About Us

Since 1988, we have performed real estate market research and appraisals including market studies and inspections on all types of real estate for individuals, developers, banks, savings and loans, mortgage companies, attorneys, courts, accountants, builders, contractors, and state and federal government agencies. We are committed to quality work – delivered on time. We prepare reports in all sectors of the real estate industry; however, we specialize in health care facilities (assisted living, nursing care, independent living, CCRC), multifamily residential and affordable housing market studies and appraisals.

-

Out Focus Areas

Out Focus Areas

Multi-family

-

Health-care, (Assisted Living)

-

Independent Living, Nursing Care, CCRC)

Affordable Housing (LIHTC)

-

Retail

-

Office

-

Commercial

-

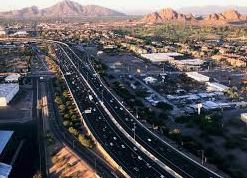

ROW

ROW

-

Estate Tax

-

Estate Planning

-

Acquisition/Disposition

-

Underwriting

-

Portfolio

-

Litigation Support

-

Market Studies

-

Multifamily Accelerated Processing (HUD MAP)

-

Rental comparable studies

-

Capitalization Rate Studies (NationalCapRates.com)

-

-

Clients include

-

Lenders

-

Individuals

-

Legal and Accounting firms

-

Local, State and Federal government agencies

-

-

-

480-497-1113

Additional Services

In addition to commercial appraisals, we provide the following services to our clients:

Due Diligence

Commercial Property Inspections

Highest and Best Use Studies

Audit Reasonability and Sensitivity Testing

Specialized Services

Market Studies

Types of Market Studies Preformed:

LIHTC rental housing

- Market rate rental developments

- Government subsidized rental housing developments (HUD and USDA Rural Development projects)

- Integrated multi-family and senior (Mixed developments)

- Assisted living

- Student housing

- Condominiums

- Single Family/Owner-Occupied

- Subdivisions

- Senior Housing

- Congregate-care

- Continuum of care

- Commercial (Retail & Industrial)

Rent Comparability Studies

A Rent Comparability Study (RCS) must be submitted with a Section 8 contract renewal. Because the RCS is submitted to HUD, it must meet specific requirements and guidelines. The Rent Comparability Studies are prepared in accordance with the Uniform Standards of Professional Appraisal Practice (USPAP) and the supplemental standards of HUD Chapter 9. Market rents are defined and estimated in accordance with Section 9-7 through Section 9-13 of Chapter 9, and the reports are prepared in accordance with Section 9-14 through Section 9-16 of Chapter 9.

Expert Witness

The need for real estate appraisals has become increasingly common in litigation proceedings. Considering today’s legal climate, to win settlements or court decisions involves a need for highly skilled professionals. Schnepf Ellsworth Appraisal Group LLC’s staff has tremendous experience in litigation support and expert witness services. Clients who have used our expert testimony services include government agencies, tax entities, financial institutions, legal and accounting firms and many other businesses.

HUD MAP/Lean

We have been appraising HUD insured properties for the Phoenix HUD Office since 1988.

The Multifamily Accelerated Processing (MAP) Guide, originally published May 17, 2000, was revised March 15, 2002. The MAP Guide is approved for use by MAP-approved Lenders and by HUD Multifamily Offices.

Lean Processing of Section 232 Projects

HUD developed its Lean process for Section 232 applications in 2008. Previously, loans were processed under Multifamily Accelerated Processing (MAP) or Traditional Application Processing (TAP) by the local HUD Field Office. It should be noted that non-Section 232 projects will continue to be processed under MAP or TAP.

LIHTC

We are experienced as appraisers for LIHTC properties. Given the use and income restrictions, these are very unique properties to appraise and the misuse or misapplication of data can lead to erroneous conclusion if the analysts is not well seasoned.

As part of the Tax Reform Act of 1986, the United States Congress created the Low Income Housing Tax Credit (LIHTC) (IRC Section 42) Program to promote the development of affordable rental housing for low-income individuals and families. To date, it has been the most successful rental housing production program in Arizona, creating thousands of residences with very affordable rents. The Low Income Housing Tax Credit, rather than a direct subsidy, encourages investment of private capital in the development of rental housing by providing a credit to offset an investor’s federal income tax liability.

Out Focus Areas

Out Focus Areas

ROW

ROW