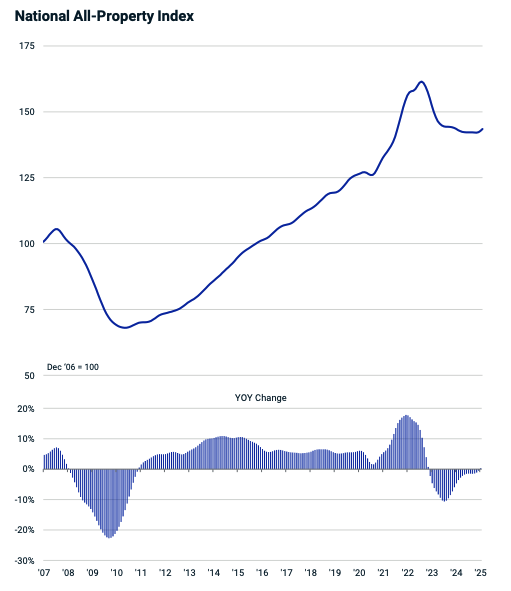

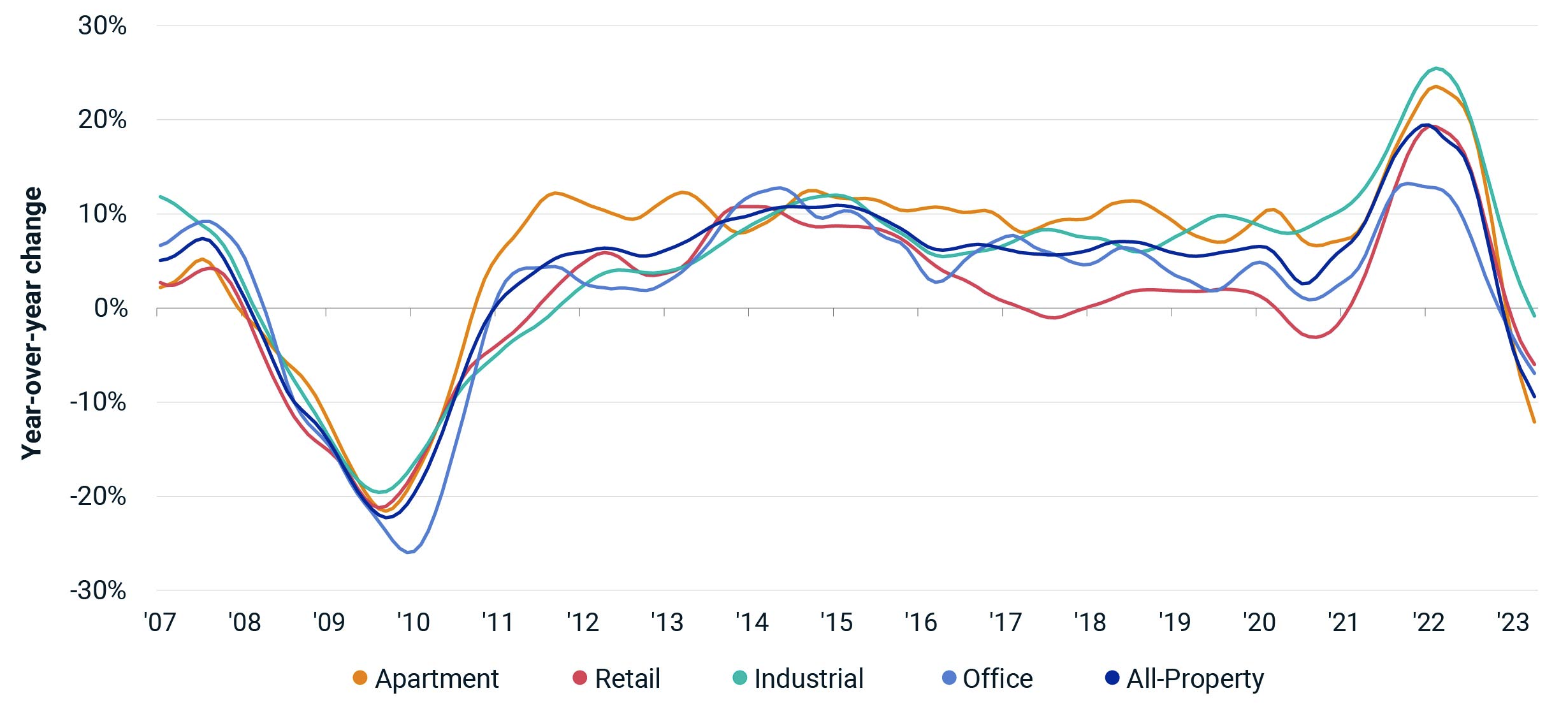

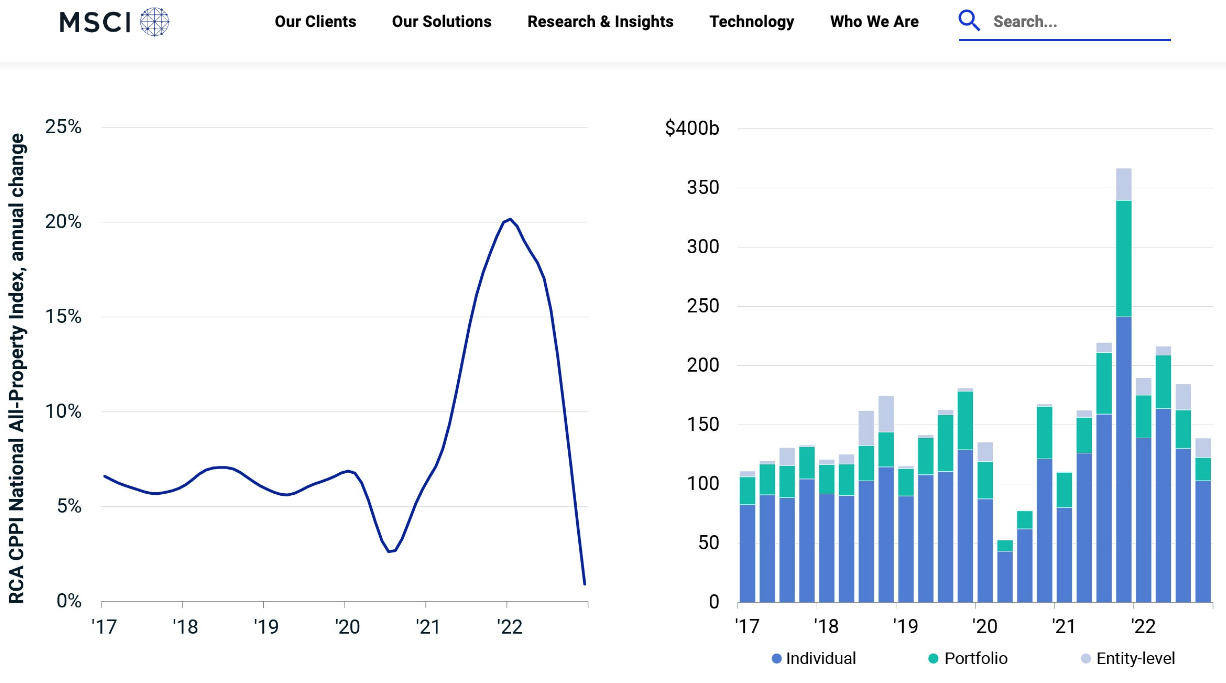

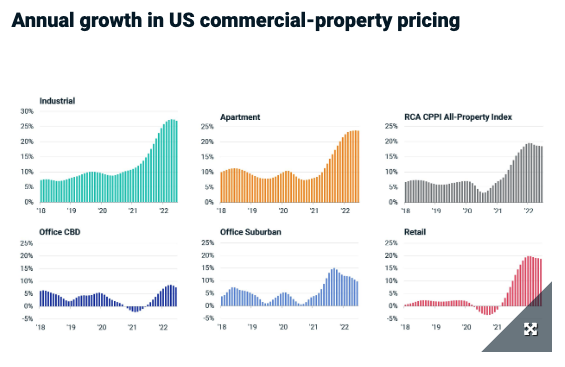

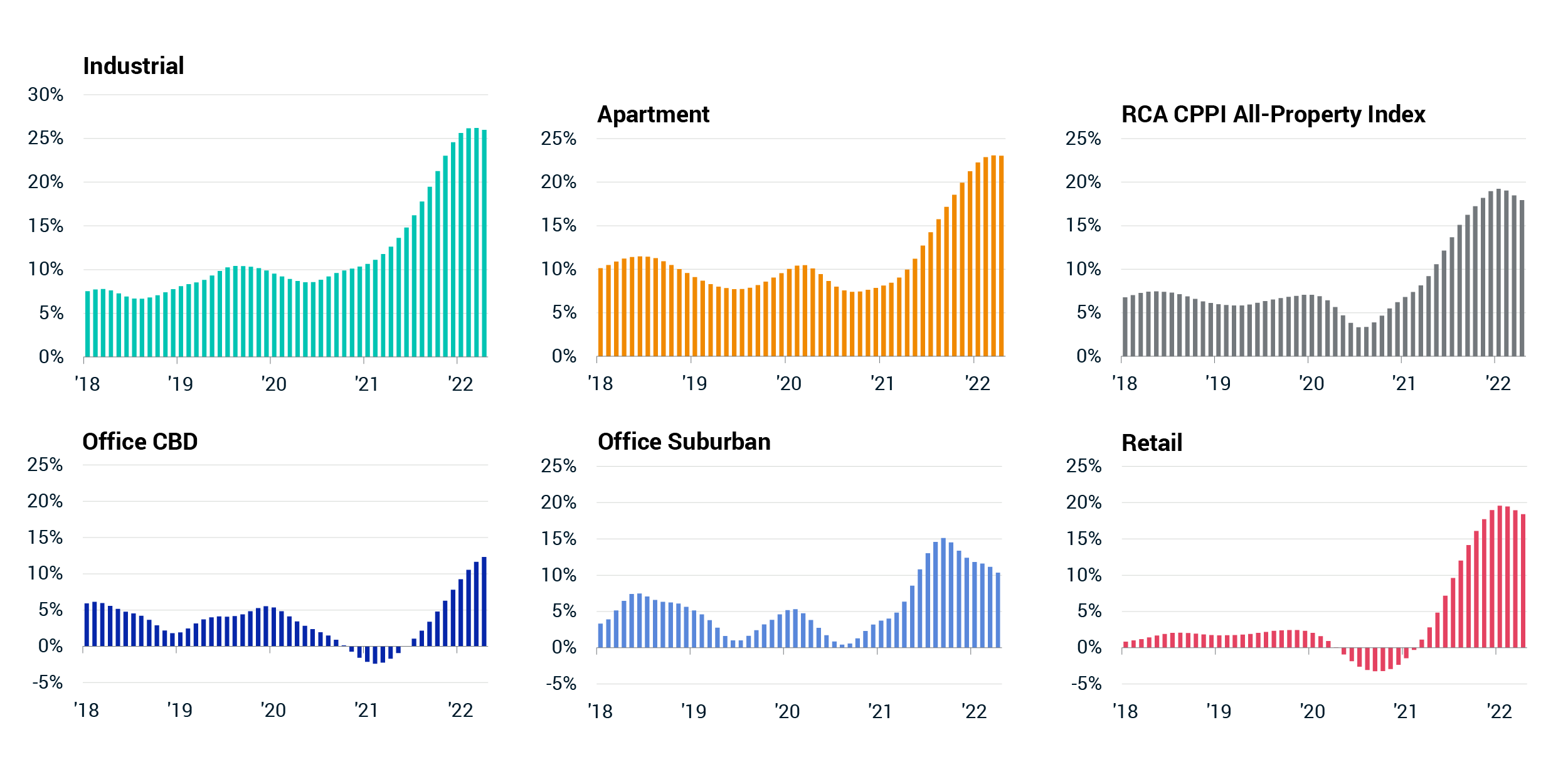

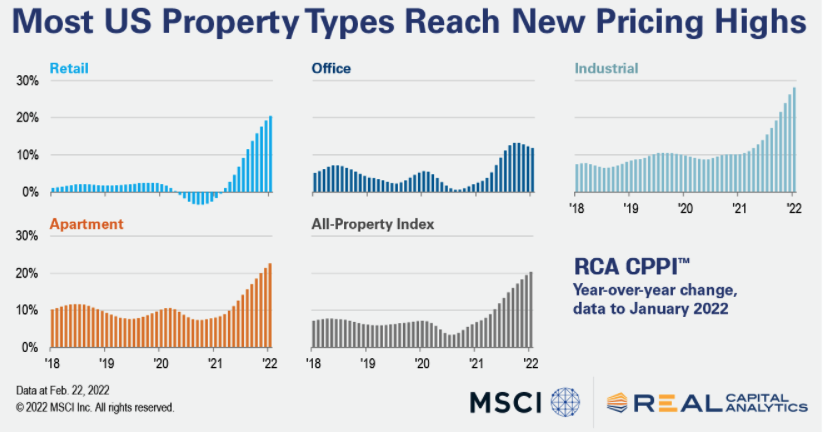

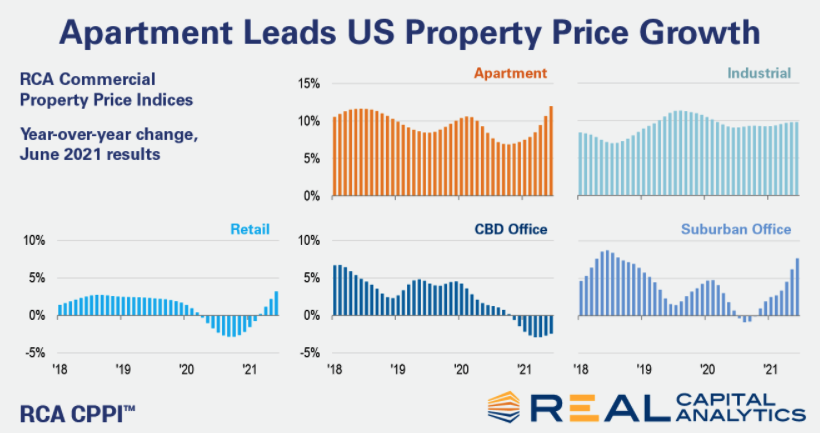

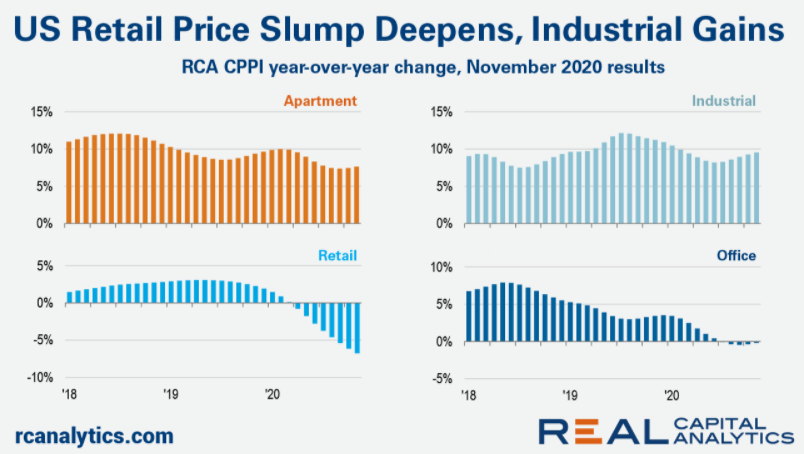

Commercial property price indexes report

Commercial property prices edged into annual growth in January, with a 0.3% increase in the RCA CPPI National All-Property Index. The index has posted three consecutive monthly increases, and in January prices rose 0.5% from December, suggesting a faster annualized pace of growth of 6.5%. January 1, 2025

Source - read more

Home-selling season starts after LA Wildfires- and there is demand

LOS ANGELES—In two Los Angeles neighborhoods where wildfires destroyed thousands of homes less than two months ago, the selling season is already well under way.

More than 80 new listings of scorched plots in Pacific Palisades and Altadena have hit the market since the middle of February. Land parcels where homes once stood are commanding selling prices above early expectations.

Febuary 3, 2025

Source - read more

More than 80 new listings of scorched plots in Pacific Palisades and Altadena have hit the market since the middle of February. Land parcels where homes once stood are commanding selling prices above early expectations. Febuary 3, 2025

Source - read more

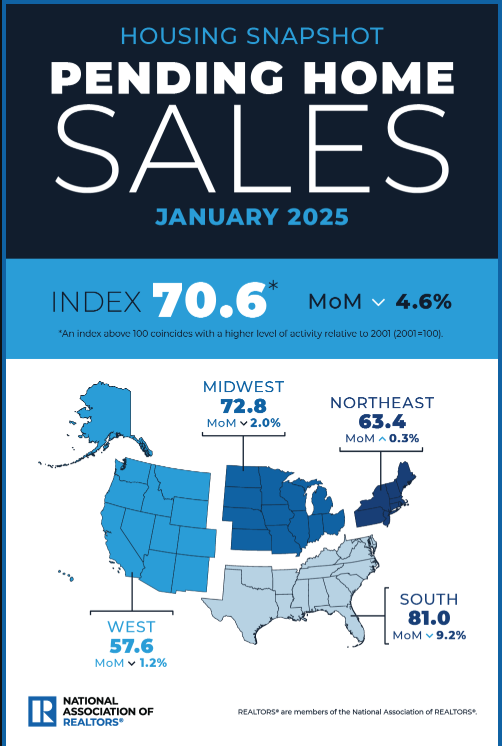

Pending home sales waned 4.6% in January

WASHINGTON (February 27, 2025) – Pending home sales pulled back 4.6% in January according to the National Association of REALTORS®. The Midwest, South and West experienced month-over-month losses in transactions – with the most significant drop in the South – while the Northeast saw a modest gain. Year-over-year, contract signings lowered in all four U.S. regions, with the South seeing the greatest falloff.

Feb 27, 2025

Source - read more

Feb 27, 2025

Source - read more

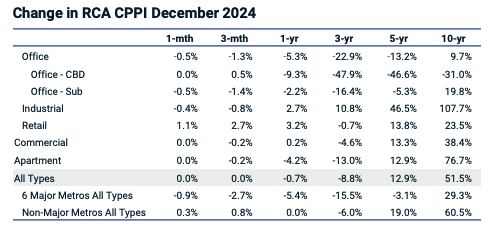

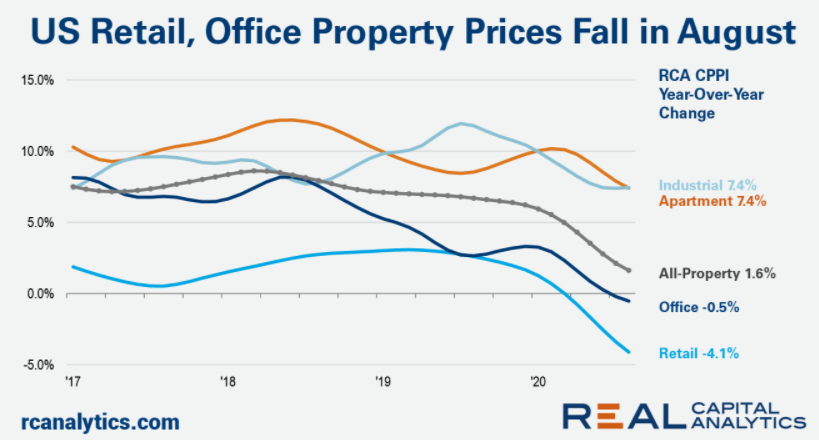

RCA CPPI Commercial property price indexs

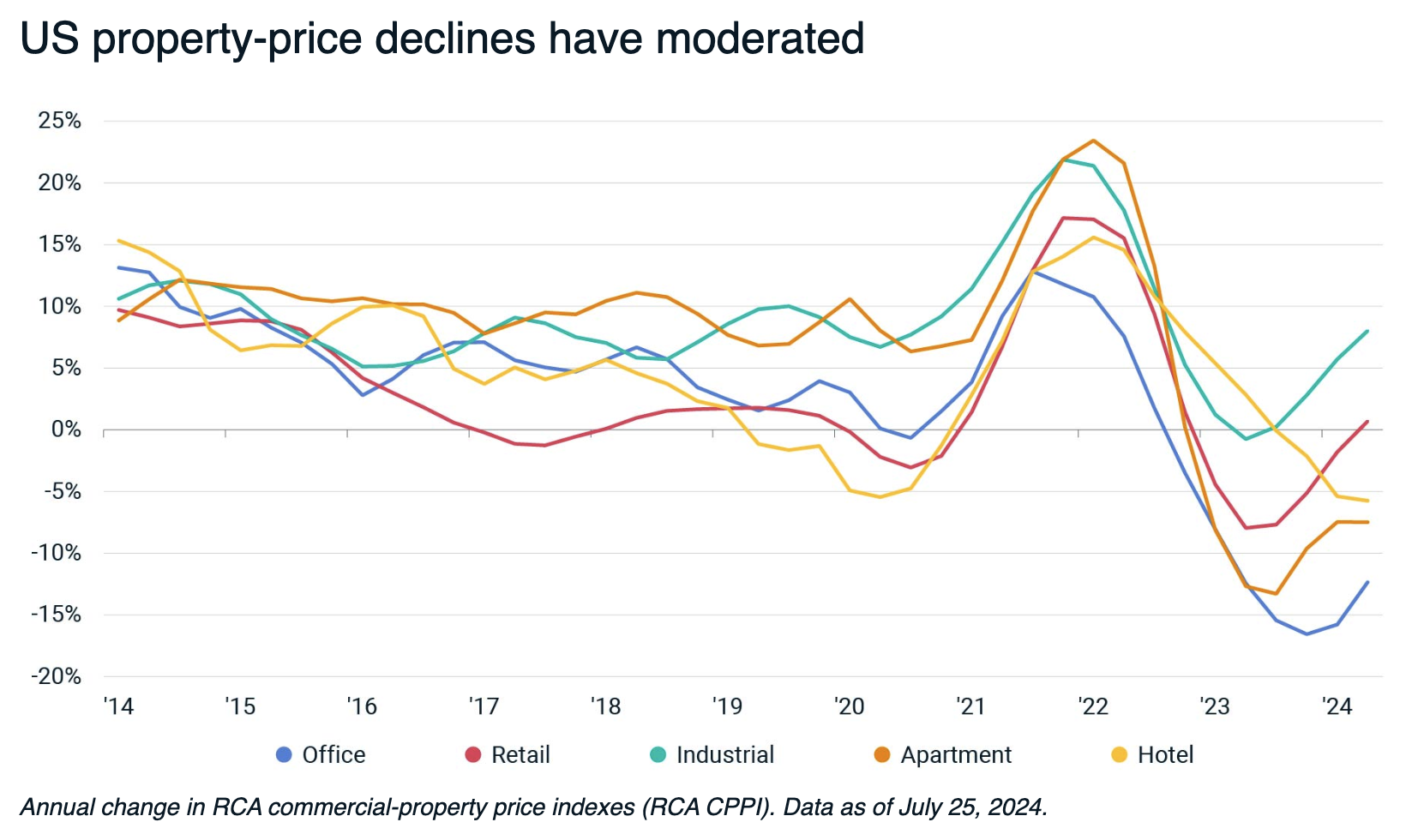

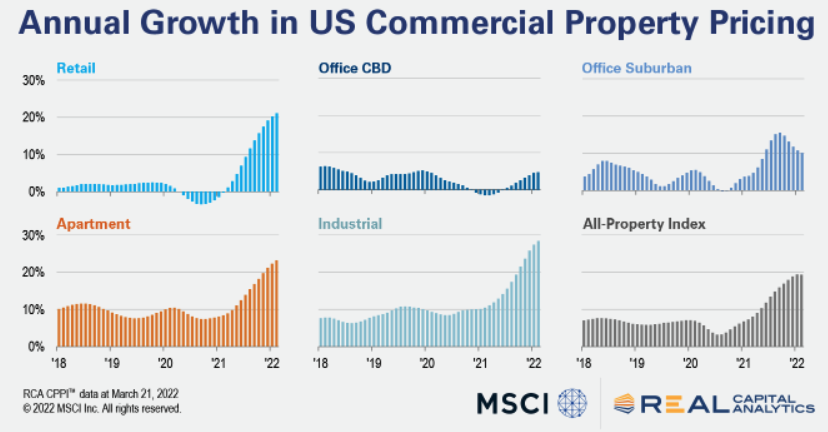

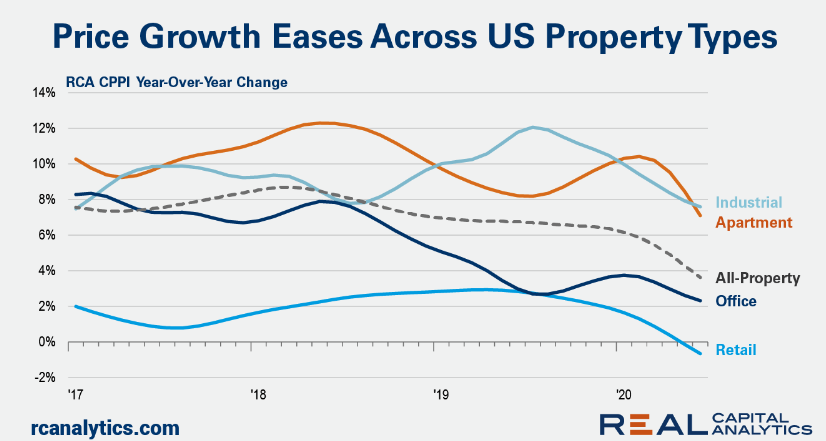

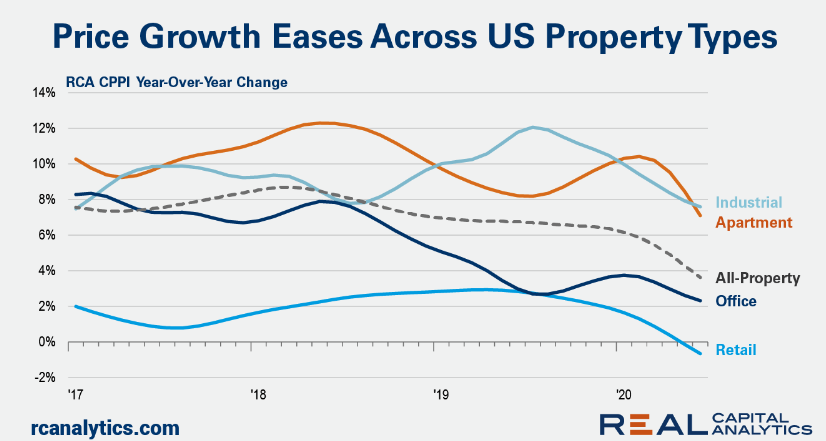

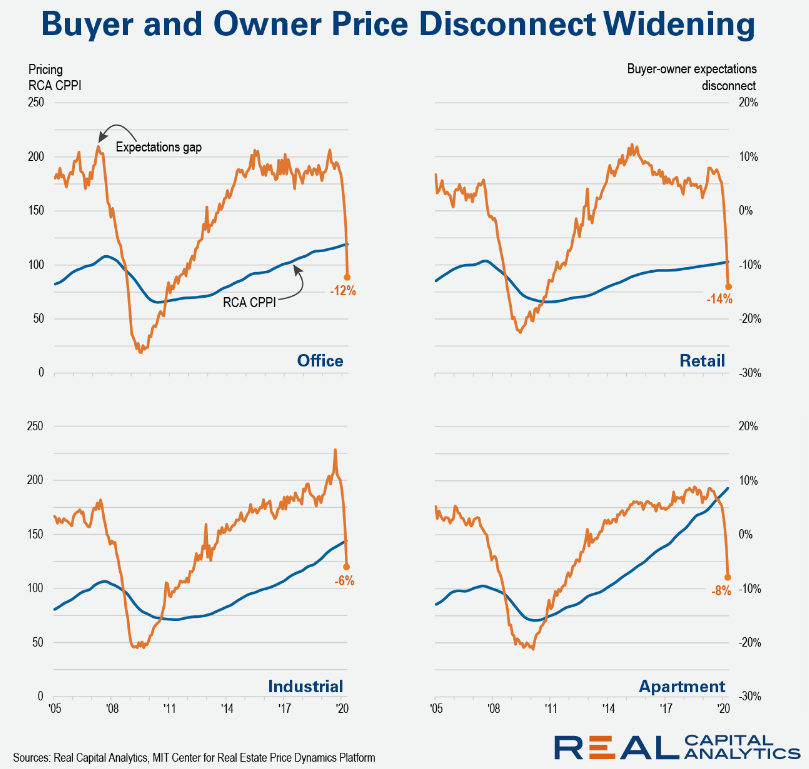

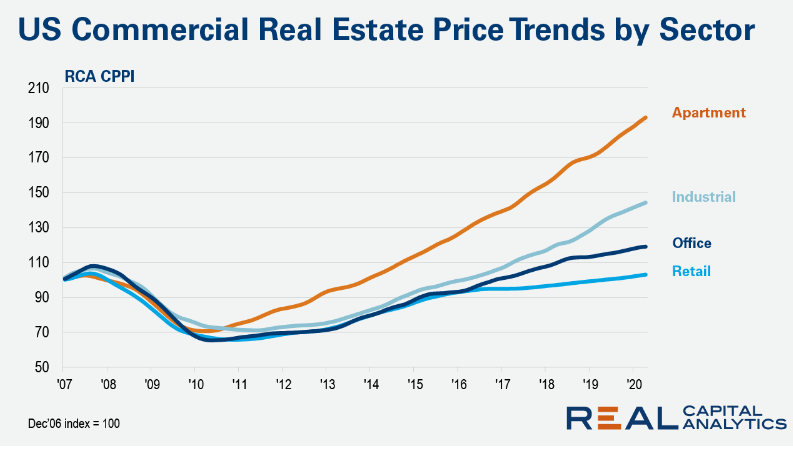

U.S. commercial property prices continued to stabilize in 2024, with encouraging signs of recovery emerging across property markets. The RCA CPPI National All-Property Index fell 0.7% YOY in December, a significant improvement on the 5.9% drop recorded at the close of 2023. The index was little changed relative to November.

Earlier in 2024, increased optimism about Federal Reserve rate cuts and less uncertainty around inflation contributed to the start of a rebound in activity. The shift in outlook supported improved alignment between buyers and sellers on pricing.

Dec, 2024

Source - read more

Earlier in 2024, increased optimism about Federal Reserve rate cuts and less uncertainty around inflation contributed to the start of a rebound in activity. The shift in outlook supported improved alignment between buyers and sellers on pricing. Dec, 2024

Source - read more

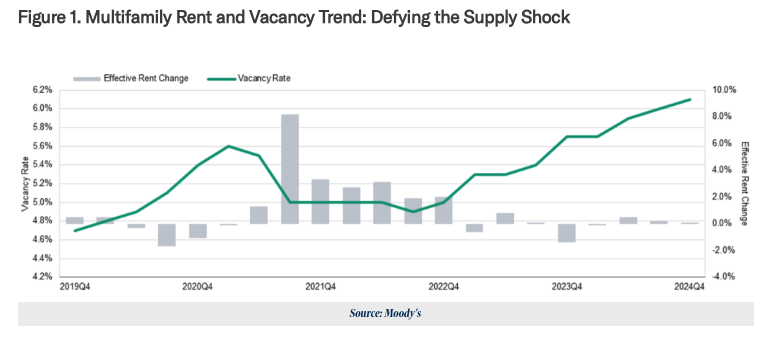

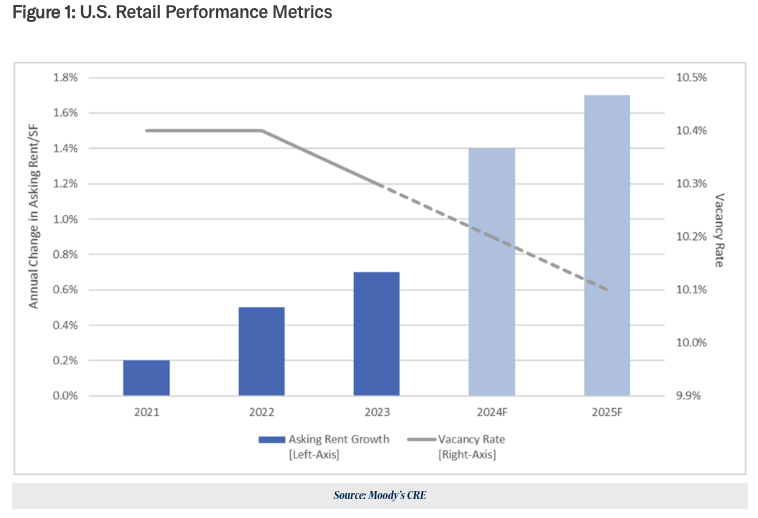

Moody's Q4 2024 Preliminary Trend Announcment

Multifamily Continued to Defy the Supply Shock, Office’s Vacancy Rate Broke Another Record, Retail Rents Drift Higher with Tight Supply, And Industrial Maintains Status Quo

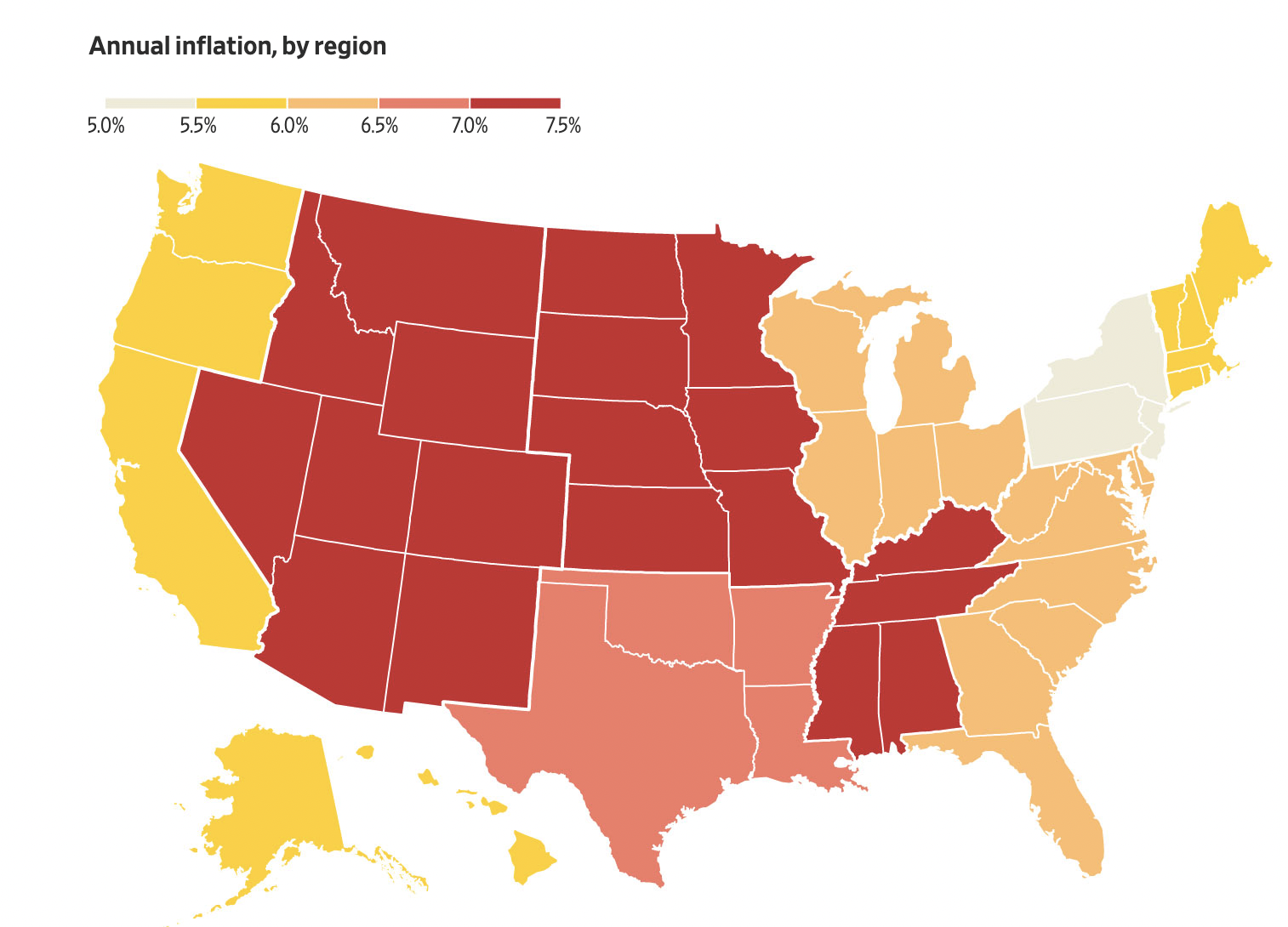

The Federal Reserve’s battle against inflation continues to remain important as the prolonged economic soft landing endures. Three rate cuts by the FOMC throughout 2024 helped the commercial real estate (CRE) industry, but with annual inflation rate accelerating to 2.7% in November expectations of slower movement for future cuts have emerged. While uncertainties remain, preliminary Q4 data shows a continued trend from prior quarters and levels of resiliencies across the sectors.

January 3, 2025

Source - read more

The Federal Reserve’s battle against inflation continues to remain important as the prolonged economic soft landing endures. Three rate cuts by the FOMC throughout 2024 helped the commercial real estate (CRE) industry, but with annual inflation rate accelerating to 2.7% in November expectations of slower movement for future cuts have emerged. While uncertainties remain, preliminary Q4 data shows a continued trend from prior quarters and levels of resiliencies across the sectors. January 3, 2025

Source - read more

The U.S. Government Has a Landlord, and Trump Isn’t a Fan

Shortly before he was elected president in 2016, Donald Trump took a break from campaigning to attend a ceremony for his new flagship hotel, the Trump International Hotel Washington, D.C.

The General Services Administration, the federal agency that owns, manages and leases much of the government’s real estate, had previously awarded Trump the rights to redevelop the government-owned Old Post Office as a luxury hotel. The GSA selected him over Hilton, Marriott International and other big-name operators.

Jan 21, 2025

Source - read more

The General Services Administration, the federal agency that owns, manages and leases much of the government’s real estate, had previously awarded Trump the rights to redevelop the government-owned Old Post Office as a luxury hotel. The GSA selected him over Hilton, Marriott International and other big-name operators. Jan 21, 2025

Source - read more

CBRE projects Cap Rates will compress in 2025

CBRE’s new report on the market outlook for U.S. real estate in 2025 presents a picture of cautious optimism with both opportunities and risks for investors. It predicts investment sales will continue to recover, boosted by strong economic growth, with volume up by as much as 10% next year. However, investors will remain careful. Primary targets will be industrial and multifamily assets. “Assuming minimal disruptions from tariffs, retail will continue to attract investors with its strong fundamentals and we expect some portfolio sales will ensure a robust year for this property type,” the report commented. Dec 13, 2024

Source - read more

Moody's Q3 2024 Housing Affordability Update

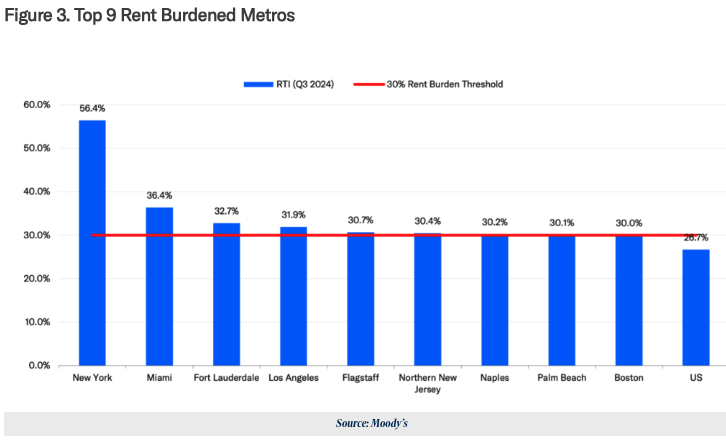

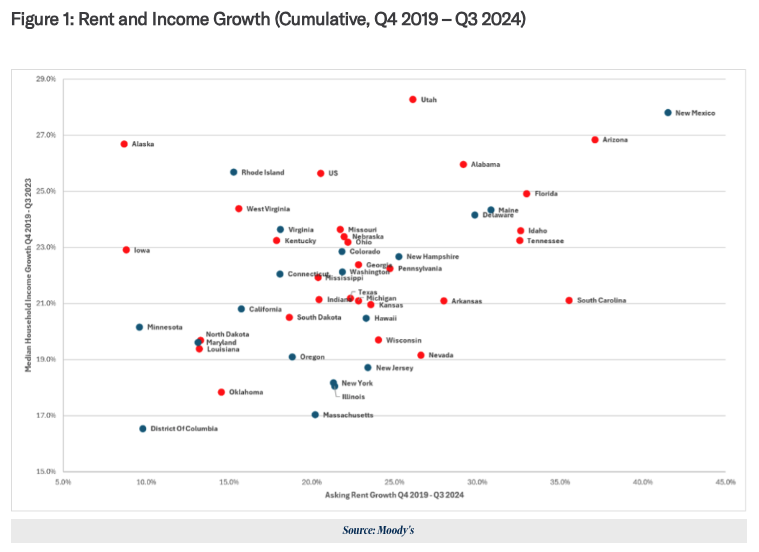

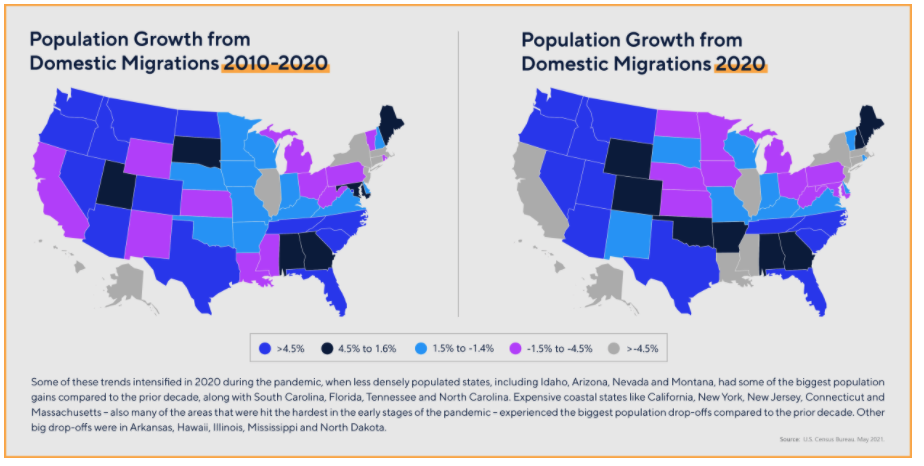

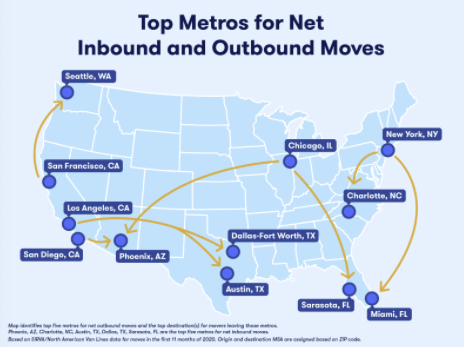

The national median household income rose 3.6% over the year, easing the Rent-to-income (RTI) ratio which declined to 26.7%, providing relief for rent-burdened metros. Population growth in the South, driven by migration from expensive cities, is changing demographics and subsequently will impact housing affordability. States with higher population churn ratios, such as North Carolina, Texas, and Florida indicate strong appeal to new residents, whereas New York and California faced significant net population losses. Student Housing rent growth outpaced multi-family rent growth over the past two years, raising affordability concerns for students. Certain universities have higher student housing rents compared to their local multi-family market, reflecting localized demand pressures. Dec 9, 2024

Source - read more

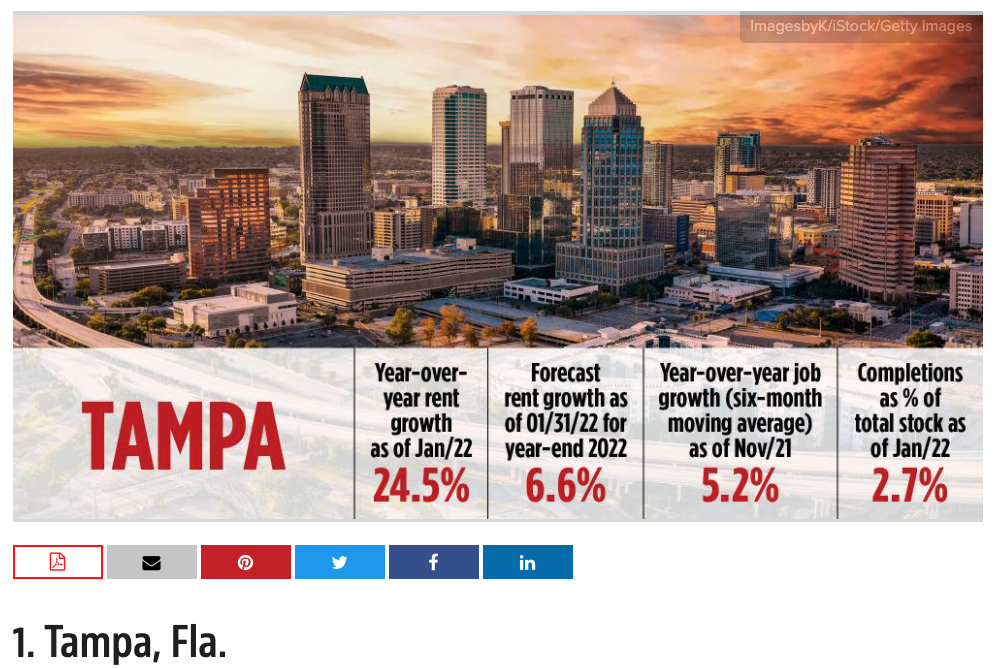

NAR: Housing Hot Spots 2025

The year ahead is poised to bring more opportunities for homebuyers as the housing market continues to stabilize. The Federal Reserve is expected to maintain a gradual approach to easing monetary policy in 2025.

While concerns about federal deficits and rising public debt may cap the extent of those rate cuts, borrowing costs are anticipated to stabilize overall, offering some relief to prospective buyers.

Sustained International Interest: Pricing in the U.S. adjusted faster than in many other parts of the globe, making the basis for acquisition attractive.

However, mortgage rates are unlikely to return to the ultra-low levels seen during the pandemic or the pre-pandemic levels. Affordability will remain a concern for many, particularly in high-demand markets. The National Association of REALTORS® forecasts mortgage rates to stabilize near 6% in 2025, likely establishing a new normal.

Dec 12, 2024

Source - read more

Sustained International Interest: Pricing in the U.S. adjusted faster than in many other parts of the globe, making the basis for acquisition attractive.

However, mortgage rates are unlikely to return to the ultra-low levels seen during the pandemic or the pre-pandemic levels. Affordability will remain a concern for many, particularly in high-demand markets. The National Association of REALTORS® forecasts mortgage rates to stabilize near 6% in 2025, likely establishing a new normal.

Dec 12, 2024

Source - read more

However, mortgage rates are unlikely to return to the ultra-low levels seen during the pandemic or the pre-pandemic levels. Affordability will remain a concern for many, particularly in high-demand markets. The National Association of REALTORS® forecasts mortgage rates to stabilize near 6% in 2025, likely establishing a new normal. Dec 12, 2024

Source - read more

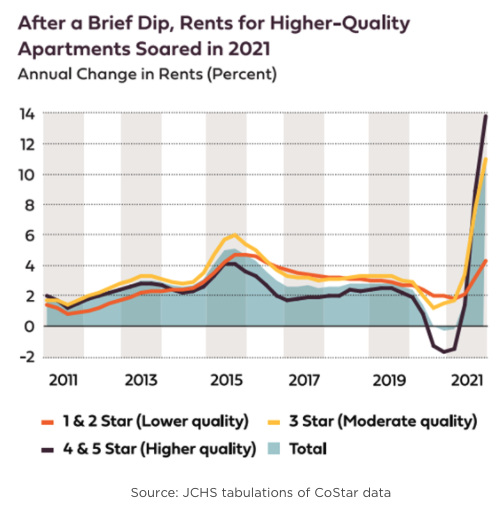

Multifamily Housing and the 2024 Election

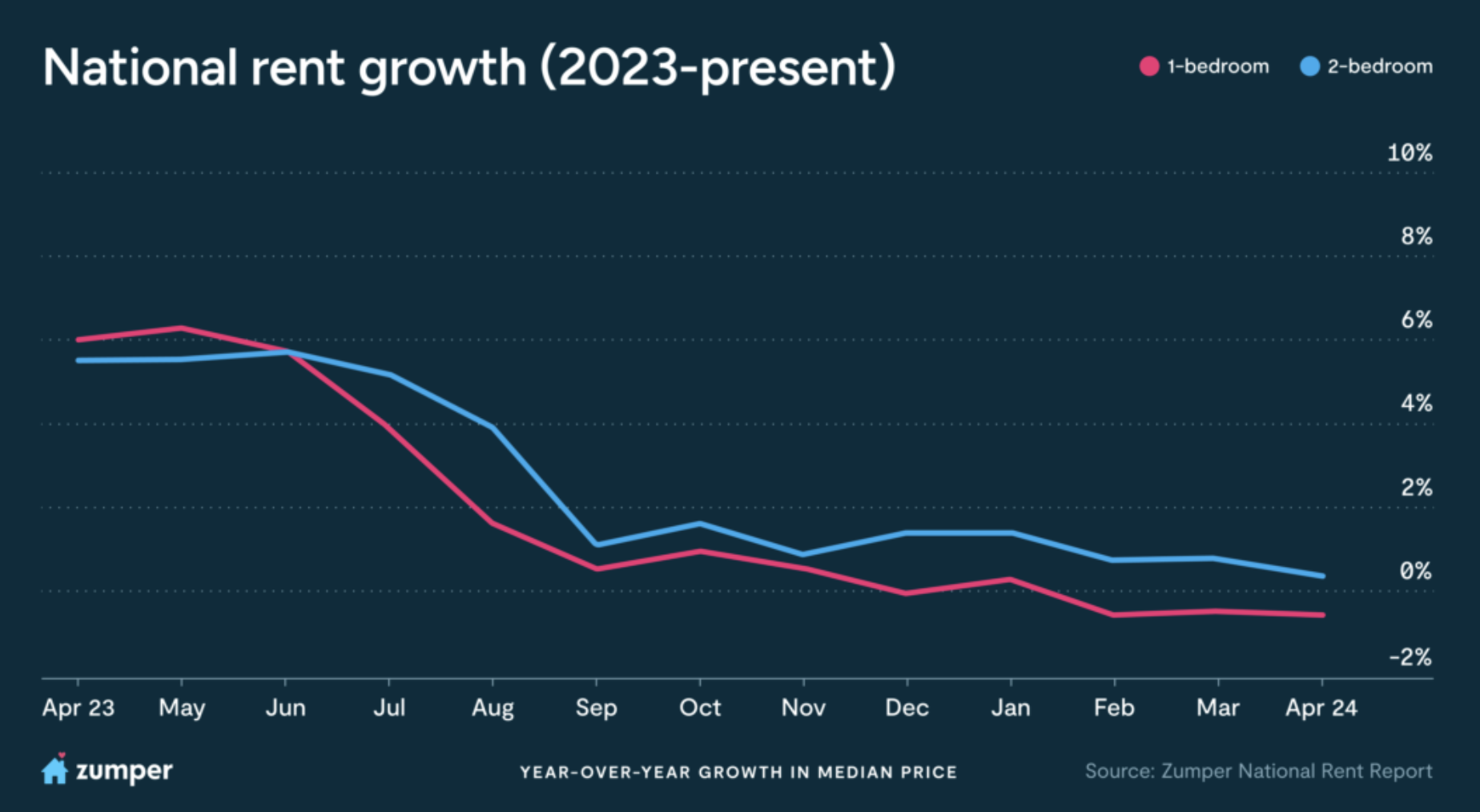

Housing affordability played an important role in the 2024 election as both parties outlined their plans to respond to rising rent levels. Effective rents have climbed 20% nationally since Q4 2019 along with rising prices throughout the economy resulting from the period of heightened inflation that the Federal Reserve continues to fight. President-elect Trump’s second term is likely to lead to adjustment in the American economy as a result of outlined plans to raise tariffs on foreign goods and tighten immigration levels along with expected tax and spending adjustments. As outlined in our analysis before the election, we expect effective rent growth to moderate as a result of macroeconomic conditions and recent supply growth, with reduced housing demand placing further downward pressure on rent growth with a tradeoff of lower expected supply growth. Nov 13, 2024

Source - read more

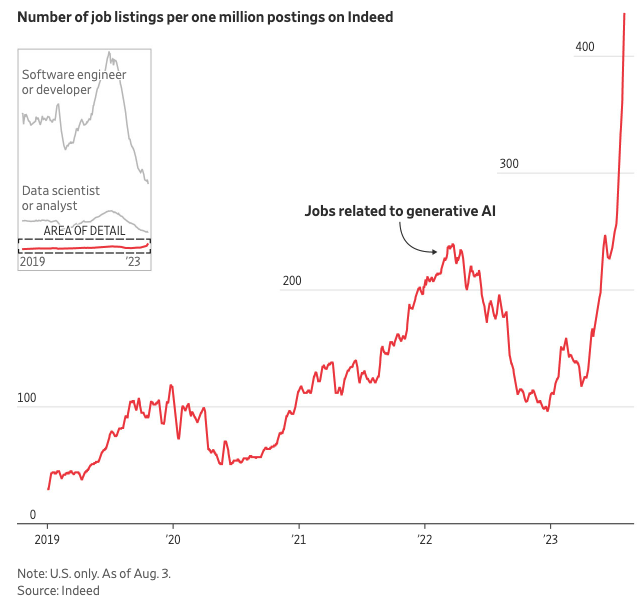

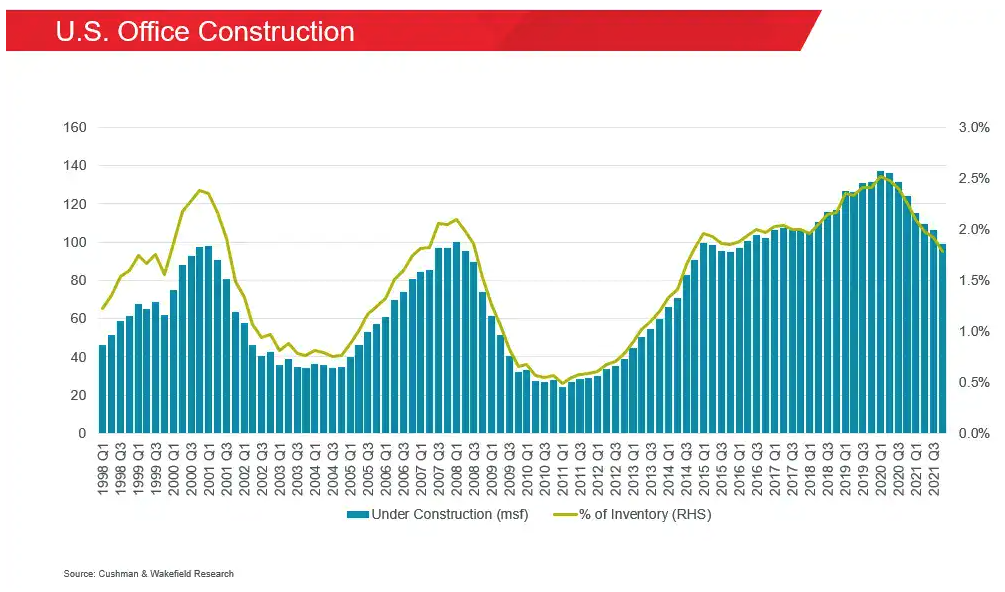

Led by AI, Tech Demand for Office Space Is on the Rise

Technology companies’ leasing of office space jumped in the third quarter to its highest level in nearly three years, reflecting the growth of artificial-intelligence firms and job growth in the tech industry.

Tech firms leased 9.9 million square feet of U.S. office space during the third quarter. That was up from about eight million in the second quarter, and the highest amount since the fourth quarter of 2021, according to a new report from commercial real-estate services firm CBRE Group.

Hiring by tech companies has also edged higher, resulting in an uptick in office demand. Job growth was up 1% for the year through July, compared with all of 2023 when it rose 0.3%.

That is still well off the 5.4% growth in 2021, CBRE said. The U.S. office market remains in a glut, in part because many tech companies are taking less space when signing new leases because of hybrid workplace strategies.

Nov 12, 2024

Source - read more

Tech firms leased 9.9 million square feet of U.S. office space during the third quarter. That was up from about eight million in the second quarter, and the highest amount since the fourth quarter of 2021, according to a new report from commercial real-estate services firm CBRE Group.

Hiring by tech companies has also edged higher, resulting in an uptick in office demand. Job growth was up 1% for the year through July, compared with all of 2023 when it rose 0.3%.

That is still well off the 5.4% growth in 2021, CBRE said. The U.S. office market remains in a glut, in part because many tech companies are taking less space when signing new leases because of hybrid workplace strategies.

Nov 12, 2024

Source - read more

That is still well off the 5.4% growth in 2021, CBRE said. The U.S. office market remains in a glut, in part because many tech companies are taking less space when signing new leases because of hybrid workplace strategies. Nov 12, 2024

Source - read more

Colliers 2025 Global Investor Outlook

Commercial real estate markets worldwide are showing signs of positive momentum, with stronger sentiment growing as asset values stabilize. Investor confidence is rising,

and while gross transaction volumes remain modest, conversations and funraising activity indicate that markets are moving past their low point.

Revival in Activity: Investors can now look forward to falling interest rates and improved market conditions. A tailwind of declining rates will be supportive of a market rebound

over the next several quarters.

Sustained International Interest: Pricing in the U.S. adjusted faster than in many other parts of the globe, making the basis for acquisition attractive.

Asset Class Allocation: The multifamily and industrial sectors are expected to lead sales, while office presents unique buying opportunities. Additionally, growth in alternative assets can unlock investment potential.

Nov 19, 2024

Source - read more

Revival in Activity: Investors can now look forward to falling interest rates and improved market conditions. A tailwind of declining rates will be supportive of a market rebound

over the next several quarters.

Sustained International Interest: Pricing in the U.S. adjusted faster than in many other parts of the globe, making the basis for acquisition attractive.

Asset Class Allocation: The multifamily and industrial sectors are expected to lead sales, while office presents unique buying opportunities. Additionally, growth in alternative assets can unlock investment potential.

Nov 19, 2024

Source - read more

Sustained International Interest: Pricing in the U.S. adjusted faster than in many other parts of the globe, making the basis for acquisition attractive.

Asset Class Allocation: The multifamily and industrial sectors are expected to lead sales, while office presents unique buying opportunities. Additionally, growth in alternative assets can unlock investment potential.

Nov 19, 2024

Source - read more

Asset Class Allocation: The multifamily and industrial sectors are expected to lead sales, while office presents unique buying opportunities. Additionally, growth in alternative assets can unlock investment potential. Nov 19, 2024

Source - read more

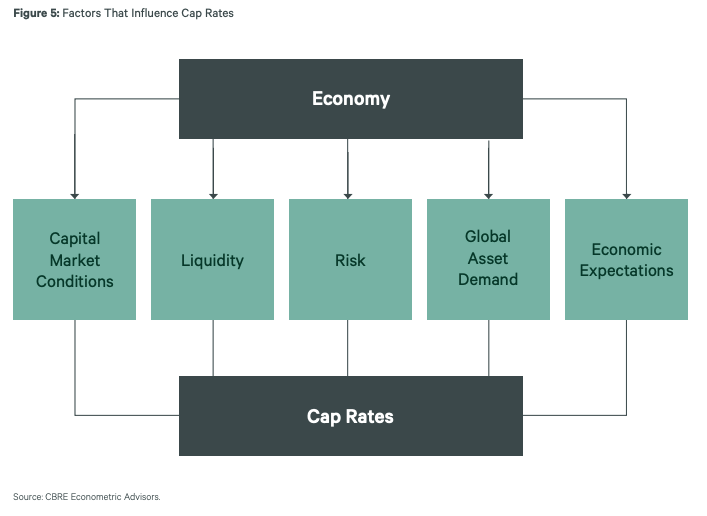

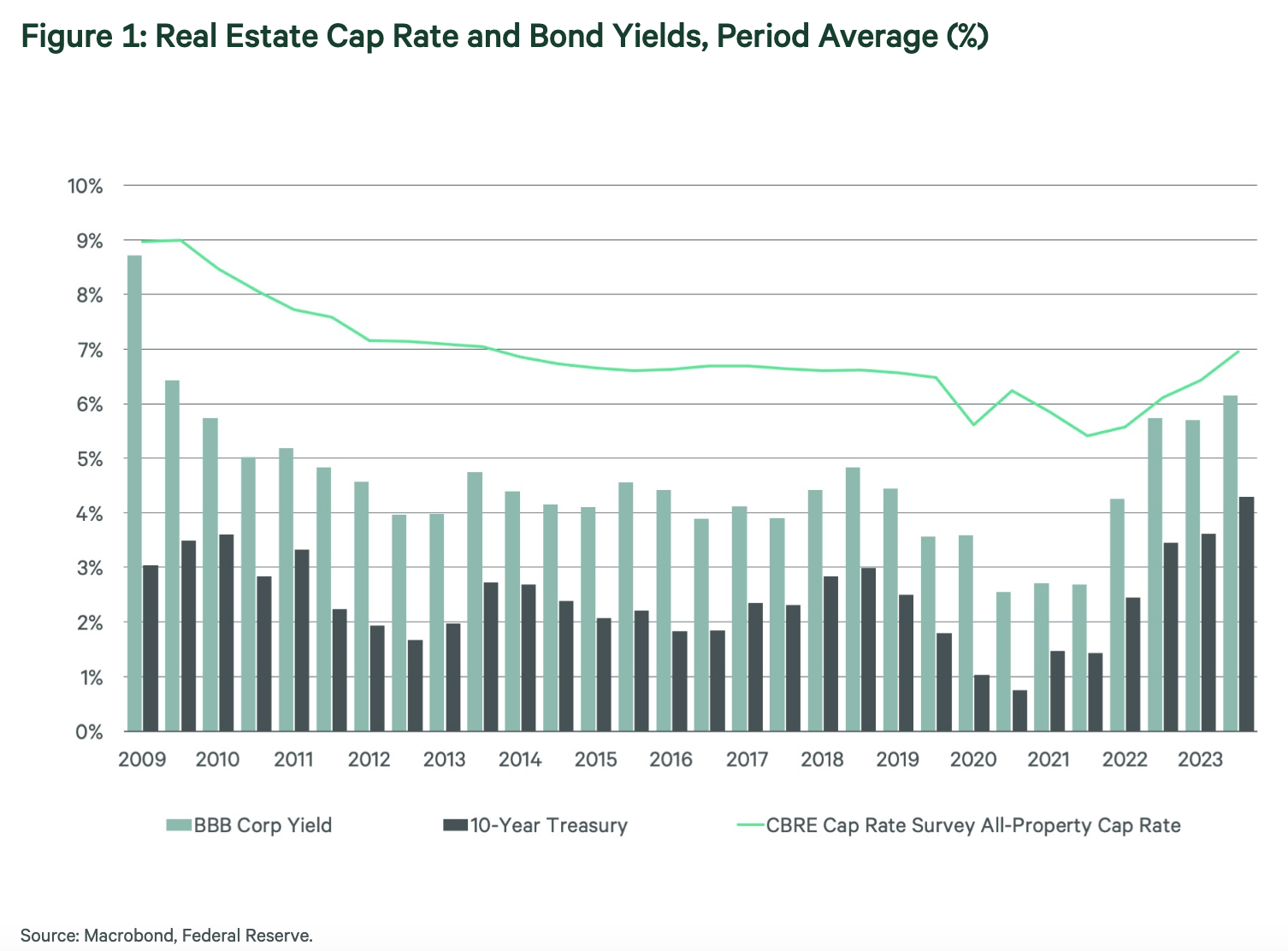

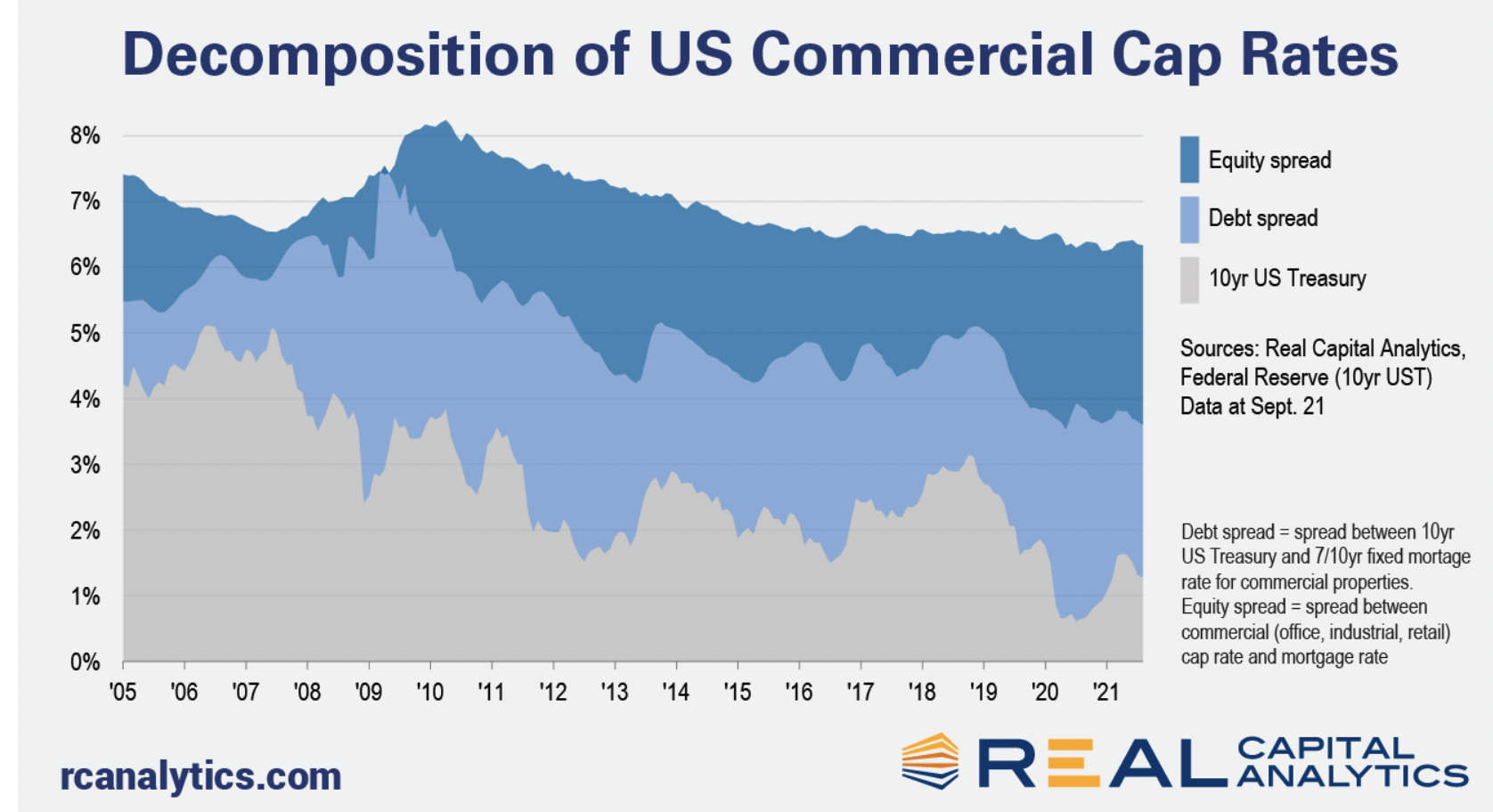

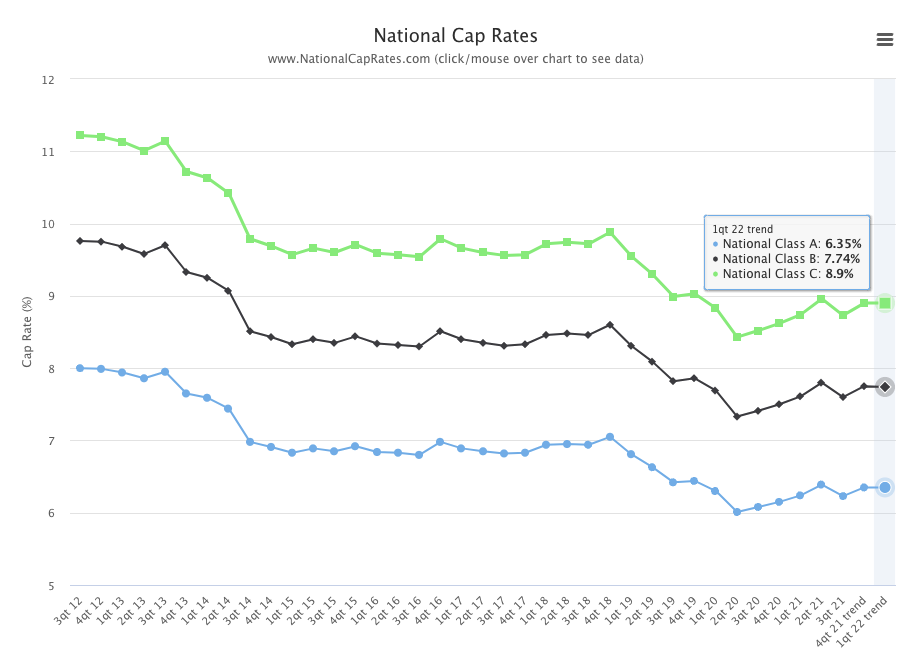

Impact of Interest Rate Cuts on Real Estate Cap Rates

Now that the Fed is starting to cut interest rates, how will real estate capitalization rates react? Conditions that facilitate changes in short-term policy rates influence the long-end of the yield curve, which in turn most influences real estate investment activity. A CBRE Econometric Advisors (CBRE EA) review of cap rates since 1995 shows that for every 100-basis-point change in the 10-year Treasury yield, cap rate movements range between 41 basis points (bps) on average for industrial assets to 78 bps for retail assets. Office cap rate movements averaged 70 bps, while those for multifamily assets averaged 75 bps. Oct 10, 2024

Source - read more

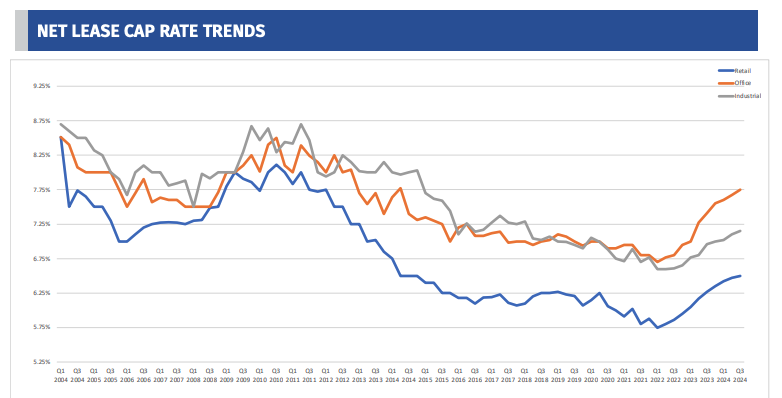

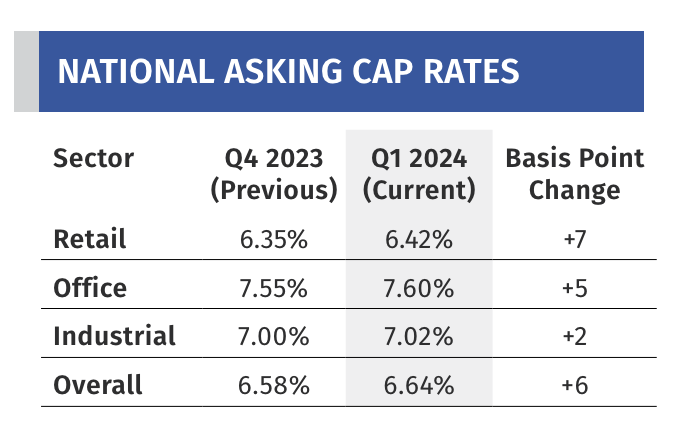

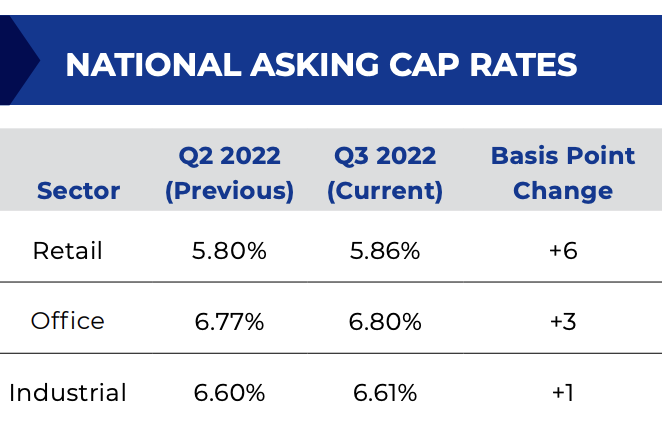

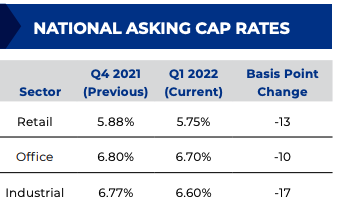

Boulder Group - STNL Cap Rates Inch Higer in 3Q

Cap rates in the single tenant net lease sector increased for the 10th consecutive quarter within all three sectors in the third quarter of 2024. Single tenant cap rates increased to 6.50% (+3 bps) for retail, 7.75% (+8 bps) for office, and 7.15% (+5 bps) for industrial. The persistent upward trend in cap rates can be primarily attributed to sustained high interest rates. Additionally, there is a stagnant supply of net lease properties on the market resulting from limited transaction activity from both private and institutional buyers. Oct 3, 2024

Source - read more

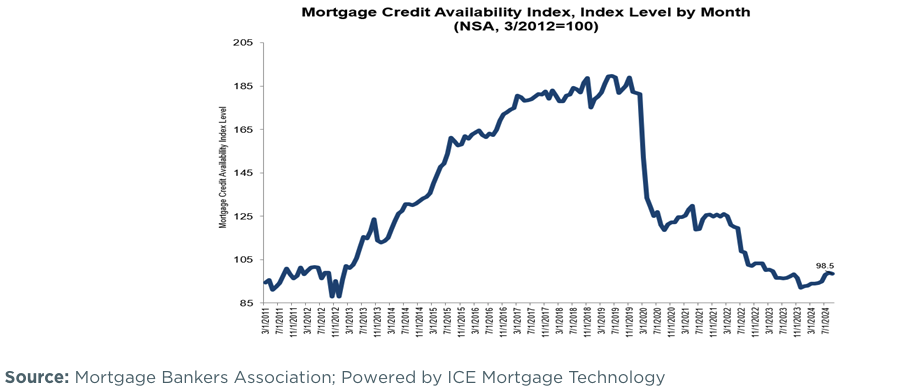

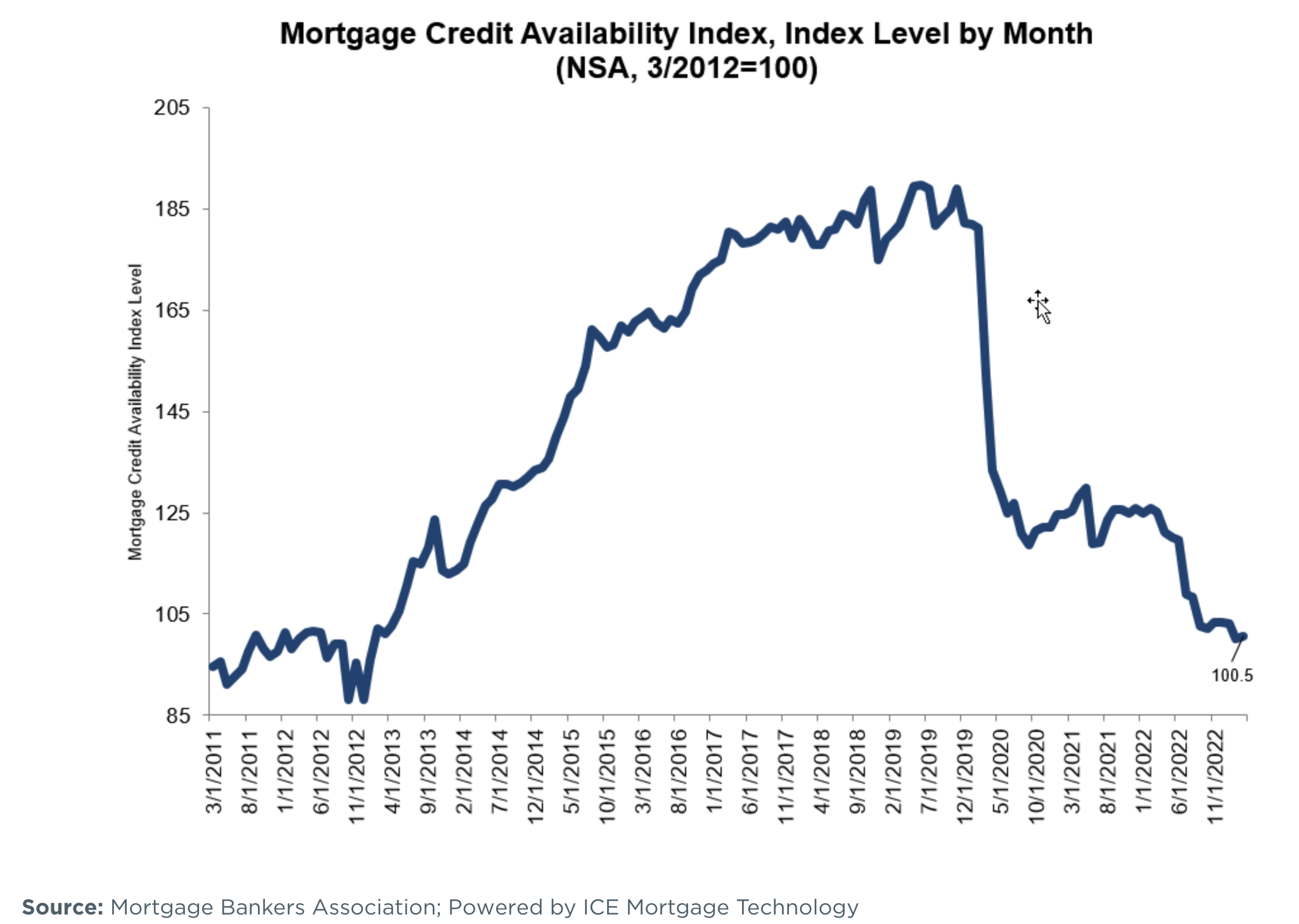

Mortgage Credit Availability Decreased in September

Mortgage credit availability decreased in September according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) that analyzes data from ICE Mortgage Technology. The MCAI fell by 0.5 percent to 98.5 in September. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012. The Conventional MCAI decreased 1.7 percent, while the Government MCAI increased by 0.8 percent. Of the component indices of the Conventional MCAI, the Jumbo MCAI decreased by 2.6 percent, and the Conforming MCAI remained unchanged. Oct 15, 2024

Source - read more

Baby Boomers Refuse to Sell Homes as Younger Families House Hunt

A shortage of homes for resale is helping keep home prices up and beyond the reach of many would-be buyers. However, the majority of baby boomers who own many of the existing houses that could become the dream homes of young families have no interest in selling. Indeed, more than half believe younger generations could afford to buy a home if they tried harder or were more responsible. These are the findings of a survey of 1,100 Americans born between 1946 and 1964 by Clever Real Estate, a St. Louis-based real estate company. The survey was conducted in July. Of the boomers surveyed, 61% currently own their homes, and 54% of them plan never to sell because they attribute much of their financial security to home ownership. Almost 90% also say it leads to a more stable home life. And 46% say they would consider themselves failures if they didn't own a home. Only 15% expect to sell in the next five years. However, 25% of boomer owners also want to stay put because a new home would cost more than they could afford as a result of inflation or because of the high costs of assisted living or retirement communities. Sept 12, 2024

Source - read more

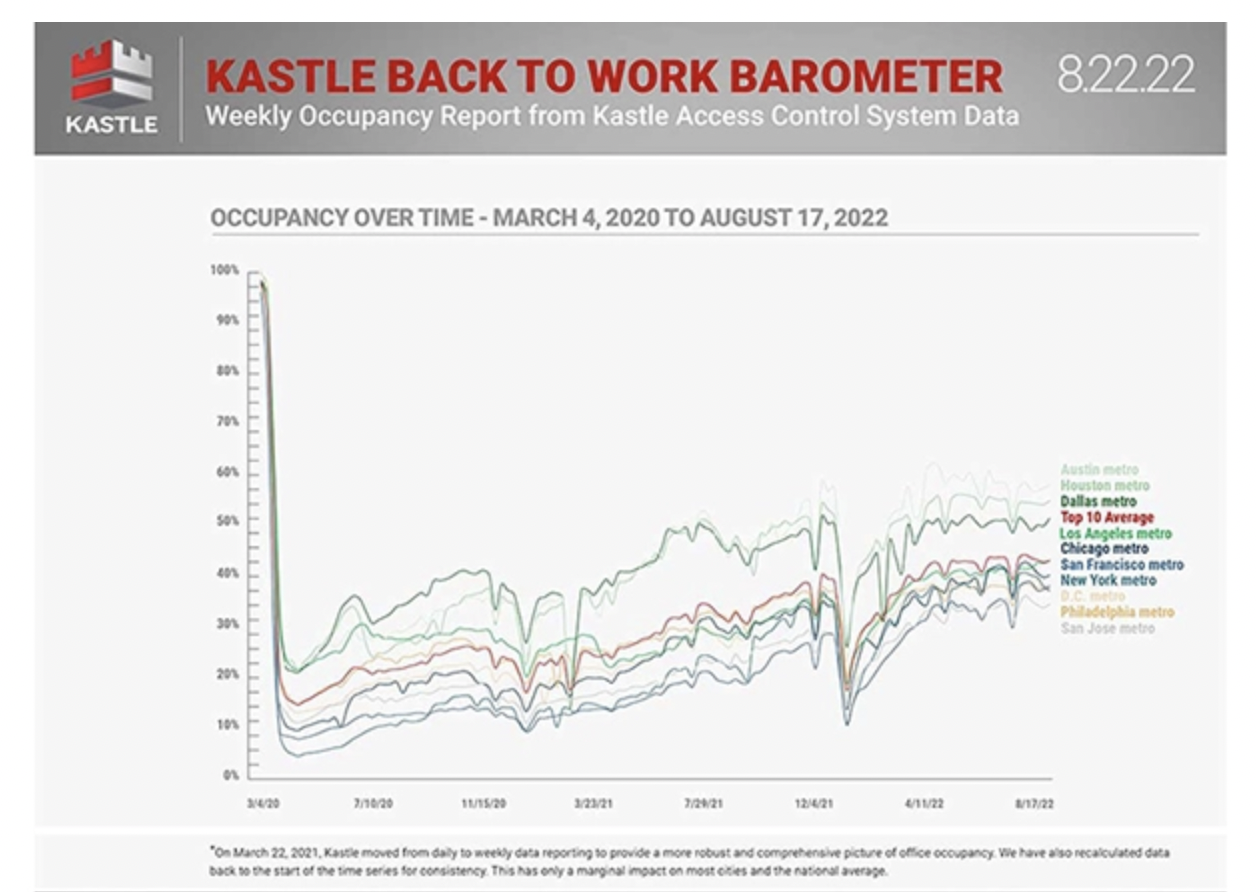

Increasing Office Visits Not A Panacea for Record High Vacancy Rates

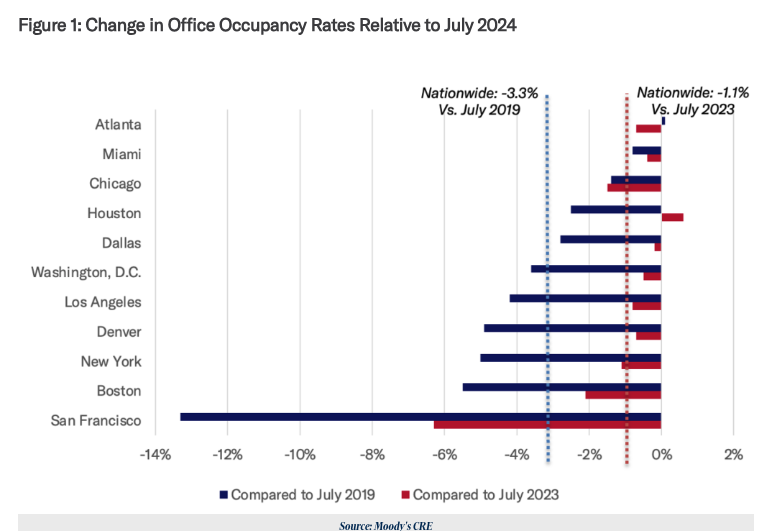

According to Placer.ai – a startup that uses cell phone data to analyze foot traffic patterns down to the property level – nationwide employee office visits were 27.8% lower than compared to July 2019 and 16.5% higher than July 2023. Perhaps unsurprisingly, among the eleven metros included in Placer.ai’s report, San Francisco’s office recovery has been the most mired with office visits (as of July 2024) 47.3% lower relative to July 2019. However, relative to July 2023, office visits in San Francisco were 20.2% higher, which was tied with Los Angeles for the second-highest percentage increase (behind Miami) among those select metros. Combining the Placer.ai with Moody’s CRE data continues to suggest that higher employee utilization rates do not necessarily translate into higher office occupancy rates. Specifically, for every one percentage point increase in office visits, the occupancy rate either increased or decreased by approximately 16-bps depending on the time interval used in the regression. Sept 9, 2024

Source - read more

Can 3-D Printing Revolutionize Real Estate? Walmart Puts That Question to the Test

A Walmart Supercenter’s new expansion is one of the largest 3-D printed commercial real-estate projects in U.S. history. Its bumpy road to completion illustrates the new technology’s promise and shortcomings. The retail giant added the 8,000-square-foot space to its Athens, Tenn., location to hold items customers buy online for pickup or delivery. Walmart, which has more than 200 other additions like this in the pipeline, wanted to see if 3-D printing could get the job done faster and more cost-effectively. Sept 9, 2024

Source - read more

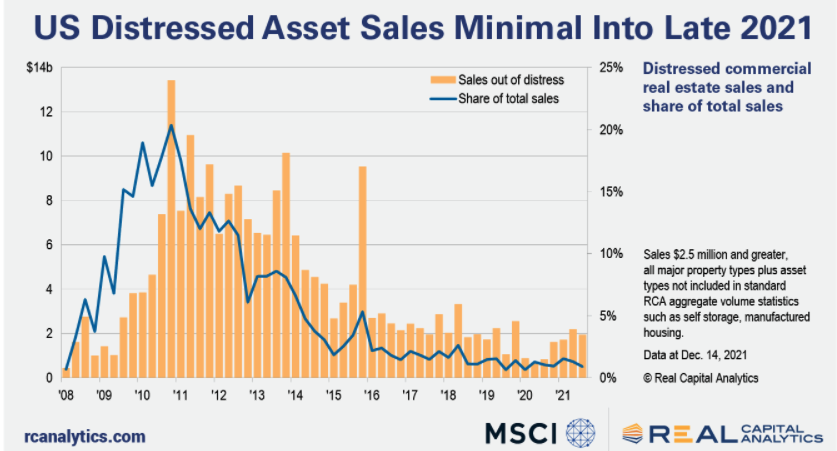

Real Estate in Focus: Signs of Recovery After the Shocks

Key findings Global commercial real estate is showing signs of recovery from the slowdown sparked by higher interest rates. Sales of commercial property worldwide in the second quarter of 2024 matched the levels of the same period in 2023, and price declines in the U.S. moderated. Challenges remain, including fears that slowing U.S. job growth could lead to an abrupt economic downturn. Aug 9, 2024

Source - read more

Q2 2024 Housing Affordability Update

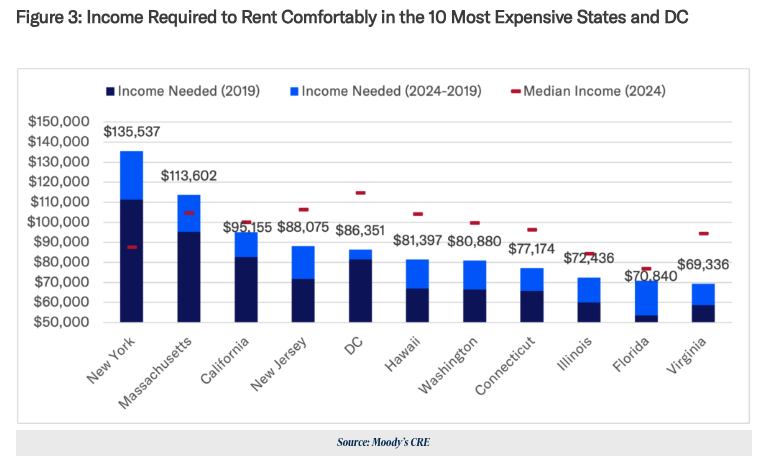

Over the first half of the year, rents have declined while income grew on a year-over-year basis, easing the rent-to-income ratio on the national level. Among the top ten metros with the highest RTIs, most have enjoyed a decrease, except the New York metro in the last 12 months due to its lackluster income growth in comparison with rent growth. Household formation accelerated in recent quarters, contributing to rent growth turning the corner, but the rate varies across areas as they are influenced by demographic and economic factors, with the required income to reside in the costliest states ranging between $69,336 and $135,537. The lack of affordable housing in densely populated states poses challenges for both renters and policymakers, particularly affecting the younger population and immigrants. A living wage is essential for financial sustainability in areas with high living costs. Aug 20, 2024

Source - read more

Left Behind in the Retail Real-Estate Comeback: Department Stores

Department stores are bleeding customers, and landlords no longer view them as magnets for shoppers. Discounters are underpricing them. Specialty stores are outmaneuvering them. And luxury brands are sometimes bypassing department stores to open their own shops. The surviving operators are making big moves in hopes of turning things around. Saks Fifth Avenue’s parent company is buying rival Neiman Marcus. Nordstrom executives are exploring taking the company private. Macy’s new chief executive is closing stores while trying to improve the shopping experience at its leaner fleet. Aug 6, 2024

Source - read more

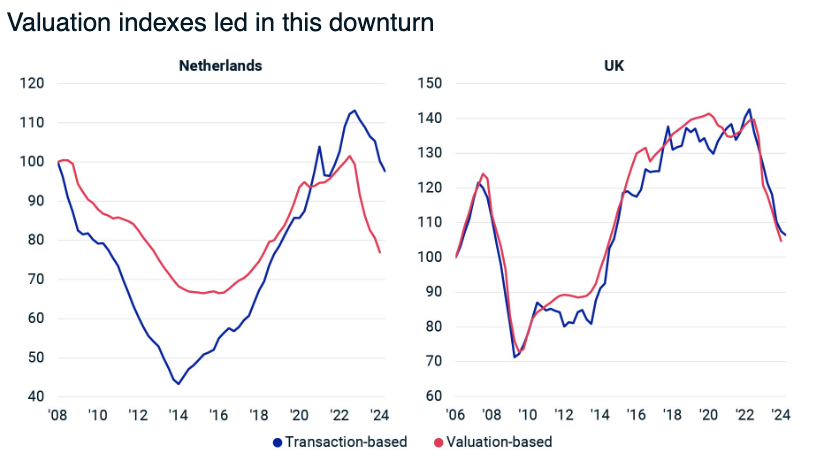

Revenge of the Appraiser: The Power of Valuations

Understanding market performance is essential for any investor in commercial real estate. Accurate and timely pricing data is of high value, especially during periods of uncertainty. Representing market trends with a transaction-based index is challenging in times such as the current period, however, when fewer transactions are occurring. The judgment applied by valuation professionals can help provide clarity in these times. May 20, 2024

Source - read more

Office Submarkets Bucking the Trend

As of the first quarter of 2024, our top 82 primary office markets were evaluated based on their year-to-date change in effective revenue. Among our five regions, while the Northeast was the top ranked region for the multifamily sector, its office sector performance ranked last given its effective revenue declined by 87-bps during the quarter. Similarly, while the Southwestern Region ranked second-to-last in terms of multifamily sector performance this quarter, its office sector performance ranked first given its effective revenue was higher by 0.62%. Knoxville, TN reported the largest increase in effective revenue at 8.0% – well outpacing the runner up (Greensboro/Winston-Salem, NC) by 450-bps – while Buffalo, NY reported the largest decline at -4.1%. Among our bottom ten office metros, there were several submarkets that bucked the trend in generally down markets. Interestingly, three of those top five submarkets were from Raleigh-Durham, NC. However, the Beltsville submarket in Suburban Maryland took the crown considering its effective revenue increased the most at 10.8%. May 28, 2024

Source - read more

How Much Is Mar-a-Lago Actually Worth? It’s a Billion-Dollar Question.

It has been called “the Mona Lisa,” “the crown jewel” and “a national treasure.” As one of the largest, best-located estates in South Florida, former President Donald Trump’s Mar-a-Lago Club—a roughly 17-acre waterfront property on Palm Beach’s Billionaires’ Row—has long been a subject of fascination. The property’s potential value has also been a matter of debate in recent months. It emerged as a key example in a civil trial in New York that found Trump committed fraud by inflating his wealth and the value of his real-estate empire to secure low-interest financing. A competitive market for luxury Palm Beach properties and a string of recent big-ticket home sales there, including the $150 million deal in May for Tarpon Island, has led to further speculation about the price Mar-a-Lago could command. June 6, 2024

Source - read more

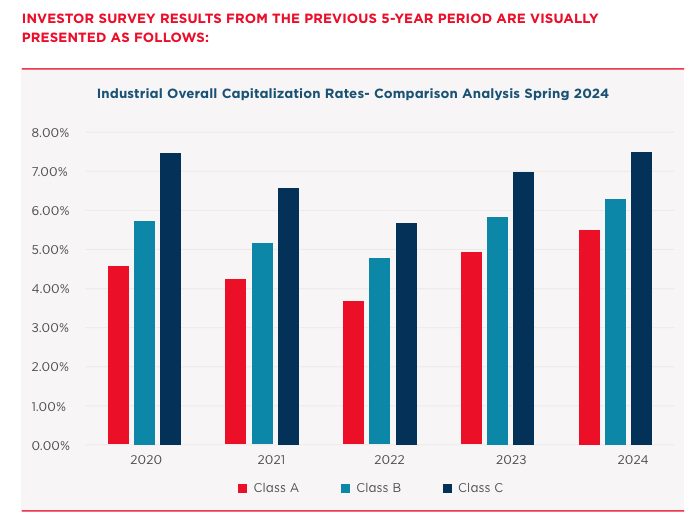

Port Cities Command Most Aggressive Industrial Cap Rates

Port cities are commanding the more aggressive overall capitalization rates for Class A properties although Midwest markets are not far behind, according to Cushman & Wakefield’s Industrial Investor Survey and Outlook for spring 2024. Most investors in the survey do not anticipate further increases in overall interest rates, as their current yield rates have been considered or priced in any potential near-term rate hikes. Activity in the 10-year US Treasury has resulted in higher yield rates and overall capitalization rates, as well as a higher cost of capital. This led the average capitalization rates for Class A assets higher by 58 bps compared to the spring 2023 survey. Likewise, Class B assets rose by 45 bps and Class C assets were up by 52 bps. May 3, 2024

Source - read more

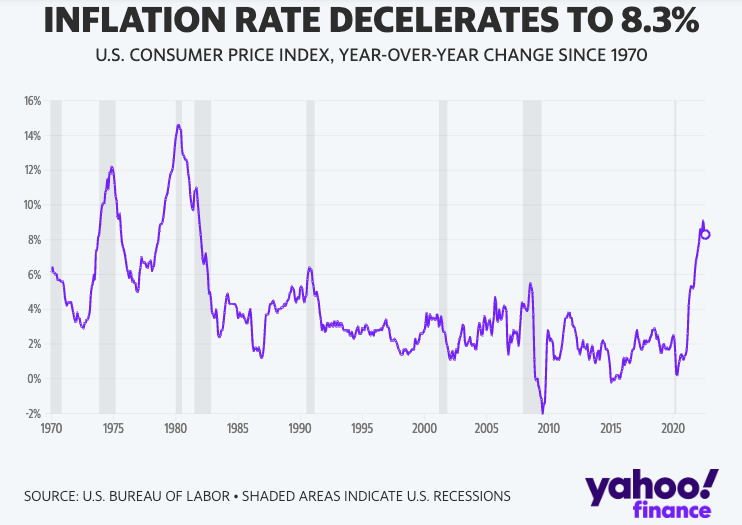

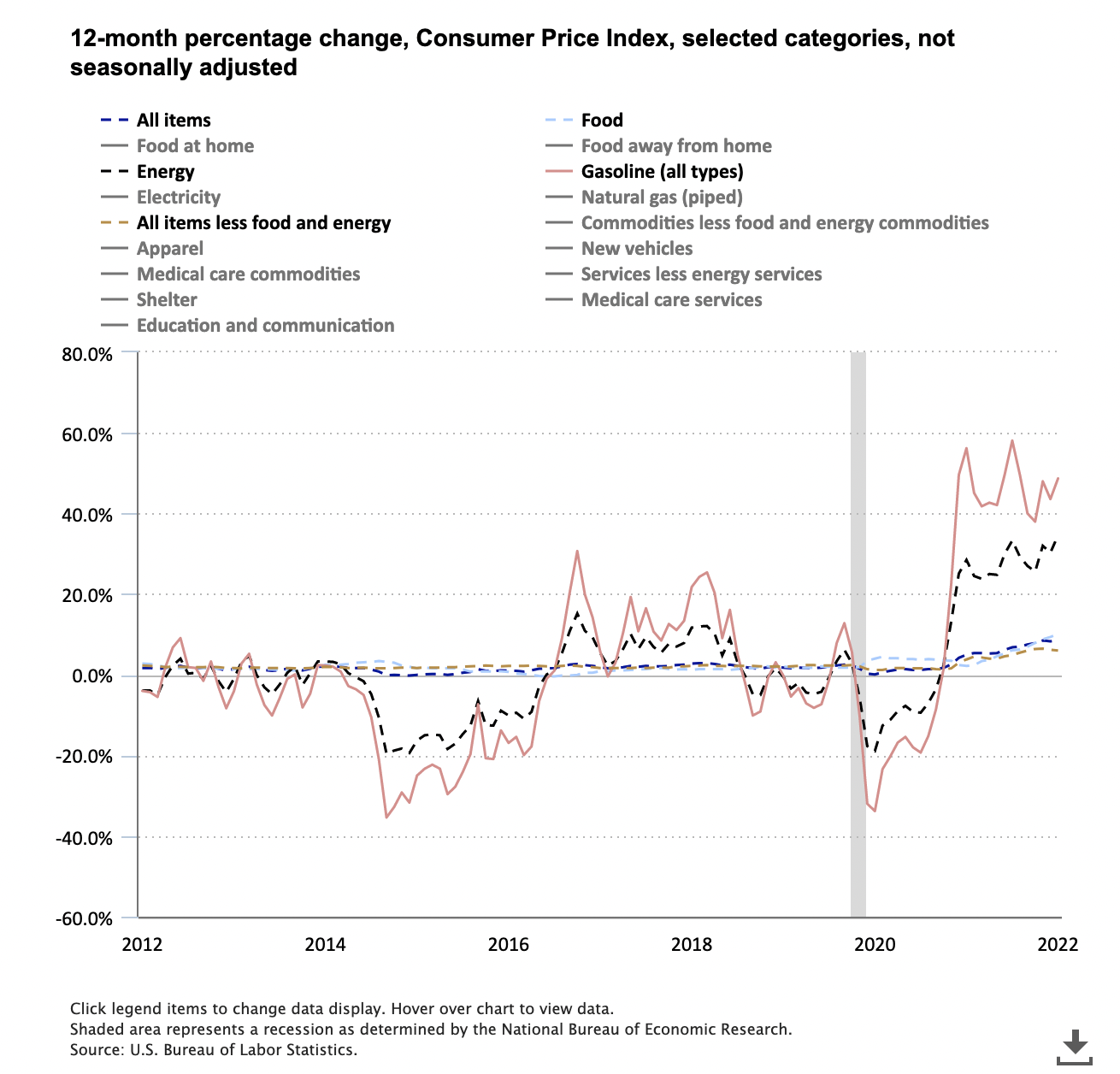

Stalled Inflation Vexes the Fed. Is It Noise or a New Trend?

Explaining why underlying inflation fell steadily from its pandemic peak of over 5% in 2022 to under 3% at the end of last year is straightforward: improved supply, softer demand and well-anchored inflation expectations. Explaining why it stalled in the first quarter is a lot harder. The fundamentals still look good: Supply and demand are coming back into balance, at least in the labor market, and inflation expectations have edged lower. Mar 2, 2024

Source - read more

Moody's: GDP Misses While Chipotle Cooks Red Lobster

After several weeks of generally hotter-than-expected economic data, Thursday’s advance estimate of Q1 real GDP fell well short of the consensus estimate of 2.5%, increasing at a still healthy annual rate of 1.6%. Meanwhile, the Federal Reserve’s preferred inflation gauge or the core PCE Price Index, rose by 0.3% MoM and 2.8% YoY in March. With the rate of consumer spending outpacing consensus, along with initial jobless claims falling to lowest level in nine weeks, markets have scaled back the projected number of interest rate cuts to just one, 25-bps reduction by year-end. Although aggregate consumer spending habits have continued to defy expectations over the past year, elevated inflation has disproportionately affected those in lower-income households. For retailers unable to adapt to ever-changing consumer spending habits, bankruptcies have loomed large with a few notable examples of late including Red Lobster, Express, Bed Bath & Beyond, and Joann Fabrics. Evidently, not all retailers have been in dire straits. Chipotle, for example, who targets more affluent customers, recently announced on its Q1 earnings call that same store sales rose by 7% and it plans to open 285 to 315 new restaurants this year. April 29, 2024

Source - read more

Zumper (MF) National Rent Report

The national rent index continued its trend of stable annual rates with one-bedrooms down 0.6% to $1,486, while two-bedrooms increased 0.1% to $1,843. As normal seasonality patterns return and the rental market has leveled off from the price spikes seen in the last few years, the national one-bedroom rate is now about $9 cheaper than it was last year. However, even with this cooling, the national one-bedroom rent is still nearly $250 pricier than it was in 2021. April 23, 2024

Source - read more

The Bolder Group: Cap Rates in the STNL sector increased 8 consecutive quarters

During the second month of the year, the Commercial Real Estate (CRE) market presented a mixed picture, with certain sectors showing resilience while others continued to face uncertainties and losses. The office sector has unquestionably borne the brunt of the most severe and persistent challenges than any other CRE category, and its outlook remains uncertain. The industrial sector has slowed down, with demand falling beneath levels seen before the pandemic. However, multifamily and neighborhood retail sectors remain strong. In the meantime, lower interest rates later this year are expected to create a more favorable environment for the CRE market by reducing costs, increasing demand, and stimulating economic activity. Q1 2024

Source - read more

Reversing the Real-Estate Doom Loop Is Possible. Just Look at Detroit

Barely a decade after Detroit declared bankruptcy, the city is emerging as America’s most unlikely real-estate boomtown. A development frenzy has gripped Detroit’s central business district. Big companies, including Ford and developer Related Cos., are spending billions of dollars on office buildings and other properties. Dan Gilbert, a Detroit native and the billionaire co-founder of home lender Rocket Mortgage, is leading the city’s revitalization. His new skyscraper, still under construction, recently topped out at 681 feet, making it the city’s second-tallest tower. It sits across the street from downtown Detroit’s first Gucci store. April 22, 2024

Source - read more

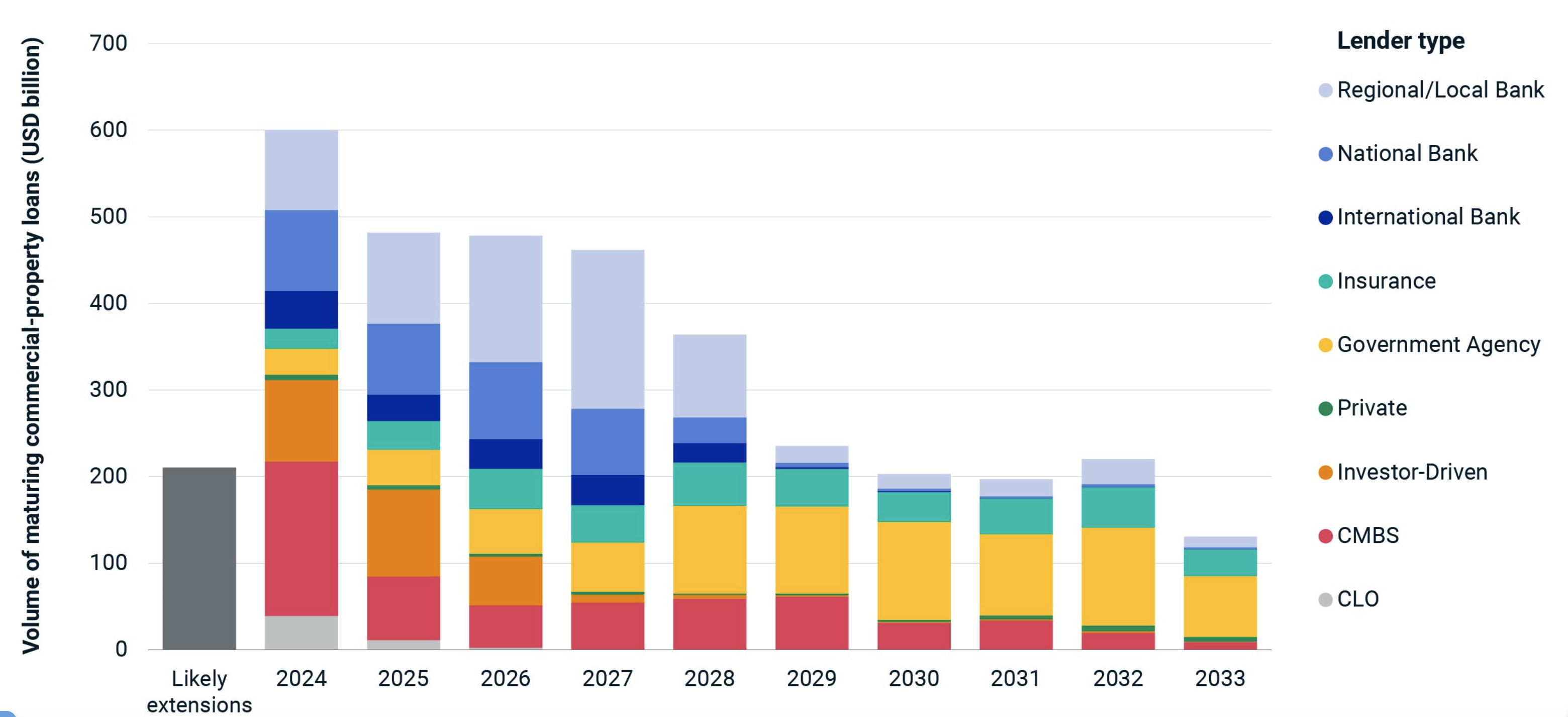

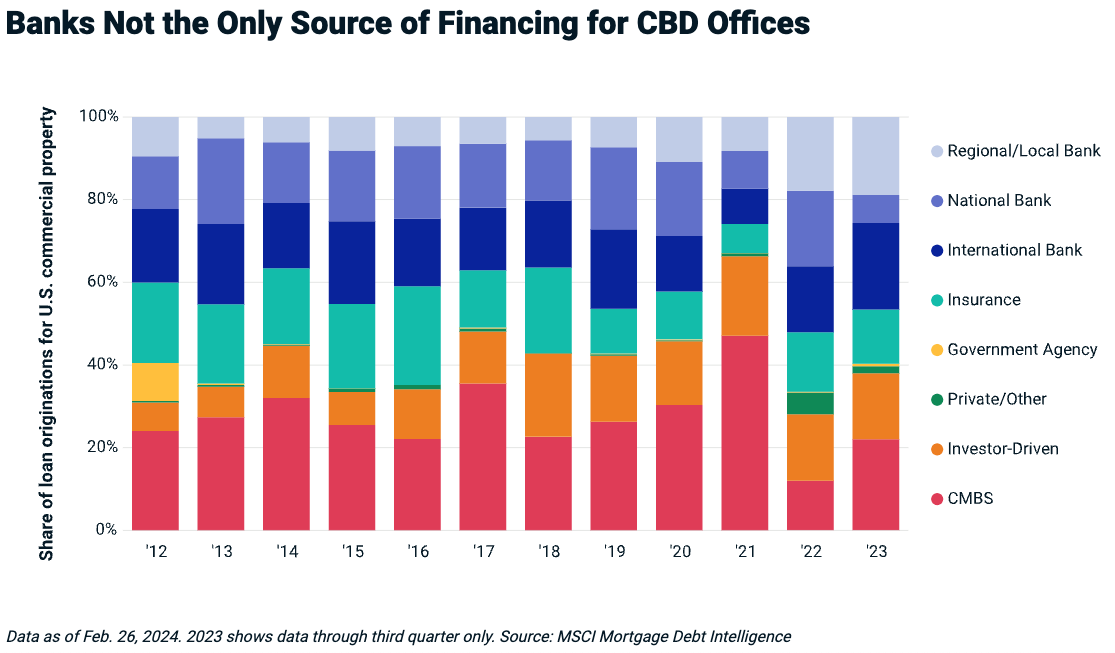

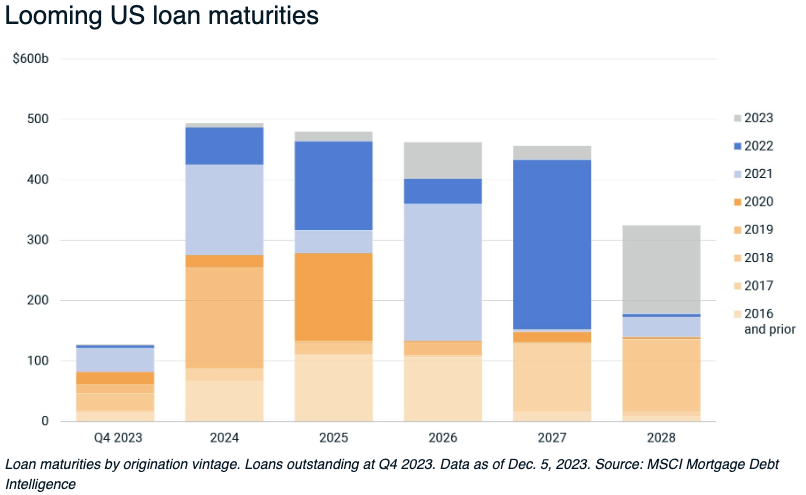

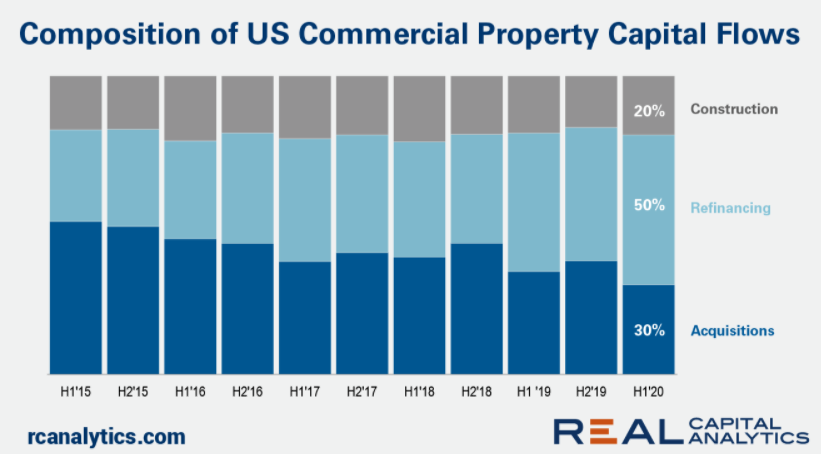

Wave of Property-Loan Maturities Amplified by Extensions

Close to USD 820 billion of U.S. commercial-property loans could mature in 2024, coming due after a broad decline in property prices and sharp increase in borrowing costs that may stymie the refinancing of some mortgages. Loans maturing in 2024 total around USD 600 billion, according to MSCI Mortgage Debt Intelligence data. Additionally, USD 214 billion of loans were slated to come due in 2023 but, according to our analysis, were not subsequently refinanced and no sale of the associated collateral occurred; we have deemed these loans “likely extensions.” Of the loans coming due this year, more than half were provided by commercial mortgage-backed security (CMBS), collateralized loan obligation and investor-driven lenders (e.g., debt funds). CMBS lenders have the single largest exposure to loans maturing in 2024, accounting for nearly 30% of the outstanding balance. Later in the maturity schedule, banks dominate. Bank lenders are behind at least 45% of the loans scheduled to come due in 2025, 2026 and 2027. Loans originated in 2021 make up the largest single vintage for 2024 loan maturities. Given these loans were originated around record-high prices and at ultra-low interest rates, we anticipate that many of these borrowers will look to their lenders in the hopes of extending the maturity of their loans. Not every lender will be willing or able to extend, however, making this vintage of loans a prime target for those investors looking for opportunities in the dislocation. March 26, 2024

Source - read more

March 2024 Commercial Real Estate Market Insights

During the second month of the year, the Commercial Real Estate (CRE) market presented a mixed picture, with certain sectors showing resilience while others continued to face uncertainties and losses. The office sector has unquestionably borne the brunt of the most severe and persistent challenges than any other CRE category, and its outlook remains uncertain. The industrial sector has slowed down, with demand falling beneath levels seen before the pandemic. However, multifamily and neighborhood retail sectors remain strong. In the meantime, lower interest rates later this year are expected to create a more favorable environment for the CRE market by reducing costs, increasing demand, and stimulating economic activity. March, 2024

Source - read more

Private Cash Buyers Dominate Net Lease

Are you a net lease investor with $5 million cash in your pocket? Then you’re golden in the current market. Right now the sector’s biggest problem is that there is a considerable amount of supply on the market and not enough buyers willing to invest at cap rates where the merchant developers can break even or make some money, explains Jimmy Goodman, partner with The Boulder Group. Goodman will be a moderator at GlobeSt.com’s upcoming Net Lease conference. Most of the deals he is seeing come from private buyers because institutional capital needs to be at a much higher cap rate – over 7% – compared to what private buyers can do. “There are not enough sellers that can meet that high of a cap rate,” Goodman says. A private buyer with cash, though, does not have to secure expensive financing, which is why the sub $5 million deal space right now is particularly robust. “The larger the deal the more likely you will need some form of debt and that makes a deal harder to pencil, Goodman says. March 29, 2024

Source - read more

CBRE: U.S. Cap Rate Survey H2 2023

Welcome to CBRE’s H2 2023 Cap Rate Survey (CRS). This survey comes at a unique time for real estate capital markets as limited investment volume has caused pricing uncertainty. The data driving this report was gathered from mid-November through December 2023 and informed by deals that occurred throughout the second half of 2023. We acknowledge that market conditions are fluid but believe that the CRS provides a useful base and unlocks important truths about how investor sentiment is changing.ommercial-property prices are falling, and lenders, investors and especially regulators are fearful of the impact on the broader financial system. The risks in the system today are not the same as those seen during other crisis events, however. Making the assumption that all banks will face the same challenges as in other downturns may lead one down a path to bad decisions. March 5, 2024

Source - read more

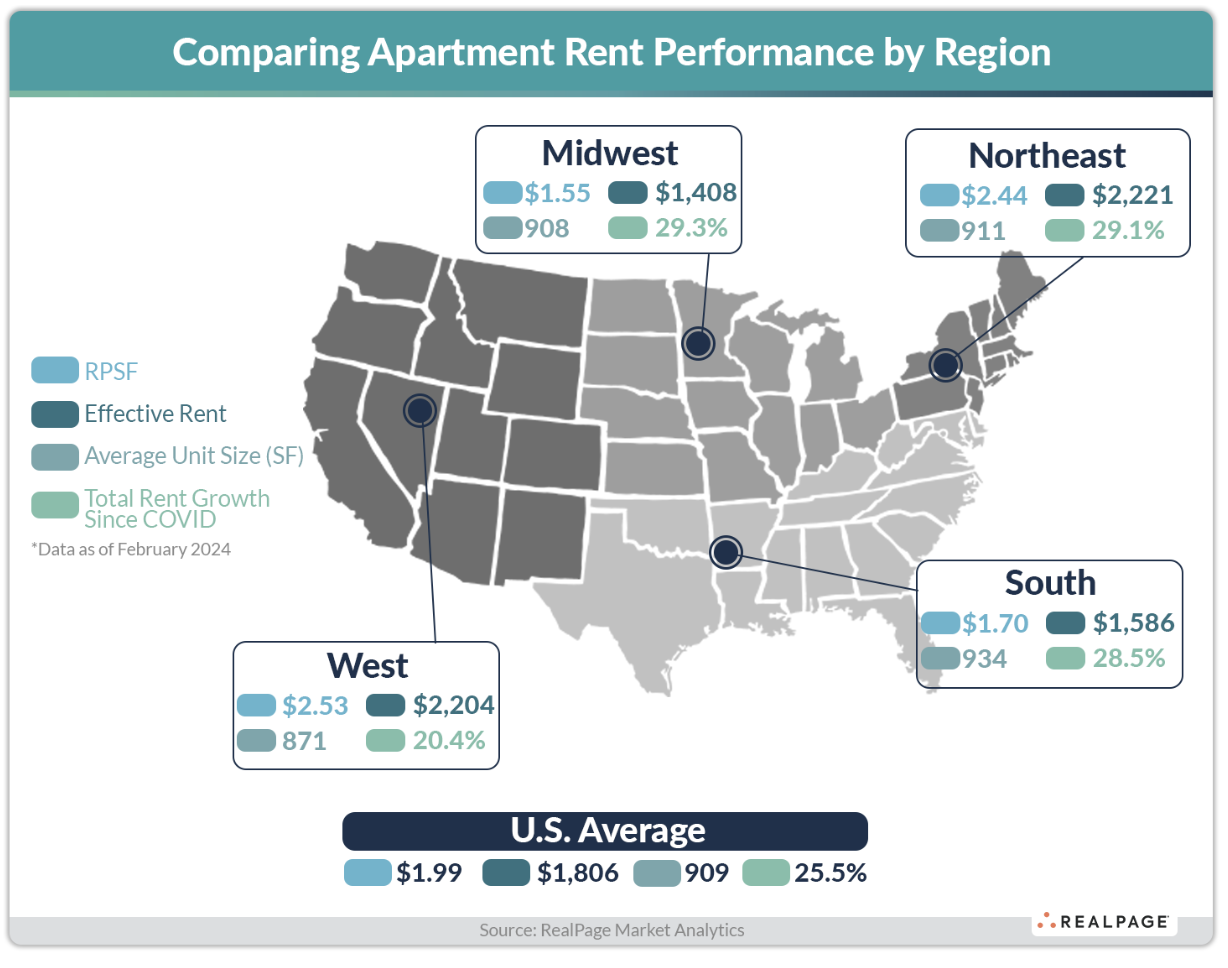

West Region Records Nation’s Slowest Apartment Rent Growth Since Pandemic

Since the global pandemic, apartment rents in the West region have grown at the slowest rate in the nation. Meanwhile, rents in the nation’s three other regions – the South, Midwest and Northeast – have all grown effective rents at a rate faster than the national norm. In turn, average effective rents in the West region now run below that of the Northeast for the first time since mid-2015. March 20, 2024

Source - read more

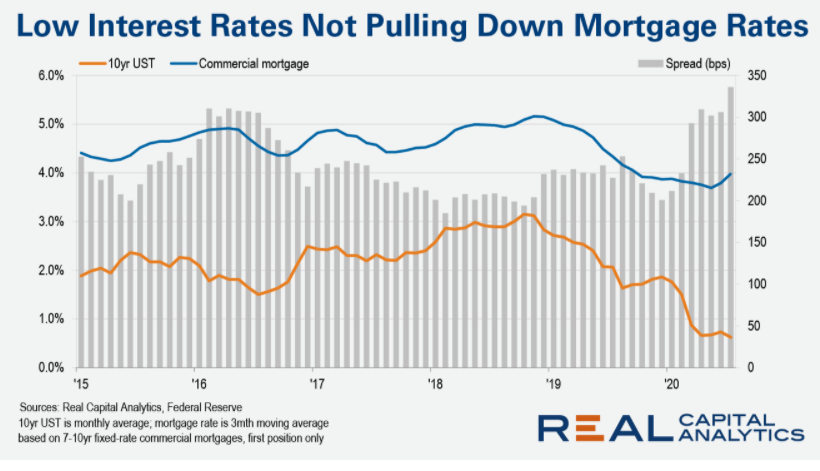

The New Normal for Mortgage Rates Will Be Higher Than Many Hope

Interest rates are likely to come down later this year, with the Federal Reserve on track to start cutting rates. But mortgage rates might not follow as quickly. That is because mortgages, and mortgage-backed bonds, just aren’t as in demand in financial markets as they were in the years before the Fed began to start to tighten in 2022. And they might not be for a while. March 22, 2024

Source - read more

Not Every Bank Is at Risk from CRE Lending

Commercial-property prices are falling, and lenders, investors and especially regulators are fearful of the impact on the broader financial system. The risks in the system today are not the same as those seen during other crisis events, however. Making the assumption that all banks will face the same challenges as in other downturns may lead one down a path to bad decisions. March 7, 2024

Source - read more

Why Private Developers Are Rejecting Government Money for Affordable Housing

LOS ANGELES—State and local governments in California have committed tens of billions of dollars to build more affordable housing. A new complex for some of the neediest low-income people doesn’t use any of it. By forgoing government assistance and the many regulations and requirements that come with it, SDS Capital Group said the 49-unit apartment building it is financing in South Los Angeles will cost about $291,000 a unit to build. The roughly 4,500 apartments for low-income people that have been built with funding from a $1.2 billion bond measure L.A. voters approved in 2016 have cost an average of $600,000 each. March 16, 2024

Source - read more

The CRE Digest: February 20, 2024

Office Space, Q4 2023 Housing Affordability Update, Q4 2023 Tech Markets, and More News from Last Week Between policy changes, market shifts, and sector trends, keeping up with all the news in the CRE world can be difficult. The CRE Digest gives you the quick insight you need into the latest goings-on, from the state of financing to deep dives on climate risk to individual metro forecasts. Check back every week for the new CRE Digest, so you can stay in the know. February 20, 2024

Source - read more

Offices Around America Hit a New Vacancy Record

America’s offices are emptier than at any point in at least four decades, reflecting years of overbuilding and shifting work habits that were accelerated by the pandemic. A staggering 19.6% of office space in major U.S. cities wasn’t leased as of the fourth quarter, according to Moody’s Analytics, up from 18.8% a year earlier. That is slightly above the previous records of 19.3% set in 1986 and 1991 and the highest number since at least 1979, which is as far back as Moody’s data go. The new record shows how remote work has upended the office market. But that is only part of the story. Much of the market’s current malaise traces its roots to the office-market downturn of the ’80s and ’90s. Jan 8, 2024

Source - read more

Investment Trends in Focus: Five Key Themes for 2024

2024 could be the year when major structural shifts in the economy start to have a significant effect on institutional and individual investors alike. MSCI remains committed to providing the data, models and tools that will help investors navigate both cyclical and structural challenges. With this backdrop, MSCI’s chief research officer, Ashley Lester and team have identified five key themes for this year. The macro backdrop will continue to dominate short-run concerns. But some major strategic shifts will be playing out simultaneously, including an acceleration in the growth of private credit, ongoing global power shifts, and the widespread deployment of artificial intelligence (AI). The long shadow cast by climate change lurks behind all these themes, with investors increasingly turning their attention towards the investment necessary to fund the transition. Jan 2, 2024

Source - read more

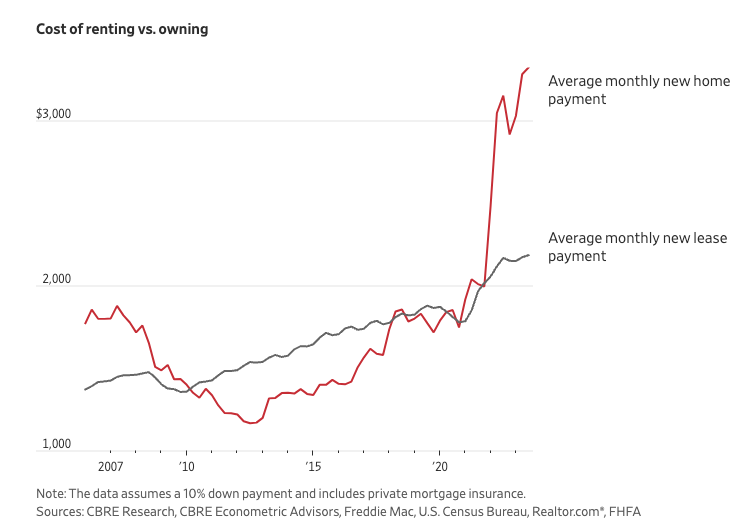

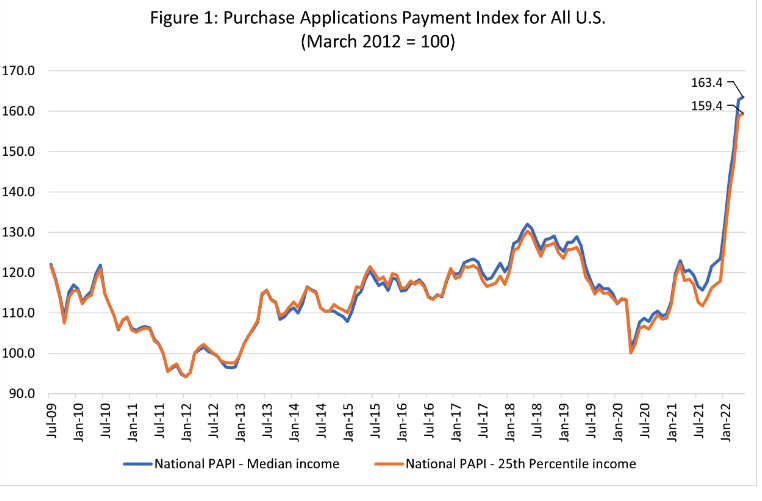

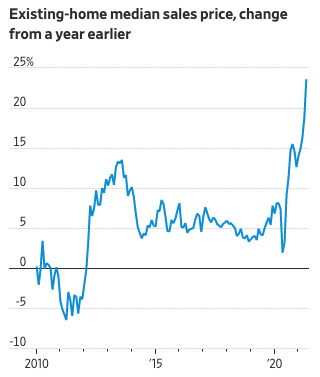

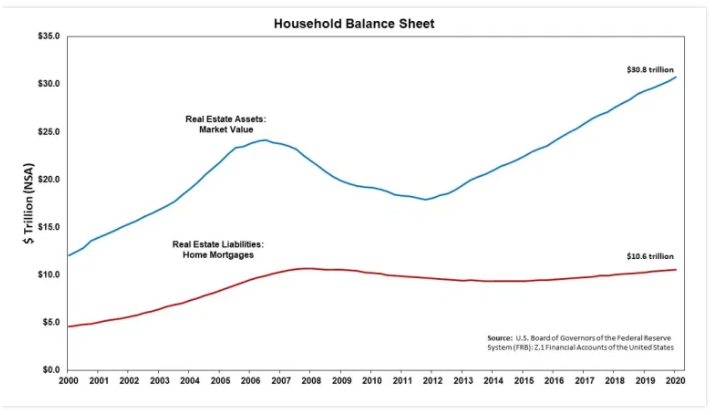

Housing Affordability Remains a Critical Concern

Industry leaders suggest it is time to let go of any notion that the real estate market will return to pre-pandemic conditions. Rather, according to PWC’s Emerging Trends in Real Estate report, pundits say they’ve accepted that a large number of Americans might not return to offices, a possibility that they say has “profound implications” not only for owners of commercial properties but also multifamily property owners as well as urban downtowns, other property sectors, and any neighborhood that depends on vibrant local office markets. Housing affordability remains a primary concern in today’s real estate market, according to the report, which last year noted that affordability had fallen to its lowest level in 30 years. “This year, it’s even worse, especially for homebuyers,” the authors note, adding that “a troubling combination of rising home prices and rapid increases in borrowing costs has put home purchases further out of reach for more people.” Jan 12, 2024

Source - read more

2024 Trends to Watch in Real Assets

The year 2023 was an especially tough one for real estate. Declines in asset valuations, which had begun in the second half of 2022 in many markets, proliferated across a broader range of markets through the rest of 2023. Transaction volume also continued to fall through the year, with dealmaking often paralyzed by the standoff between potential buyers and sellers on pricing. Investors will be hoping for a better 2024, where we find a floor in pricing that will return the market to more-normal levels of activity. When and how that happens remain to be seen. It may be through increased distress forcing sellers onto the market. Or we might eventually see interest rates start to fall, returning confidence to potential buyers. Whatever the details of exactly when and how we reach that point, the sudden market movements we’ve seen over the last 12 to 18 months have shifted the playing field. Investors are reassessing their real-estate allocations and strategies to mitigate significant risks but also exploit opportunities posed by this market dislocation. Dec 13, 2023

Source - read more

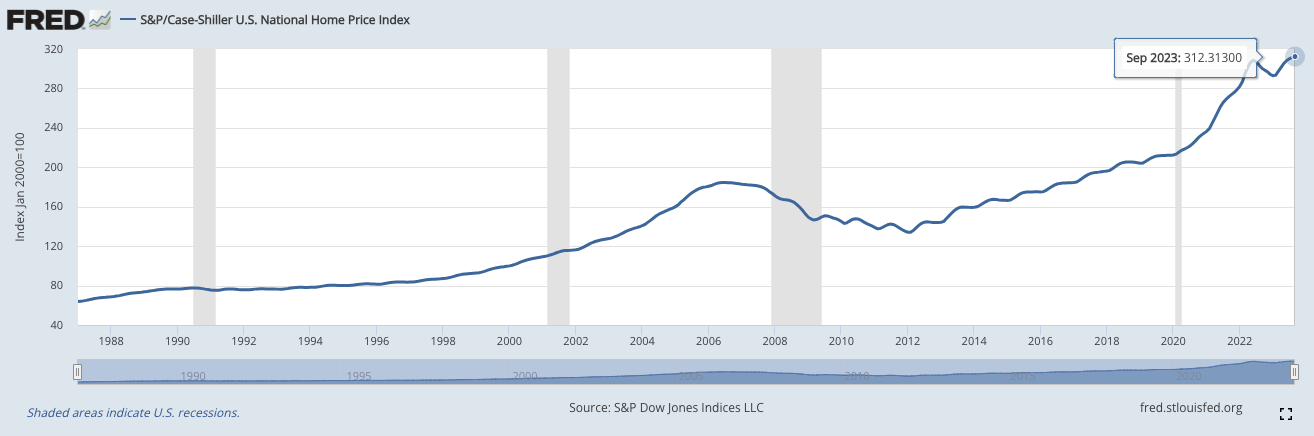

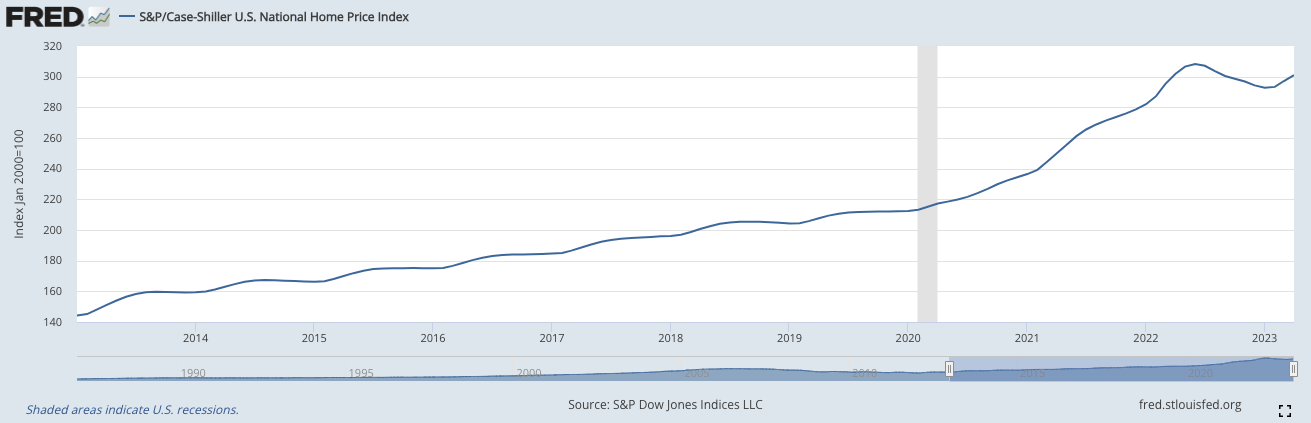

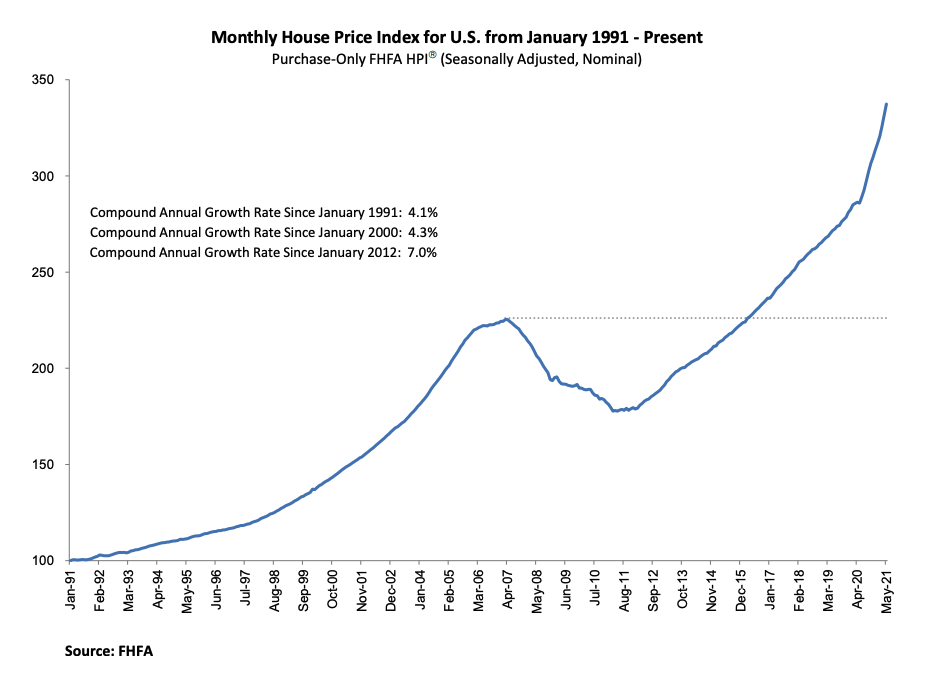

S&P/Case-Shiller U.S. National Home Price Index up

S&P/Case-Shiller U.S. National Home Price Index is at 312.31 for September 2023. This is up from a drawdown to 293.47 for February 2023. This followed an previous all time high of 308.30 in June of 2033. The index had increased every month since Feb 2012 until the draw down started in July 2022. Dec 18, 2023

Source - read more

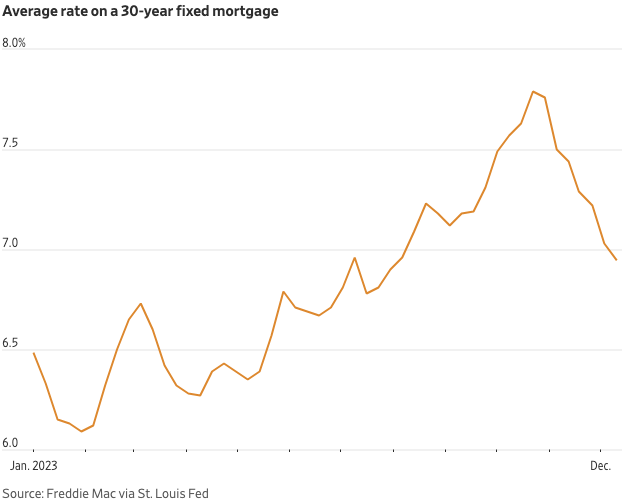

Home Buyers Are Ready to Buy. But Sellers Aren’t Selling

The lowest mortgage rates since the summer are starting to lure frustrated home shoppers back to the market. The problem is that few homeowners who have locked in much lower rates appear ready to sell. Home sales this year are on track to be the lowest since at least 2011. But as mortgage rates retreated from nearly 8% in October to below 7% last week, buyers are responding. Mortgage applications have increased for six straight weeks on a seasonally adjusted basis, though they are still down from year-ago levels, according to the Mortgage Bankers Association. Dec 17, 2023

Source - read more

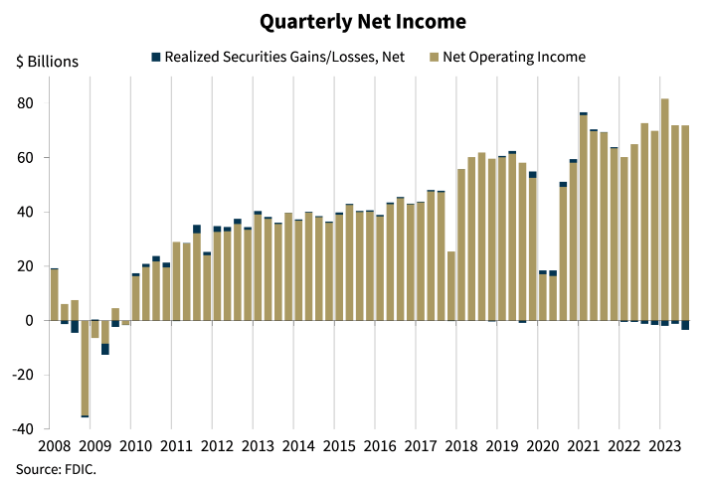

FDIC: Banking Industry strong but CRE a Significant Concern

The banking industry continued to show resilience in the third quarter. Net income remained high, overall asset quality metrics remained favorable, and the industry remained well capitalized. Despite a modest improvement in the industry’s net interest margin, funding pressures continued to challenge the industry. In the third quarter, the banking industry’s net income was $68.4 billion, a decrease of $2.4 billion from last quarter. But after adjusting for non–recurring accounting gains, the industry’s profitability has been remarkably stable for the past year. In the first two quarters of this year, the industry’s noninterest income was boosted by the accounting treatment of the acquisition of the three large failed banks. Without these non–recurring gains, net income would have been right around $68 billion—a high level by historical standards—for the past four quarters. Dec 8, 2023

Source - read more

The Math for Buying a Home No Longer Works

Homeownership has become a pipe dream for more Americans, even those who could afford to buy just a few years ago. Many would-be buyers were already feeling stretched thin by home prices that shot quickly higher in the pandemic, but at least mortgage rates were low. Now that they are high, many people are just giving up. It is now less affordable than any time in recent history to buy a home, and the math isn’t changing any time soon. Home prices aren’t expected to go back to prepandemic levels. The Federal Reserve, which started raising rates aggressively early last year to curb inflation, hasn’t shown much interest in cutting them. Mortgage rates slipped to about 7% last week, the lowest in several months, but they are still more than double what they were two years ago. Dec 11, 2023

Source - read more

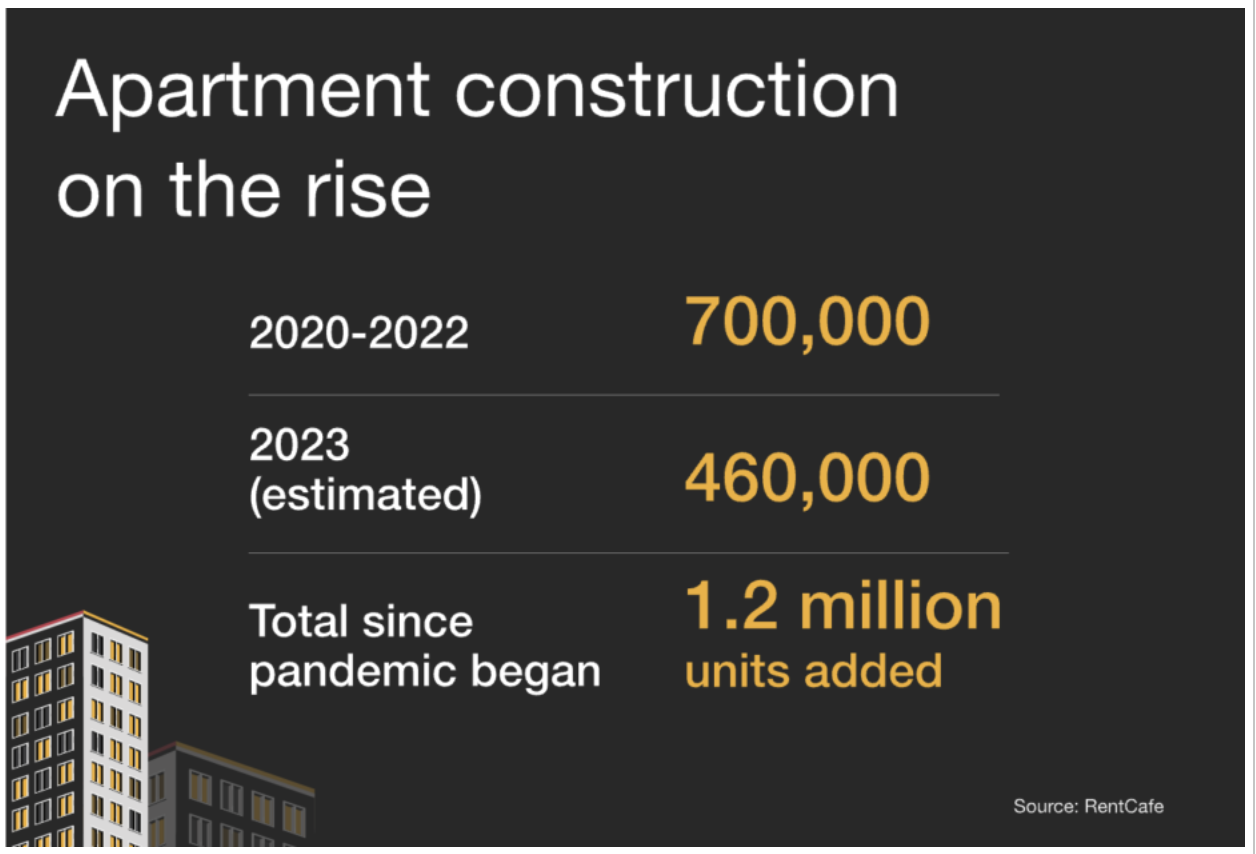

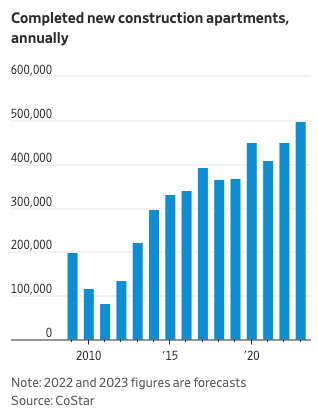

Apartment Owners Prioritizing Occupancy Over Rent

Apartment demand rebounded in 2023 after a dreadful year prior, especially during the second half of it, Cushman & Wakefield said. Therefore, “apartment operators today are prioritizing occupancy over rent,” its economist, Sam Tenanbaum said. There are 800,000 apartment homes currently under construction, which is about 5% of the country’s inventory, “so supply-side economics are expected to be a key theme for the next few years,” he said. Cushman & Wakefield’s most recent multifamily report said that despite an unprecedented supply wave, the multifamily market is enjoying a solid year, characterized by healthy rental demand and positive rent growth. Looking at vacancy rates alone, which steadily increased from an all-time low of 5.0% in 2021 to 7.8% as of Q3 2023, “would be suggestive of deteriorating market conditions, but it also masks favorable demand-side trends that have reemerged this year,” the report said. Dec 11, 2023

Source - read more

United States Industrial Outlook Q3 2023

Industrial fundamentals showed increasing signs of slowing in Q3 as the turbulent macroeconomic environment persists. With decreased leasing velocity and sluggish pre-leasing rates, absorption figures continued to slow. With the wave of new deliveries, the vacancy rate increased 70 basis points quarter-over-quarter to 4.9% as anticipated. While this figure seems high on the tail of historic low vacancy rates during the Covid era, the current figure is below the historical average which was 7.7% in 2013. Nov 08, 2023

Source - read more

The Fed Says Best Not to Get Too Optimistic Right Now

In the minutes of the last Federal Open Market Committee’s meeting, held from October 31 to November 1, the overall take was, “Financial conditions continued to tighten, driven by higher yields on Treasury securities as well as by lower equity prices and a stronger dollar, which themselves partly reflected higher interest rates.” Nov 22, 2023

Source - read more

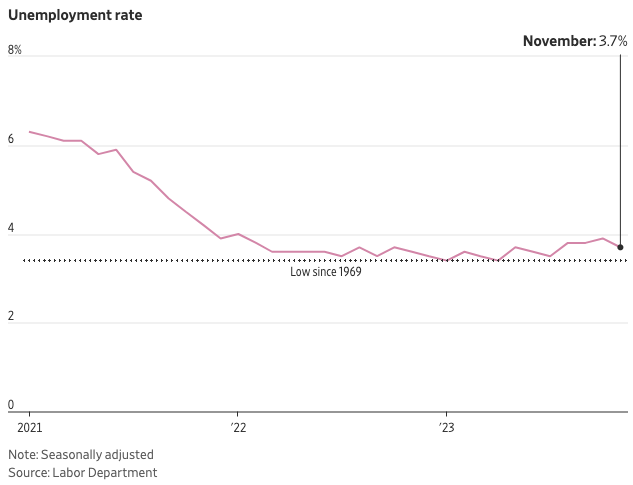

Economy’s Soft Landing Comes Into View as Job Growth Slowly Descends

A gradual cooling of the still-solid labor market extended into November, renewing optimism the economy is still on a glide path for a soft landing. Employers added a seasonally adjusted 199,000 jobs last month, the Labor Department reported Friday, slower than earlier in the year but consistent with gains before the pandemic. When excluding the effects of autoworker strikes in recent months, November’s job gain was roughly 169,000, slightly cooler than 180,000 in October. Most recent hiring occurred in two big sectors: healthcare and the government. Dec 8, 2023

Source - read more

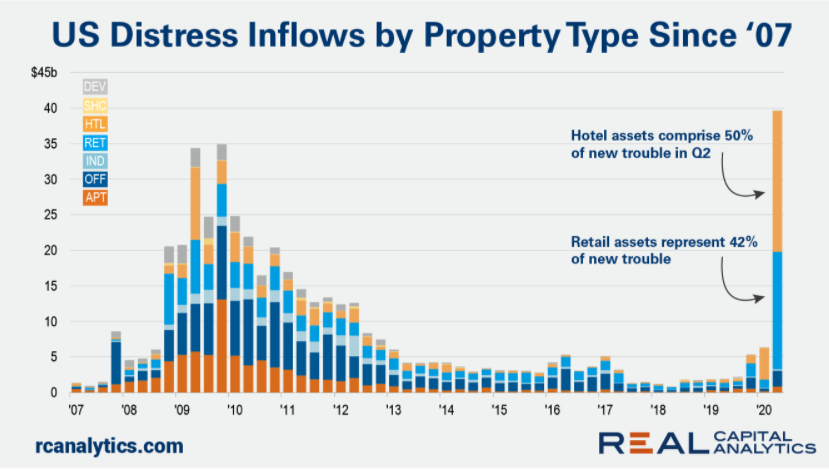

The Clearest Sign Yet That Commercial Real Estate Is in Trouble

Foreclosures are surging in an opaque and risky corner of commercial real-estate finance, offering one of the starkest signs yet that turmoil in the property market is worsening. Lenders this year have issued a record number of foreclosure notices for high-risk property loans, according to a Wall Street Journal analysis. Many of these loans are similar to second mortgages and commonly known as mezzanine loans. November 13, 2023

Source - read more

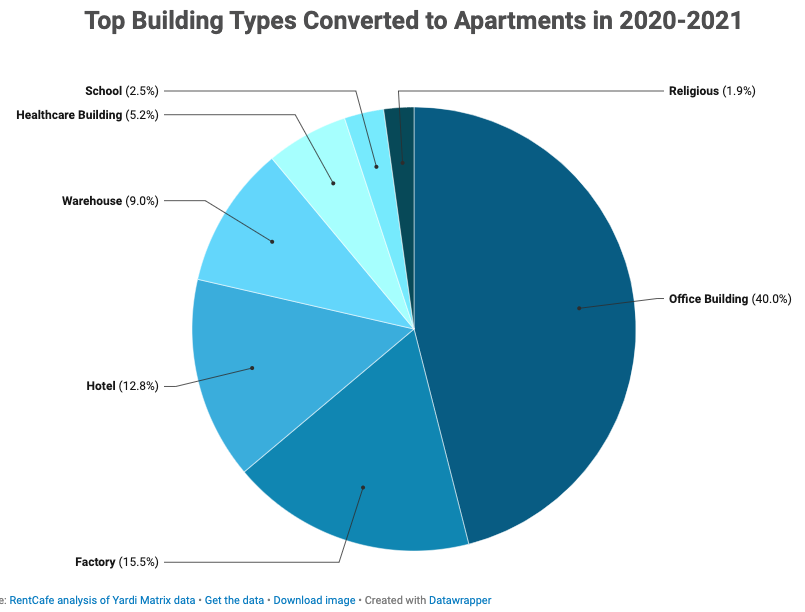

Biden-Harris Administration Takes Action to Create More Affordable Housing by Converting Commercial Properties to Residential Use

Today, the Biden-Harris Administration is announcing new actions to support the conversion of high-vacancy commercial buildings to residential use, including through new financing, technical assistance, and sale of federal properties. These announcements will create much-needed housing that is affordable, energy efficient, near transit and good jobs, and reduce greenhouse gas emissions, nearly 30 percent of which comes from the building sector. Nov 8, 2023

Source - read more

United States Retail Outlook Q3 2023

Despite concerns over inflation and high-interest rates, retail sales continue to grow. However, leasing activity is constrained by the limited availability of desirable retail space, higher operating costs, labor shortage, and increased interest rates. Retail real estate is experiencing a significant shortage of available space, with the availability rate below historical averages. M&A transactions buoyed retail capital markets activity, while power center deliveries remained low, leading to low vacancy rates and steady rent gains. Overall, there is a shift in consumer spending towards experiences and the need for retailers to adapt to changing consumer behavior. November 7, 2023

Source - read more

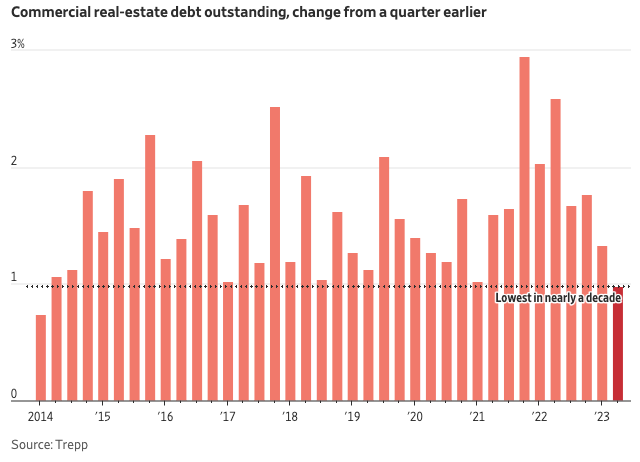

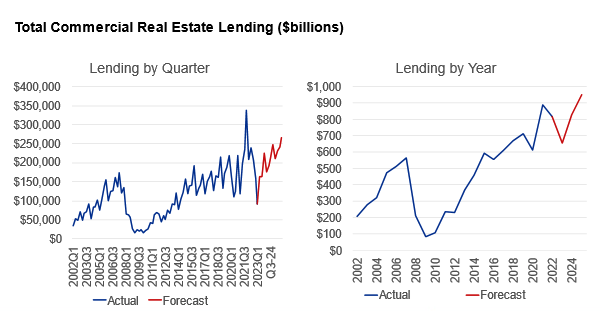

The Money Has Stopped Flowing in Commercial Real Estate

Commercial real-estate lending is shrinking to historically low levels, threatening a rise in defaults on expiring debt and a sharp decline in new construction of warehouses, apartments and other property types. Banks, insurance companies and other commercial property lenders have been cutting back since the first half of 2022 when the Federal Reserve began increasing interest rates and recession concerns intensified. But creditors have been even more reluctant to make new loans as Treasury bond yields have soared since early August. October 31, 2023

Source - read more

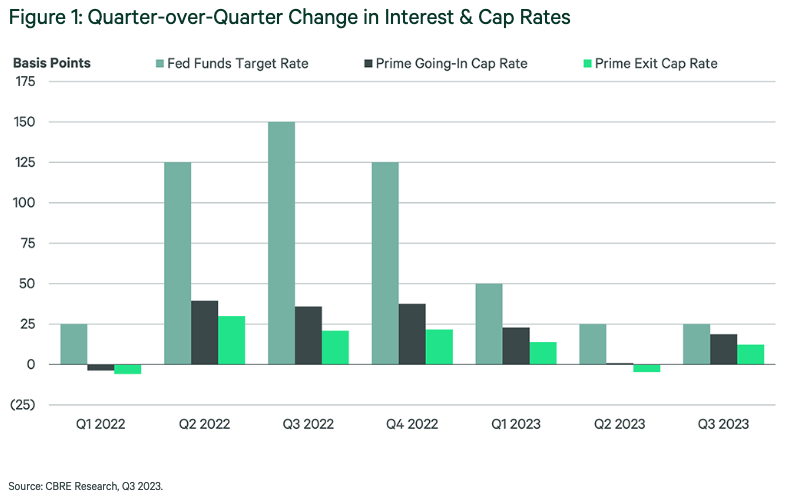

Higher Rates Push Up Prime Multifamily Cap Rates in Q3

Both going-in and exit cap rates for prime multifamily assets increased slightly in Q3 after the Federal Reserve’s 25-basis-point interest rate hike in July and the steady rise in the 10-year Treasury rate during the quarter. Although we expect that cap rates likely are near their peak, they could increase slightly into early 2024 if rates continue to rise. The average prime multifamily going-in cap rate has increased by 155 basis points (bps) to 4.92% since Q1 2022, exceeding the pre-pandemic 2018-2019 average by 70 bps. Though some additional expansion is likely, particularly if the Fed raises rates again in November or long-term rates continue to climb, underwriting assumptions for prime multifamily assets are likely nearing their peak. October 5, 2023

Source - read more

Strip Malls Are the New King of Retail Real Estate

A major shopping-center owner is spinning off all its strip malls into a new publicly traded company, indicating that this property type is thriving under a hybrid work environment. SITE Centers, which owns and manages open-air shopping centers in affluent suburbs, is placing 61 strip-mall properties into a real-estate investment trust called Curbline Properties, company executives said Monday afternoon. This new company will own and manage all of SITE Centers’ strip malls, which aren’t anchored by a grocery or big-box store. SITE Centers said it is valuing Curbline at $1.7 billion. October 30, 2023

Source - read more

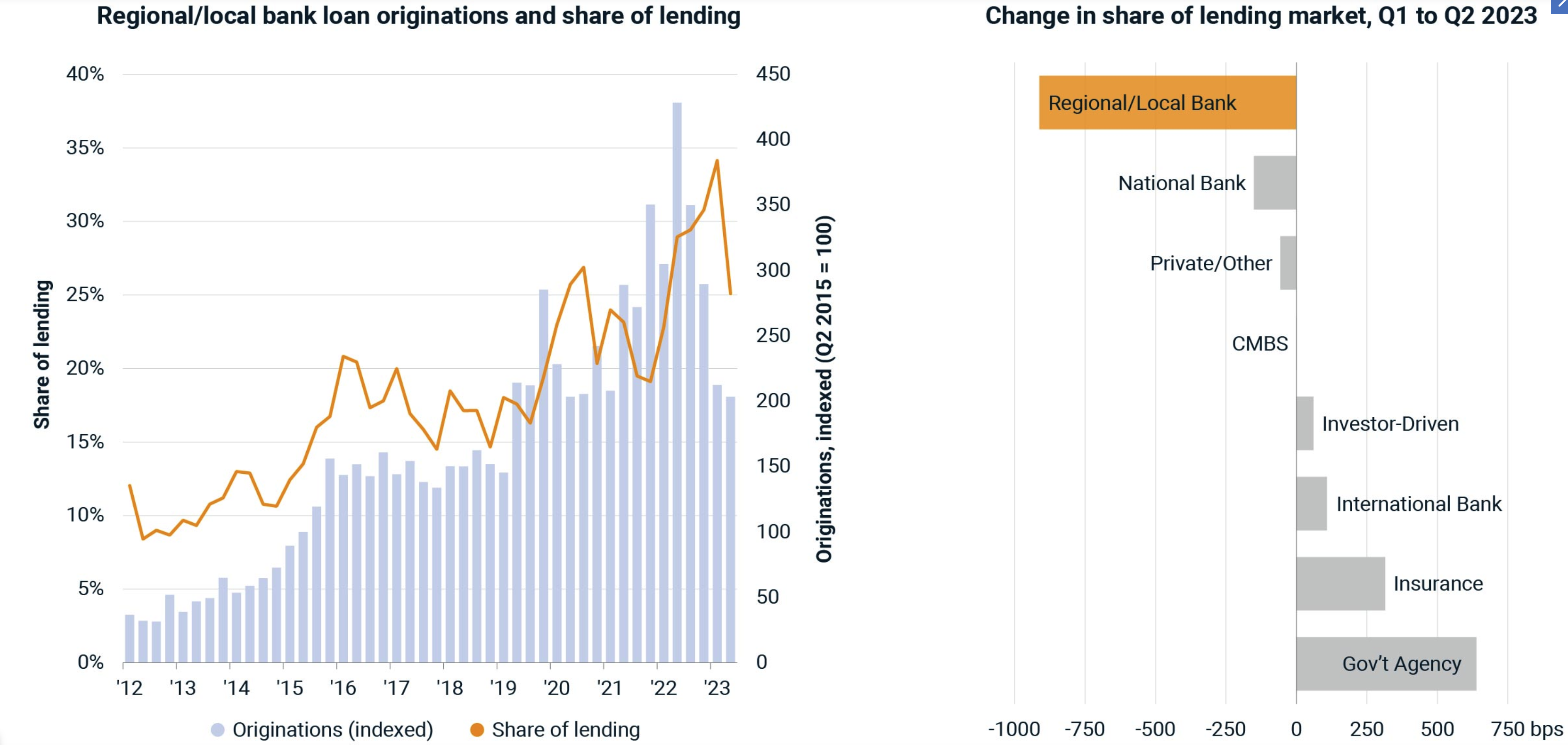

Small Banks Falter in US Commercial-Property Lending

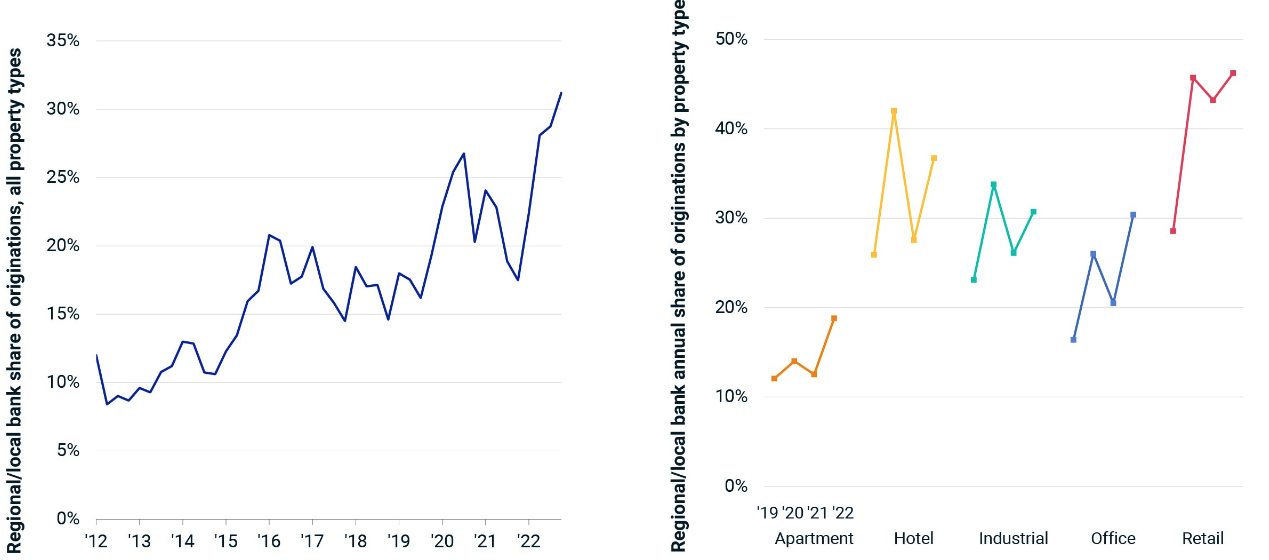

Smaller U.S. banks retreated from commercial-real-estate (CRE) lending in Q2 of 2023. From a record high of 34.2% of all commercial-mortgage originations in the first quarter of 2023, these regional/local banks captured only 25.1% of the market in the second quarter. Never has the share of lending by these smaller banks fallen so sharply in a single quarter. The share of all CRE loans originated by regional/local banks fell 900 basis points (bps) in the second quarter. The next sharpest decline was 650 bps in Q4 of 2020. These smaller banks had consistently captured an average of 17% of the market for loans from 2015 to 2019, before their share surged into the COVID-19 era. October 2, 2023

Source - read more

Soft Landing Still Possible for U.S. Economy: Moody’s

A soft landing is still possible as the US economy enters a transition phase, a leading CRE analyst told attendees at the GlobeSt Fall Net Lease conference last week in Los Angeles. “The economy will transition,” Natalie Ambrosio Preudhomme, associate director at Moody’s Analytics, said Tuesday. “There will be further softening, but no cliff. We expect to see a small increase in growth in the near term.” October 23, 2023

Source - read more

October 2023 Commercial Real Estate Market Insights

In the final quarter, there is usually the opportunity to end a year and start the next year strong. Although the third quarter of the year has already ended, there is still much uncertainty in the market since the Federal Reserve continues its tightening monetary policy. The labor market remains firm, and the U.S. economy grows faster than the expectations. However, risks are still anticipated in the market as the full impact of the Federal Reserve's higher rates may not have been fully reflected yet in households and businesses. October, 2023

Source - read more

Do Not Fear the Impact of AI on Commercial Real Estate

Do Hype over the negative impact of AI on commercial real estate is on the rise. To hear some commentary, we should be welcoming our new robot overlords in the hopes that they will deign to give us menial jobs since all knowledge-driven activity will be replaced by machines. Forget about debates over the return to office — such a worst-case scenario caused by AI could be far more devastating to office demand. There are other, more hopeful views on the future, however, which could spell out even more demand for commercial real estate as AI gains a foothold in the economy. August 22, 2023

Source - read more

Six Office Markets That Have Seen Growth This Year

The office market may have its problems, but not everywhere according to a recent Green Street weekly institutional marketplace update that included data on how certain property types were doing by major metro in a year-over-year look at the first half of 2023 and 2022. Though while there is good news for some, there’s bad news for more. Office has likely been one of the most followed property types of late for no other reason than uncertainty about how it would do. Hybrid work, companies considering how they might cut back on real estate use and cost, all are raising questions of how many investors or existing property owners and managers want to pick up more office buildings. September 5, 2023

Source - read more

How to Play the Property Meltdown in Five Charts

Is the pain over yet for U.S. commercial real estate? The answer might be yes for stocks but no for the assets they own. A record $205.5 billion of cash is earmarked for investment in U.S. commercial real estate, according to dry-powder data from Preqin. But good deals may not be available for another six to 12 months. Here are some trends investors can watch for signs of when it is the right time to buy. August 30, 2023

Source - read more

The $900,000 AI Job Is Here

American companies are in the midst of an AI recruiting frenzy, and some are willing to pay salaries approaching seven figures to hire top talent. Firms in industries such as entertainment and manufacturing are racing to seize on the potential of artificial intelligence by wooing data scientists, machine-learning specialists and other practitioners skilled at deploying the technology. The rush to hire is pushing up pay for technical professionals and prompting companies to hone their pitches to applicants to avoid losing out to rivals. Some companies, including Accenture, are building their AI expertise through individual hires and internal training programs. Others, including the technology company ServiceNow, say they are open to acquiring smaller AI startups as a way to scoop up talent. August 14, 2023

Source - read more

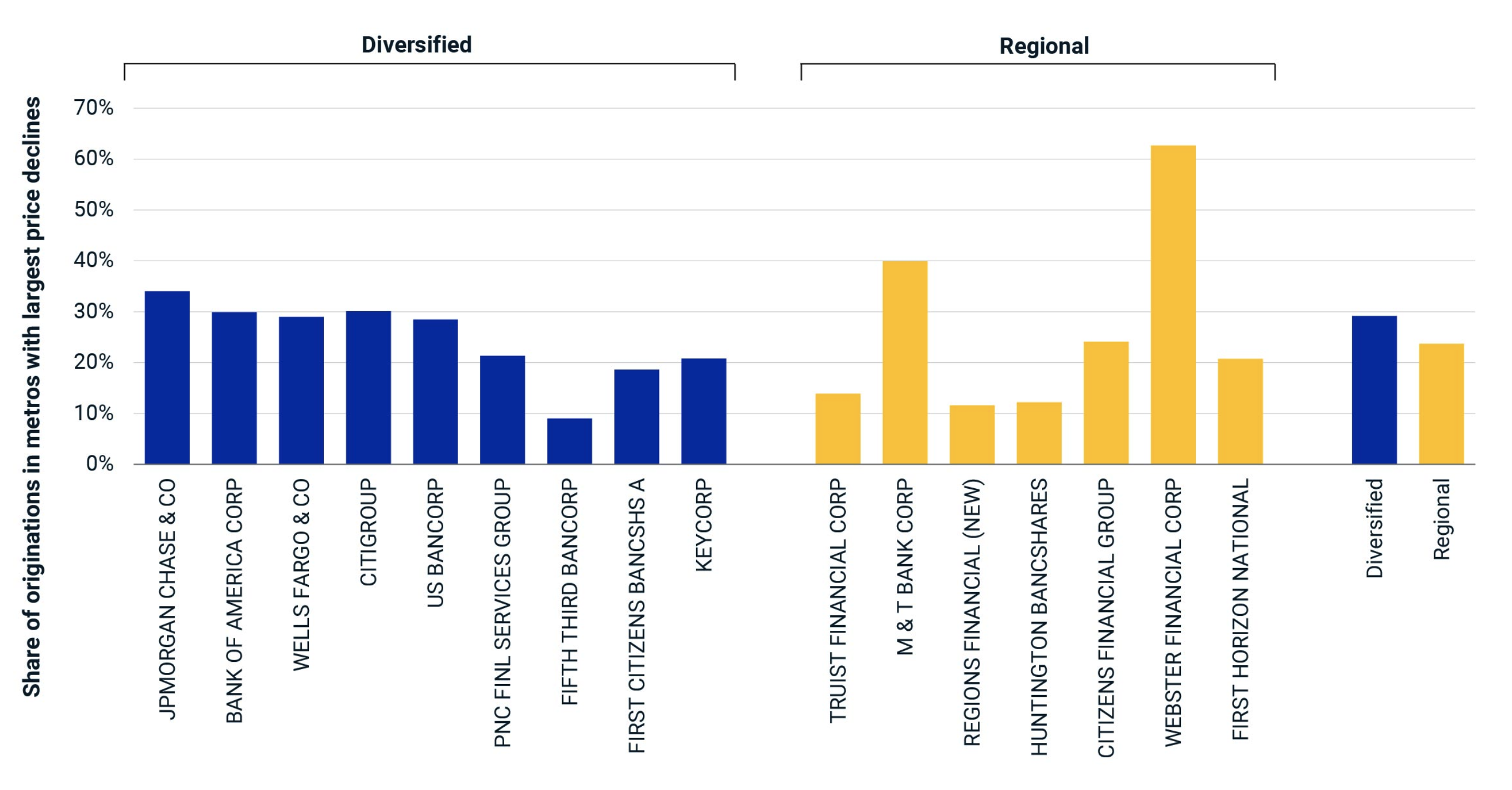

Banking on Commercial Real Estate

Worries about U.S. banks' exposure to souring commercial-property loans have weighed on bank stocks, particularly regional ones. In the four months following the collapse of two lenders in March (and another failure in May), the MSCI USA Banks Index fell 15%, compared to a 12% increase for the MSCI USA Index.1 Using data from MSCI Mortgage Debt Intelligence, we examined the commercial-mortgage originations of the seven regional banks and nine diversified banks in the MSCI USA Banks Index to identify exposures to the property types and markets under pressure. August 3, 2023

Source - read more

July 2023 Commercial Real Estate Market Insights

Leasing velocity slowed down in commercial real estate during the year's second quarter. While there is still much uncertainty about the total impact of the bank failures earlier in the year, there are rising concerns and speculation about where commercial real estate is headed. Since commercial real estate relies heavily on small banks for capital, a pullback in lending among these banks could further impact commercial real estate. However, data shows that commercial real estate lending activity is increasing weekly. Meanwhile, delinquency rates for commercial loans have increased since the end of 2022, but they remain below 1%. Nevertheless, delinquencies are expected to rise further in the year's second half. July 2023

Source - read more

S&P/Case-Shiller Home Price Index down

The S&P/Case-Shiller US National Home Price Index showed a decrease in home values from June 2022 to January 2023 of 15.60 points. The Index has rebounded slightly +8.33 points as of April 2023. June 27, 2023

Source - read more

Green Street Lowers Its Office Valuations. Again.

Plunging office valuations are creating challenges for analyst firms when assessing how low will they go. A Green Street office report from June 28 states as such, adding that additional signs now indicate the firm’s estimates are too high – despite already marking down A-quality office values several times this year. Green Street’s Commercial Property Price Index for REIT-quality office assets “has already been marked down 30% from pre-Covid highs prior to this recent reduction.” The report indicated that conversations with private market participants suggest at least another 5%-10% decline on average is reasonable, adding that “this varies significantly by market,” authors Dylan Burzinski and Michael Manos, wrote. June 30, 2023

Source - read more

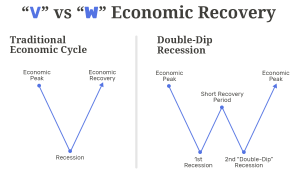

Are we headed towards recession? If so, how long and how bad will it be?

Cushman & Wakefield's Glide Path report: Comments from the Microeconomy section: We’re not quite “there yet” on inflation; underlying pressure remains for some of the stickier portions of inflation. Fed will remain cautious and data-dependent before prematurely cutting. Expect the Fed to pivot in early 2024. Economy remains resilient due to the ongoing strength of the consumer and labor markets. Recession timing keeps getting pushed back, now expect a year-end start. Economic recession will run its course through Q3 2024. The correction in CRE started mid-2022; this is not the first inning. Recovery speeds will vary based on property type, quality and geography, but a rebound is not far off. Historically, the best time to buy property is when the Fed starts to cut rates (this tends to coincide with a bottoming and inflection in property values). June 2023

Source - read more

Looking for Loan Trouble

Refinancing commercial-property loans has become tougher because of an increase in interest rates and more-conservative lending terms. Different trends in asset-price growth and loan-to-value ratios mean that not all asset classes and markets will face pressure equally. Using a high-level estimation based on value growth and loan terms, one can home in on the market and asset-class combinations that may face more trouble. Investors in commercial real estate are alternatively worried or excited about the repricing of assets over the last year. Those who are excited are trying to determine which assets are most likely to default and may be available on the cheap. The answer may lie in the timing of loan maturities. June 2, 2023

Source - read more

Fed Chair Powell sees progress on inflation, though not quickly enough

WASHINGTON (AP) — Inflation may be cooling — just not yet fast enough for the Federal Reserve. Chair Jerome Powell offered a nuanced view Wednesday of how the Fed intends to address its core challenge at a time when inflation is both way below its peak but still well above the central bank’s 2% target: Give it more time, and maybe some help from additional interest rate hikes. Yet on a hopeful note, Powell also suggested that the trends that are needed to further slow inflation, from lower apartment rents to slower-growing wages, are starting to click into place. As a result, the Fed decided Wednesday to forgo another increase in its benchmark interest rate, leaving it at about 5.1%. The pause followed 10 straight hikes in 15 months — the fastest series of increases in four decades. June 14, 2023

Source - read more

Vacant Offices Are Piling Up in Silicon Valley

Silicon Valley companies are dumping office space at an accelerating pace, as tech leaders such as Google and Facebook parent Meta Platforms close locations and reassess their commitments to the workplace. Office-vacancy rates in Silicon Valley, which includes the Northern California communities of San Jose, Palo Alto and Sunnyvale, were up to 17% in June from 11% in 2019, according to data firm CoStar Group. In some spots, such as Menlo Park and Mountain View, the rate surpassed 20% this spring, CoStar said. June 21, 2023

Source - read more

Prices of All Major US Property Types Fell in April

All major U.S. commercial-property types posted annual price declines in April, marking the first time since September 2010 that prices fell across the board. The industrial index had held out until April, when it experienced both monthly and annual price drops. Industrial prices slipped by 0.5% on the month and fell 0.8% versus a year earlier. The RCA CPPI National All-Property Index fell 1.1% relative to March and dropped 9.4% from April of 2022, dragged down by the slide in apartment prices. May 26, 2023

Source - read more

JPMorgan Chase: Plenty of Big Questions for Commercial Real Estate

Economic uncertainty remains high for commercial real estate through the rest of 2023, reported JPMorgan Chase & Co., New York. “There are plenty of big questions, including the interest rate environment and the future of office space,” said JPMorgan Chase & Co. Head of Commercial Real Estate and Commercial Banking Al Brooks in the firm’s 2023 Midyear Commercial Real Estate Outlook. “But there are also positives: multifamily and industrial continue to perform well, and the industry may have underestimated the strength of neighborhood retail.”May 24, 2023

Source - read more

MBA Forecast: Commercial/Multifamily Lending to Fall 20 Percent in 2023

WASHINGTON, D.C. (May 11, 2023) — Total commercial and multifamily mortgage borrowing and lending is expected to fall to $654 billion this year, which is a 20 percent decline from $816 billion in 2022. This is according to an updated baseline forecast released today by the Mortgage Bankers Association (MBA) at its 2023 Commercial/Multifamily Finance Servicing & Technology Conference in Chicago. Multifamily lending alone (which is included in the total figures) is expected to drop to $375 billion in 2023 – a 14 percent decline from last year’s expected total of $437 billion. MBA anticipates borrowing and lending will rebound in 2024 to $829 billion in total commercial real estate lending, with $456 billion of that total in multifamily lending. May 11, 2023

Source - read more

United States Retail Outlook Q1 2023

Retail fundamentals have started to pull back as a consequence of sustained inflation and banking troubles. Consumers have responded to persistent inflation by shifting money away from discretionary goods purchases in favor of groceries and other key necessities. Discounters and online retailers win consumers’ dollars, as real disposable income wanes. Net absorption totaled a modest 9.1 million square feet for the quarter – a substantial decline from the 20.1 million square feet absorbed in the fourth quarter. Demand is still coming largely from discounters like Burlington and dollar stores, as well as QSRs and fast casual restaurants. In fact, aggressive expansion by QSRs and coffee chains have contributed to a record-low availability rate of single-tenant retail space at just 2.4%. May 9, 2023

Source - read more

A Guide to Valuing Buildings Amid Less Debt and Changing Cap Rates

It’s no secret that as we sit here in May of 2023, there has been a significant deterioration of values across asset classes in commercial real estate. In fact, I haven’t been in a meeting or on a call in the past several months where the level to which prices have fallen has not been a topic of conversation. Questions about office buildings dominate these discussions since their value has clearly decreased the most and some of the basic going forward assumptions are a guess at this point. Time will give us the answer of course, but by simply looking at some big picture metrics we can start to get a sense, which gives us a lot to think about. May 22, 2023

Source - read more

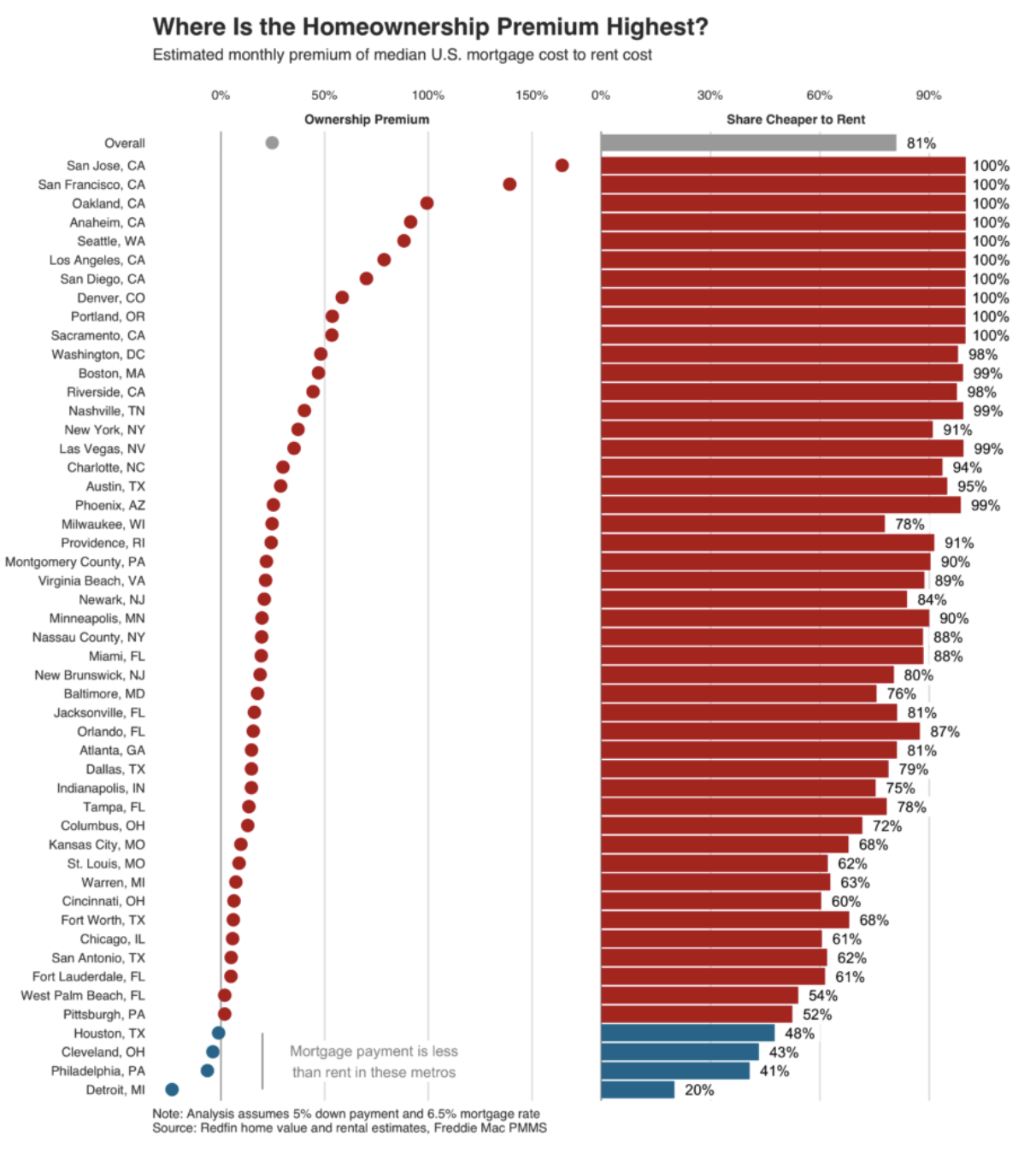

Metro Areas Where Homebuying Is Cheaper Than Renting Dwindling Nationwide

According to a new report from Redfin, there are only four major U.S. metropolitan areas where it would be cheaper to buy than rent the typical home—meaning the typical home has an estimated monthly mortgage cost lower than its estimated monthly rental cost. Key Findings: Buying is more affordable than renting in Detroit, Philadelphia, Cleveland, and Houston. The largest homeownership premium is in the Bay Area, where it’s twice as expensive to buy than rent. Nationwide, the typical home costs an estimated 25% more per month to own than rent. A drop in mortgage rates would cause the homeownership premium to shrink. If rates fell to 5%, buying the typical home would only cost an estimated 10% more than renting it. May 22, 2023

Source - read more

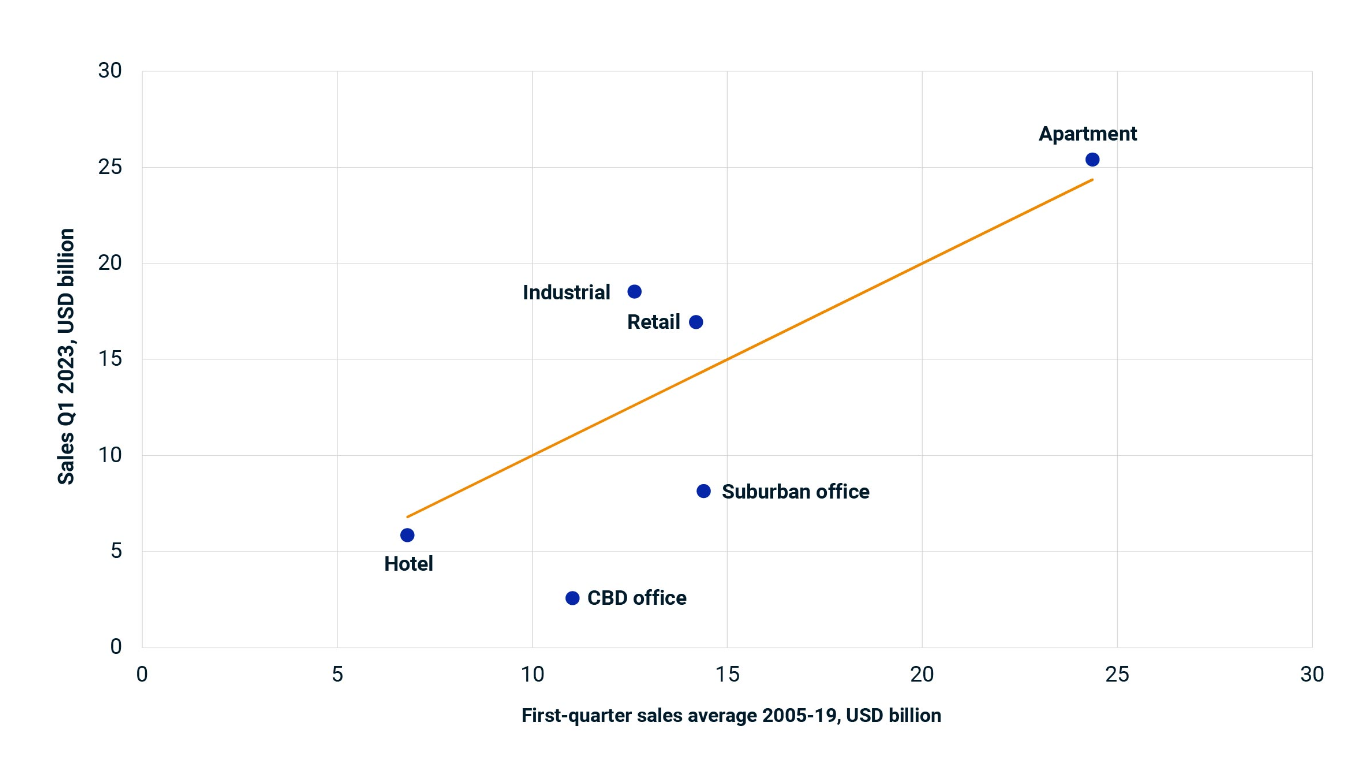

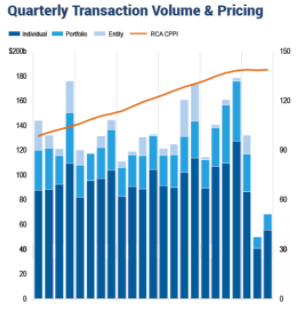

Different Takes on US Commercial-Property Sales in Q1

Deal activity for U.S. commercial property in the first quarter could be viewed as a sign of a calamitous market downturn ahead or a simple return to long-run averages after a period of excess liquidity. One’s viewpoint may differ across property types. Relative to Q1 2022, which was the most active first quarter on record, sales across property types fell 56% to USD 85 billion. The total was broadly in line with long-term pre-pandemic levels: Sale activity averaged USD 88 billion for each first quarter from 2005 to 2019. Office sales in both central business districts (CBD) and suburban locations were well down from the long-term trend, however, as shown in the chart. (Property types below the line saw less deal activity this year than the average first-quarter period over time.) CBD offices fared worse, with deal volume 77% below the average. Retail property sales were 19% higher in the first quarter than the pre-pandemic average, thanks to a one-time entity-level deal. April 21, 2023

Source - read more

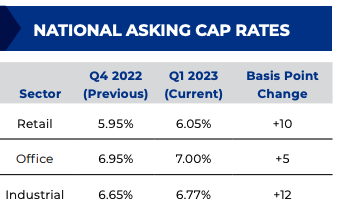

The Boulder Group Q1 23 Net Lease Market Report

Cap rates in the single tenant net lease sector increased for the fourth consecutive quarter within all three sectors in Q1 2023. Single tenant cap rates increased to 6.05% (+10 bps) for retail, 7.00% (+5 bps) for office and 6.77% (+12 bps) for industrial in Q1 2023. Cap rates in Q1 2023 represented the highest levels since Q3 2020 for both the single tenant retail and office sectors. A decrease in transaction volume for the greater real estate market continues to limit 1031 exchange buyers transitioning into net lease properties. Transaction volume in 2022 lagged 2021 and experienced more than a 25% decrease for the net lease sector. Q1, 2023

Source - read more

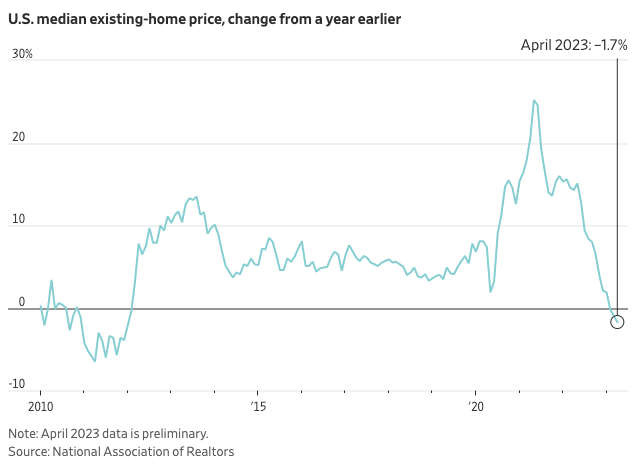

Home Prices Posted Largest Annual Drop in More Than 11 Years in April

Sales of previously owned homes fell in April from the prior month and prices declined from a year earlier by the most in more than 11 years. U.S. existing home sales, which make up most of the housing market, fell 3.4% in April from the prior month to a seasonally adjusted annual rate of 4.28 million, the National Association of Realtors said Thursday. April sales fell 23.2% from a year earlier. The national median existing-home price fell 1.7% in April from a year earlier to $388,800, the biggest year-over-year price decline since January 2012, NAR said. Median prices, which aren’t seasonally adjusted, were down 6% from a record $413,800 in June. Home prices have fallen the most in the western half of the U.S., while prices continue to rise from a year earlier in many eastern markets. May 18, 2023

Source - read more

Existing-Home Sales Surged 14.5% in February, Ending 12-Month Streak of Declines

Existing-home sales jumped 14.5% in February to a seasonally adjusted annual rate of 4.58 million, snapping a 12-month slide and representing the largest monthly percentage increase since July 2020 (+22.4%). Compared to one year ago, however, sales retreated 22.6%. The median existing-home sales price decreased 0.2% from the previous year to $363,000. The inventory of unsold existing homes was unchanged from the prior month at 980,000 at the end of February, or the equivalent of 2.6 months' supply at the current monthly sales pace. March 21, 2023

Source - read more

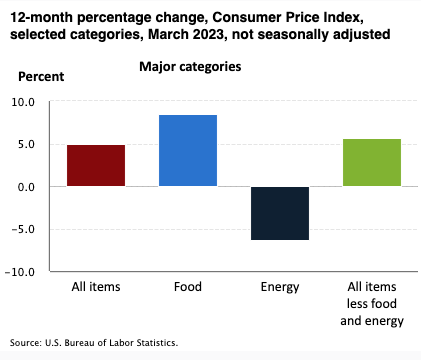

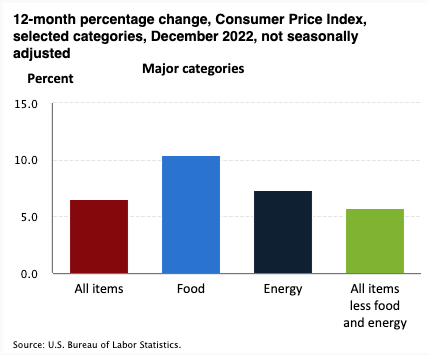

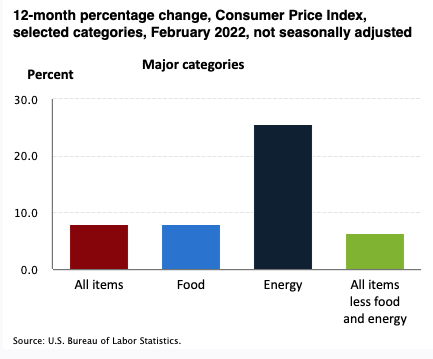

CPI for all items rises 0.1% in March as shelter increases

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in March on a seasonally adjusted basis, after increasing 0.4 percent in February, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 5.0 percent before seasonal adjustment. The index for shelter was by far the largest contributor to the monthly all items increase. This more than offset a decline in the energy index, which decreased 3.5 percent over the month as all major energy component indexes declined. The food index was unchanged in March with the food at home index falling 0.3 percent. April 12, 2023

Source - read more

Commercial-Property Debt Not Just a Small Bank Story

Recent industry chatter suggests that smaller banks are behind 70% of all commercial-real-estate lending in the U.S. Such exposure would have worrying implications for commercial real estate’s performance as these financial institutions face new challenges. That figure, however, is likely a misread of Federal Reserve data showing smaller banks are behind roughly 70% of the existing stock of bank loans to commercial real estate.1 The key words here are: “of bank loans.” Banks are not the only source of debt in commercial real estate. Looking at the MSCI Real Capital Analytics database of commercial-mortgage originations for deals priced USD 2.5 million and greater, banks of all scale were behind 40% of all loan originations from 2015 to 2019. Besides banks, lender groups active in commercial real estate include debt funds, life-insurance companies and originators of commercial mortgage-backed securities and collateralized loan obligations. April 12, 2023

Source - read more

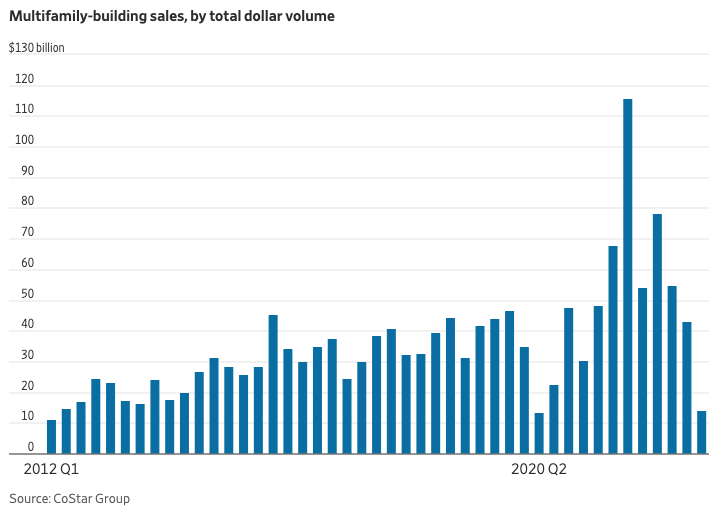

Apartment-Building Sales Drop 74%, the Most in 14 Years

Sales of rental apartment buildings are falling at the fastest rate since the subprime-mortgage crisis, a sign that higher interest rates, regional banking turmoil and slowing rent growth are undercutting demand for these buildings. Investors purchased $14 billion of apartment buildings in the first quarter of 2023, according to a preliminary report by data firm CoStar Group. That represents a 74% decline in sales from the same quarter a year earlier and would be the largest annual sales decline for any quarter going back to a 77% drop in the first quarter of 2009. April 4, 2023

Source - read more

Mortgage Credit Availability Increased in March

Mortgage credit availability increased in March according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) that analyzes data from ICE Mortgage Technology. The MCAI rose by 0.4 percent to 100.5 in March. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012. The Conventional MCAI increased 1.1 percent, while the Government MCAI decreased by 0.2 percent. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 1.4 percent, and the Conforming MCAI rose by 0.4 percent. April 11, 2023

Source - read more

Despite Q1 Bump, Industrial Vacancy Rate Remains at Historic Lows

The industrial vacancy rate ticked up for a second consecutive quarter, according to Cushman & Wakefield, but remains historically low – 70 bps below the five-year quarterly average and 170 bps lower than the 10-year average. The Q1 report measures it at 3.6% and many markets still sit below 3%. Deals are still getting done. Jason Tolliver, executive managing director and co-lead of Americas Logistics & Industrial Services at Cushman & Wakefield, said in prepared remarks, “Given the voracious pace of growth the past two years and some timidity tied to a more uncertain economic outlook, deals are taking a bit longer to get done, but they are getting done and I remain upbeat on the outlook. April 11, 2023

Source - read more

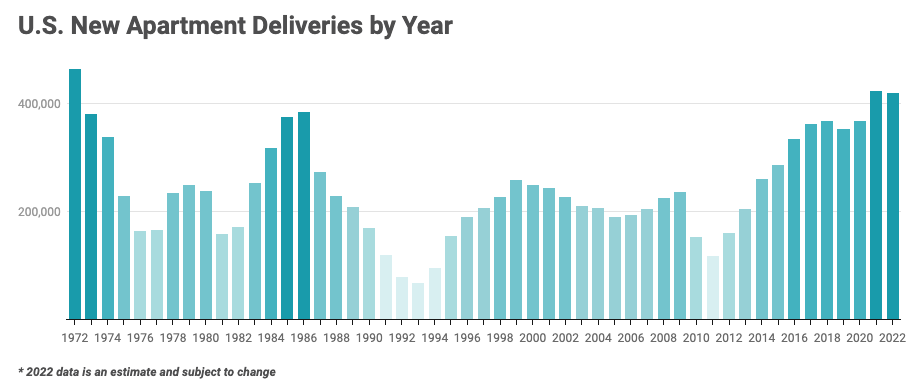

Apartment Rent Growth Set to Keep Slowing This Year

The pandemic-fueled boom for multifamily building owners is fading fast going into 2023. Apartment vacancies are piling up. The biggest wave of new rental buildings in nearly four decades is expected to cut the pace of rent growth across the country. Some in-demand Sunbelt cities are already experiencing rent declines, in part because many tenants and people searching for apartments feel they can’t devote any more of their income to rent. Rising interest rates, meanwhile, make rental-property investments less profitable than one year ago when debt was cheap and hefty rent increases were taken for granted. “We’re necessarily going to get a bit of a pullback,” said Thomas LaSalvia, senior economist at Moody’s Analytics. January 3, 2023

Source - read more

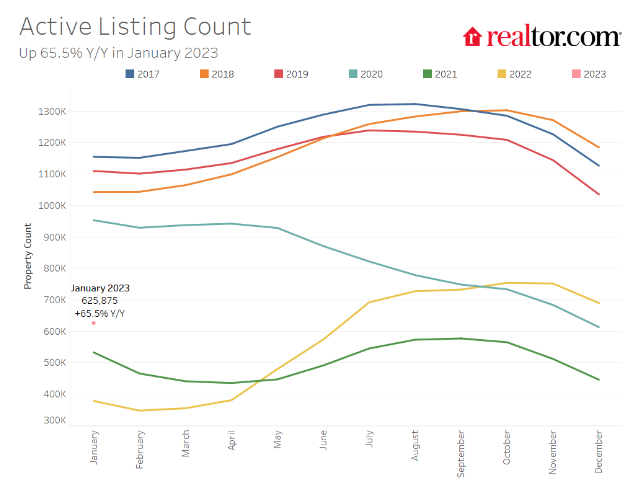

Homebuyers Gain Bargaining Power as Mortgage Rates Fall

The U.S. housing market offered homebuyers greater bargaining power in January, as mortgage rates fell to their lowest level in months, inventory rose, and the growth in the typical asking price continued to slow, according to the latest Realtor.com Monthly Housing Trends Report. Meanwhile, the annual decline in new listings also moderated to single digits in January; new listings remain an important indicator of home selling interest, and a sustained improvement would suggest more sellers are returning to the market in the coming months. February 2, 2023

Source - read more

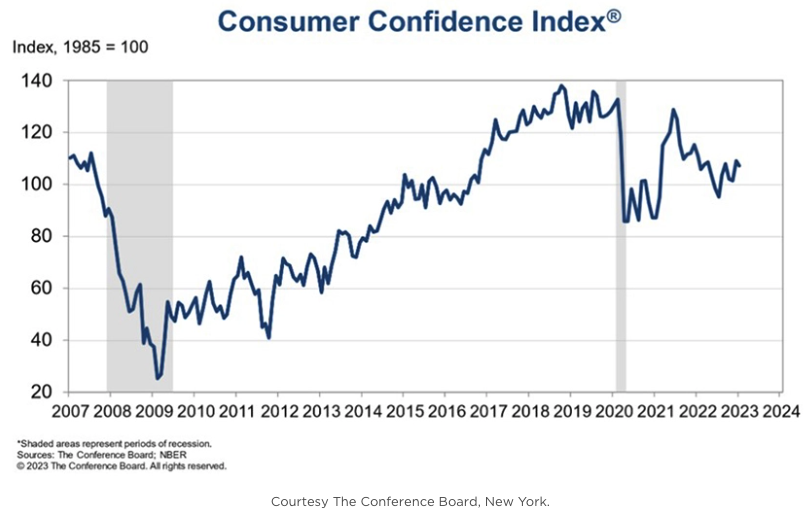

Recession Fears Fuel Dip in Consumer Confidence

The Conference Board, New York, said its Consumer Confidence Index fell in January following an upwardly revised increase in December. The Index now stands at 107.1 (1985=100), down from 109.0 in December. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—increased to 150.9 from 147.4 last month. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—fell to 77.8 from 83.4 partially reversing its December gain. The Expectations Index is below 80, which Conference Board Senior Director Ataman Ozyildirim said often signals a recession within the next year. Both present situation and expectations indexes were revised up slightly in December. January 31, 2023

Source - read more

US Property Deals Slumped, Price Growth Withered in Q4

Sales of U.S. commercial property fell 62% from a year prior in the fourth quarter of 2022, and annual price growth decelerated to the slowest rate of gain since 2011. Still, for the year in total, 2022 was the second-strongest year for sales on record, behind 2021. Trading of properties such as offices, apartment buildings and warehouses slowed over 2022 as investment conditions became more uncertain. The surprising leader in investment sales for the year was the retail sector, showing a 4% year-over-year increase. Deal volume in the office sector fell the most across the major property types, dropping 25%. January 19, 2023

Source - read more

CPI for all items falls 0.1% in December as gasoline decreases

TIn December, the Consumer Price Index for All Urban Consumers decreased 0.1 percent, seasonally adjusted, and rose 6.5 percent over the last 12 months, not seasonally adjusted. The index for all items less food and energy increased 0.3 percent in December (SA); up 5.7 percent over the year (NSA). January 12, 2023

Source - read more

The Cliched Perfect Storm May Be Headed to the Office Market

A new analysis by Trepp and Compstack raises the question of whether the office segment of CRE is facing a now-cliched perfect storm metaphor. The three dangers that could unite are office loan maturities, large lease expirations, and low space demand. Said another way, it comes down to inflation and the end of easy money, worry about corporate financial performance, and the desire of working people to control more of their lives. The report says that by the end of 2424, $40.47 billion in loans — that’s 353 loans backed by 583 office properties — and 56% are floating rate with an average remaining term of over 10 months and all with extension options of 29 months. February 6, 2023

Source - read more

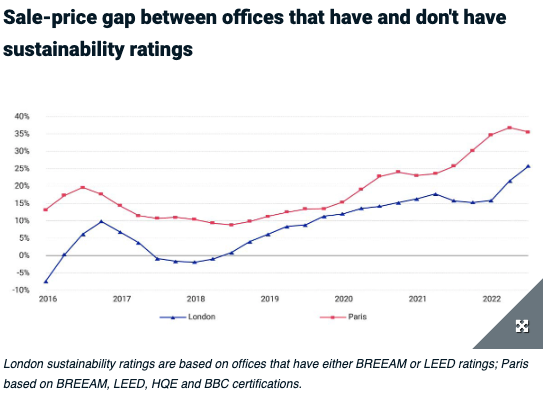

London and Paris Offices: Green Premium Emerges

Analysis of prices paid by investors for offices in London and Paris, Europe’s largest property markets, shows a premium has emerged for buildings that have sustainability ratings from organizations like the Building Research Establishment (BREEAM), U.S. Green Building Council (LEED) and GBC Alliance (HQE), versus those that have not yet achieved these standards. November 23, 2022

Source - read more